ISET-PI has updated its real GDP growth forecast for the third and fourth quarters of 2021. Here are the highlights of this month’s release:

HIGHLIGHTS

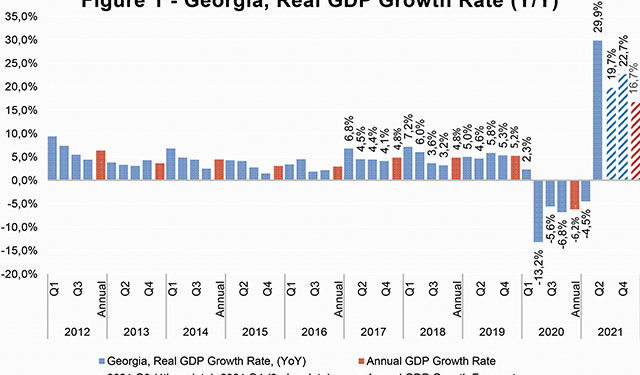

• Recently, Geostat has released the preliminary estimate of real GDP growth for the second quarter of 2021, which now stands at 29.9%.

• The real GDP growth rate reached 9.9% year-on-year in July 2021. Consequently, the estimated real GDP for the first seven months of 2021 amounted to 12.2%.

• ISET-PI’s forecast of real GDP growth for the third quarter of 2021 stands at 19.7%. The second estimate for the fourth quarter growth forecast stands at 22.7%.

• Based on July’s data, we expect annual growth in 2021 to be 16.7%. This number is most likely overestimated by the model at the current point in time. This is because the nature of the shock (a transitory lockdown event and difficult epidemiological situation) in the last three quarters of 2020 and correspondingly abnormally high GDP growth (base effect, increased external demand and higher commodity prices) in the second quarter of 2021, had not had relevant analogues in the Georgian data. However, the accuracy of annual growth forecast is expected to improve significantly once the third quarter data becomes available.

• In addition, the National Bank of Georgia revised its expectation for real GDP growth up from 4% to 8.5% in 2020. According to the Monetary Policy Report, among the reasons behind the prediction’s upward revision are recovery in external demand (expected improvement in exports of goods, a slightly slower increase in imports of goods and the gradual recovery of tourism exports), fiscal stimulus and credit growth.

GDP Growth by Sector in Q2

The Georgian statistics office, Geostat, has released its preliminary estimate of the GDP growth for the second quarter of 2021 (based on VAT taxpayers’ turnover data). The estimated growth in Q2 is 29.9%.

According to Geostat, the following sectors had the largest positive contribution to the annual real GDP growth in this period: Arts, entertainment and recreation (133.6% growth yearly), accommodation and food service activities (75.5% yearly), information and communication (56.2% yearly), wholesale and retail trade; repair of motor vehicles and motorcycle (53.9% yearly), water supply; sewerage, waste management and remediation activities (49.8% yearly), transportation and storage (47% yearly), financial and insurance activities (45.5% yearly), human health and social work activities (43.4% yearly), manufacturing (42.3% yearly); construction (36.9% yearly). While the agriculture, forestry and fishing (-2.3% growth yearly), and education (-1.4% yearly) were the only sectors that shrunk in Q2.

Variables behind the Q3 and Q4 GDP growth forecast:

National and Foreign Currency Deposits in commercial banks

This group of variables experienced notable monthly and yearly changes in July, positively contributing to Q3 and Q4 forecasts. The largest yearly increase was observed in Current Account and National Currency Demand Deposits – a 20.1% and 18.8% increase relative to the same month of the previous year, respectively. The National Currency Total Deposits increased by 16.9% year-on-year. The growth was relatively moderate in the case of Foreign Currency Deposits in commercial banks. As a result, deposit dollarization was reduced by 0.1 ppts to 60.2%. Indeed, an increase in National Currency Deposits-related variables had a positive contribution to the GDP growth projection.

Merchandise Trade

In July, Georgia’s exports increased by a 42.4% yearly. This trend was mainly driven by an increase in the export of ferro-alleys, natural grape wines, mineral waters and other fruits to Russia; alongside with the export/re-export of motor cars, telephones and cattle to Azerbaijan; alcoholic beverages and husks to Armenia; export of ferrous scrap, garment and semi-carbon steel to Turkey; export/re-export of motor cars, telephones and copper scrap to Ukraine, and re-export of copper and precious metals to China. In contrast, Georgian re-export of motor cars to UAE experienced annual decline.

