By George Welton for Investor.ge

On December 14, 2023, the European Council granted Georgia EU candidate status. The response in Georgia and among the country’s many supporters has been unequivocal. The Georgian government, opposition, and civil society groups all hailed this decision as a “historic day” and a significant step forward in Georgia’s aspirations to become an EU member state.

Business leaders were also quick to weigh-in with overwhelming support. In a letter to members following the December decision, AmCham President Irakli Baidashvili wrote, “this clearly reflects the EU’s faith that the Georgian people will always be natural members of the European family.” Many other groups expressed similar sentiments. The Investor Council, as well as a group of businesses, led by the European Georgian Business Council, signed letters of strong support for EU integration.

The decision is clearly in line with the country’s aspirations. In a recent IRI poll, 89% of Georgians reported that they support EU membership, which is the highest that support has been for many years. It has also been reflected in large public demonstrations of support for membership that took place across the country in 2023.

This is driven by a strong feeling in Georgia and abroad that the country has a natural place in the European family. At the same time, it is hoped – and supported by a large body of evidence – that economic integration with the EU will also be a major driver for economic growth and prosperity.

Economic impact

EU membership for Georgia would clearly be a game-changer. The EU market has around 450 million people and a GDP of $19.4 trillion, second only to the U.S. in terms of global markets. Georgia’s population is slightly more than 100 times smaller, and Georgia’s GDP is about 1,000 times smaller – so, even modest success in a niche EU market space has major potential upsides. This will be even more so if EU countries start to integrate Georgia into their supply chains; then, the upside for investment, jobs, and economic growth generally could be limitless.

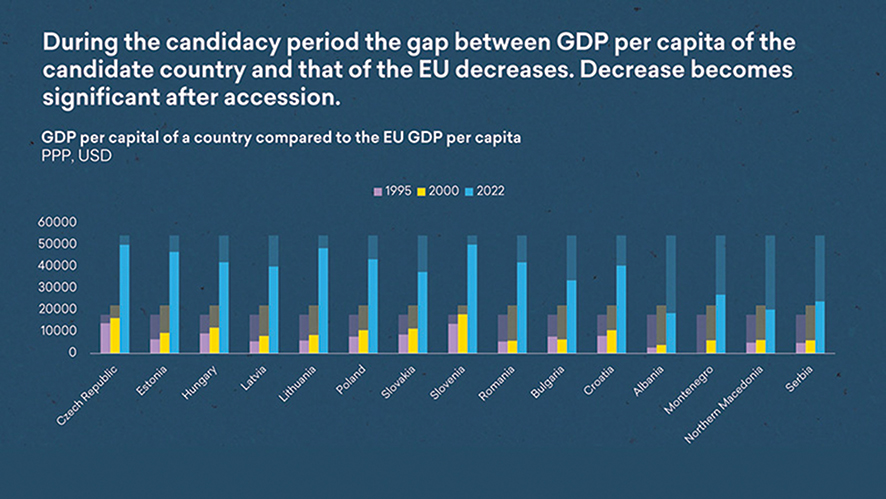

This is not only obvious from first principles but is evidenced by the examples of comparable cases. All new member states in the EU have seen significant growth in economic output as they have integrated into the bloc’s economy. A commonly cited example is the comparison between Poland and Ukraine. At the time of the collapse of the Berlin Wall, per capita income in Poland was slightly below that of Ukraine. However, Poland’s path to the EU stimulated far faster growth in the following years. So, while Ukraine’s economy fell and then stagnated, enjoying very modest growth, Poland’s grew quickly, and by 2020, per capita income in Poland was three times that of Ukraine.

This makes sense because developing countries joining a far larger developed market are likely to be driven to “catch-up” by the logic of income pressures. Eastern European countries joining the EU in the early 2000s had far lower per capita GDP than the European average. As a result, they were cheaper locations for certain kinds of investment. Germany, for example, was able to move parts of its manufacturing industry to Poland, gaining efficiencies for its nascent business while keeping a supply-chain partner nearby. This drove up efficiency overall and pushed up Polish manufacturing wages. Similarly, Georgia could become a location for relatively labor-intensive parts of the EU’s supply chain, increasing Georgia’s employment and salaries in the process.

However, when are these likely benefits going to start? And what are the mechanisms through which we will see their effect?

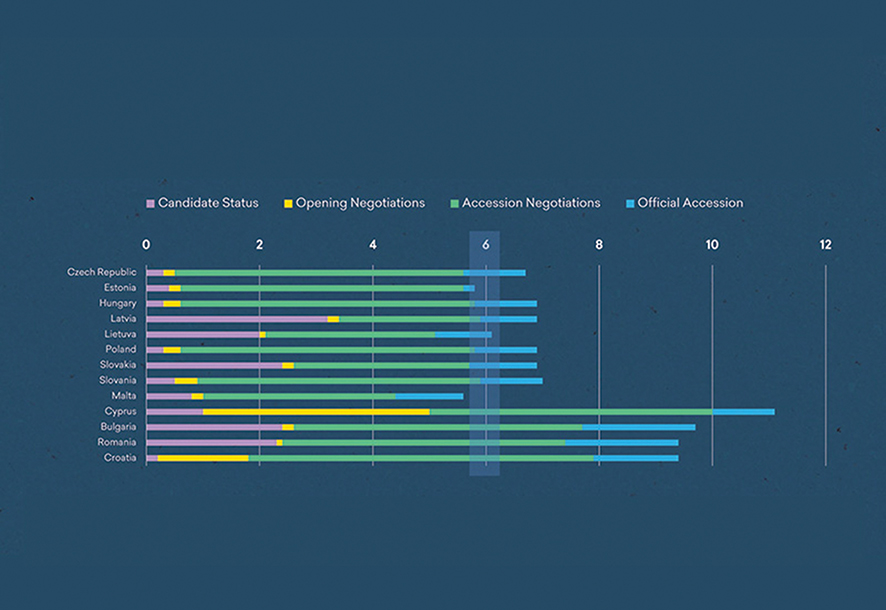

Prior to the European Council’s decision in December, AmCham and TBC Capital co-hosted an event to discuss Georgia’s aspirations and its likely impact. Recent EU expansion consisted of 13 countries that have joined the EU since 2000 (mostly in 2004). TBC Capital compared the experience of all 13 countries and saw some notable trends.

First, the average period between candidate status being conferred and EU membership was six years. This seems to suggest that if there is sufficient determination to join, countries can move fairly quickly through the accession process. In addition, Georgia’s Association Agreement with the EU came into effect in 2016 and began the process of aligning the country’s technical internal requirements with the EU. And, even prior to that, Georgia was an acknowledged global reformer, particularly on pro-business issues. So, Georgia has more than 20 years of reforms to build on. It is not starting from scratch.

TBC Capital’s research also found that considerable economic growth “catch-up” happened in candidate countries during the accession process, continuing once the countries were accepted into the EU.

There are several reasons why it makes sense that countries might see benefits even before they gain full membership.

Most directly, in the accession years, there may be pools of subsidized financing that become available. An Instrument for Pre-Accession Assistance (IPA), which provides funds from the EU to support reforms, may come available in the coming years, and Georgia may also be able to access other bilateral as well as multilateral EU sources across sectors.

Perhaps more importantly, however, could be the impact on reform and on business confidence. For a start, the accession process is generally a strong driver of economic reform. The EU alignment process in Georgia has been ongoing for many years, but the opening of negotiations will be a huge driver for more change as the government will have to prove that it is already aligned with the EU in significant commercial areas like production and safety standards, corporate governance, and capital markets.

EU candidate status could also bring with it a general increase in business confidence and increase Georgia’s visibility as an investable location, particularly if it is perceived that EU membership is likely imminent. TBC Capital examined the case of Bulgaria, for example, and found that during its accession period, growth in exports and FDI started as soon as they achieved candidate status and accelerated as they approached full accession.

Business reforms, improved FDI, and a general sense of positive forward movement could, in this way, become self-reinforcing. Again, in the case of Bulgaria, confidence was reflected in other market indicators like an improving S&P credit rating and a corresponding drop in long-term treasury bond rates.

Enthusiasm from the private sector

It is therefore easy to see why so many companies are enthusiastic about the prospect of EU membership. Of course, many businesspeople, as Georgian patriots, are simply keen to see Georgia take its rightful place as part of the European family. However, there are also clear economic upsides.

Zurab Eristavi, founder of the real estate brokerage Eristavi Estates, talking just before the decision, highlighted the way in which expectations alone can boost the economy:

“With the anticipated positive recommendation, we’re expecting an upbeat sentiment, which invariably influences real estate prices favorably. While it’s challenging to predict the exact scale of the price increase, the mere expectation can lead to significant outcomes. We’re looking at a possible 10% to 15% rise.”

In tourism, CEO of Rooms Hotels Valeri Chekheria highlights the importance of standards and training to take advantage of the opportunity. “EU candidate status creates an incredible chance for Georgia to grow its tourism sector and the economy,” he explains. “This will happen through increased standards and will need the support of experienced companies to train their staff and improve their service offerings. These improvements will help to encourage other developments, like an increase in the number of direct flights from the EU, which should further stimulate growth.”

Georgia’s winemakers and sellers also see considerable opportunities and upside to candidate status and eventual EU membership. Irakli Chkhaidze, founder of 8000 Vintages, which already has a Georgian wine shop in Berlin, says, “The ongoing facilitation of paperwork under the EU/Georgia Agreement is already evident, and our experience in Berlin underscores the growing interest in Georgian wine across Europe. As integration progresses, we anticipate heightened attention from both clientele and investors, facilitated by streamlined processes and heightened awareness.”

CEO of wine producer Mosmieri Joerg Mathies emphasizes the domestic market benefits. As he says, “The Georgian economy as a whole will benefit much more from candidate status, and as incomes rise, so will demand for better and more expensive wines in the domestic market.”

But, traditional markets may underestimate the scale of the opportunity presented by the EU. The company Georgian Products, which predominantly sells pet furniture, is a prime example of an export-oriented company that developed an unusual niche in the European market and now sells over a 100 products across the continent. With total exports of $22 million in 2022, the value of the company’s exports to the EU rivaled those of Georgia’s entire wine sector.

Similar opportunities exist in a wide range of areas, and it is often difficult to predict where exactly new opportunities may present themselves. While there is a long-standing track record of growth in exports to the EU across agribusiness, particularly in nuts and wine as well as apparel (particularly fast fashion), there are other nascent growth trends to keep an eye on – from kids clothes to toys to high-end processed foods and pharmaceuticals.

Of course, a lot still has to happen to make these opportunities into reality. But it is clear that it can be done, and 2024 could be the breakout year!

By George Welton for Investor.ge