During this period, the import of goods increased by 17.2%, driven by a increase in import of petroleum and fuel products from Turkmenistan and Azerbaijan (mostly due to a significant annual increase of crude oil prices on the international marke – 73.8% in July); Among other positively affected imports were: carbon steel and Portland cement from Azerbaijan; carbon steel rolling mills and telephones from Ukraine; petroleum and fuel products from Bulgaria; motor cars from Germany; polymers and ceramic tiles from Iran; copper ores and concentrates from Serbia and Chile; computing machines and their blocks from Hong Kong; and immune serums and hormones from China. In contrast, Georgian imports of motor cars from USA; and copper ores and concentrates from Brazil. Consequently, the trade deficit increased by 2% yearly, and amounted to 462.1 million USD. Overall, trade related variables still had a positive contribution to the GDP growth forecast.

Money Inflow

After a significant slowdown in money inflows in the beginning of the previous year, remittances were on the path of recovery. In July, remittances increased by 10.4% yearly. The main contributors to this increase were Italy (by 18.8% YoY, contribution 2.8 ppts), Kazakhstan (by 251.5% YoY, contribution 1.9 ppts), USA (by 13.7% YoY, contribution 1.6 ppts), Germany (by 43.4% YoY, contribution 1.6 ppts), Israel (by 14.4% YoY, contribution 1.1 ppts), Kyrgyzstan (by 187.5% YoY, contribution 0.6 ppts), Azerbaijan (by 11.8% YoY, contribution 0.4 ppts), and Tajikistan (by 306.1% YoY, contribution 0.4 ppts). While Ukraine (by -24.9% YoY, contribution -1.3 ppts), Turkey (by -20.7% YoY, contribution -1.2 ppts), Russia (by -0.7% YoY, contribution -0.2 ppts), and Armenia (by -11% YoY, contribution -0.1 ppts) had negative contribution to the annual growth figure. Overall, the recovery of remittances flows made a positive contribution to the Q3 and Q4 growth forecast.

Tourism Inflow

Tourism arrivals and receipts only partially recovered in July of 2021 after a sharp decline in 2020. In July, the number of international visitors increased by 403.7% yearly (which is still only 23.6% of the same measure in 2019), while the growth in tourist numbers (visitors who spent 24 hours or more in Georgia) amounted to 473.9%. Overall, recovered numbers of visitors and tourists, along with a moderate increase in touristic spending has made a small positive contribution to the growth forecast.

Foreign Direct Investment

In addition, Foreign Direct Investment (FDI) in Georgia amounted to 234.2 million USD in the second quarter of 2021 (the lowest inflow since 2014), which is 2.6% higher than the adjusted data from Q2 2021.

According to Geostat, FDI experienced slight increase in such sectors as health and social work, manufacturing, energy, hotels and restaurants, real estate, finance and, other sectors, while FDI decreased in all the other sectors (the largest decline was observable in agriculture, transports and communication, mining, and construction sectors). The recent trends in FDI are not taken into consideration in our model yet.

Inflation

In July, the annual inflation of consumer prices amounted to 11.9%, which is notably higher than the targeted 3%. Approximately 4.1 percentage points of CPI inflation were related to higher food prices, which increased 14.1% annually (this was driven by the hike in food prices worldwide). Furthermore, increased oil prices made a notable positive contribution (2.1 ppts) to the annual inflation measure. The latter trend is mostly a reflection of significantly increased oil prices on the global market (Euro Brent Spot Price (COP) increased by 73.8% yearly). Meanwhile, the measure of core inflation amounted to 6.3%.

Due to higher annual inflation rate compared to the targeted 3% and risks of emerging inflationary expectations, National Bank of Georgia (NBG) increased Monetary Policy Rate (MPR) by 0.5 ppt in August 2021 and maintained this measure on the same level (10%) in September 2021. This had a negative impact on the annual real GDP growth. Overall, CPI related variables had a slight negative contribution to the GDP forecast.

Exchange Rate

In July, the Georgian lari real exchange rate appreciated in both yearly and monthly terms against all main trading currencies. The Real Effective Exchange Rate (REER) appreciated by 2.4% and 5.3% monthly and yearly respectively. Appreciation of the REER is typically associated with domestic export goods losing competitiveness on the foreign markets, but it also translates into less pressure on the prices of imported goods. Overall, REER-related variables had a small positive contribution to the real GDP growth projections.

Our forecasting model is based on the Leading Economic Indicator (LEI) methodology developed by the New Economic School, Moscow, Russia. We have constructed a dynamic model of the Georgian economy, which assumes that all economic variables, including GDP itself, are driven by a small number of factors that can be extracted from the data well before the GDP growth estimates are published. For each quarter, ISET-PI produces five consecutive monthly forecasts (or “vintages”), which increase in precision as time passes. Our first forecast (the 1st vintage) is available around five months before the end of the quarter in question. The last forecast (the 5th vintage) is published in the first month of the next quarter.

By Davit Keshelava and Yasya Babych