Over the past few years, food prices have been increasing and Georgia has been facing food price inflation in the double digits. This is primarily due to international market trends that reflect concerns over decreased production, increased crude oil prices, as well as COVID-19 pandemic-related restrictions. Russia’s full-scale invasion in Ukraine increased pressure on international food markets already struggling with soaring prices.

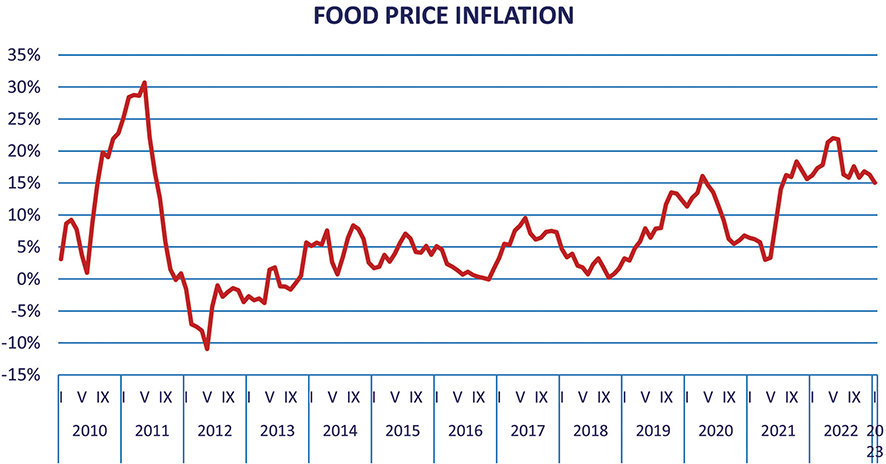

The food prices in Georgia experienced a sharp increase of 22% on a yearly basis in May 2022, but there was some moderation afterward, and the average annual increase during the rest of the year was 16.5%, as shown in Figure 1. Overall, the average price increase in the category of food and non-alcoholic beverages was 17.9% in 2022. In 2023, food prices continued to increase on an annual basis but at smaller pace of 15% in January. This is particularly concerning as households in Georgia allocate almost half of their total budget towards food expenditures: the share of expenditure on food in total household consumption expenditure increased from 43% in 2019 to 48.7% in 2021 (Geostat, 2023). As a result, the high food prices are putting significant financial strain on the general population, with the low-income families being particularly affected.

THE GOVERNMENT’S NEW INITIATIVE

In the wake of the pandemic and Russia’s invasion of Ukraine, the Government of Georgia (GoG) has been faced with the significant challenge of maintaining low and stable food prices. The current circumstances have heightened the importance of this issue, as the economic impacts of these events have already put significant strain on the population. As a result, the government has been working to address this challenge and ensure that food remains affordable for all.

In the attempt to lower the food prices earlier this year, in February, the Ministry of Economy and Sustainable Development (MoESD) of Georgia was given the task of creating a new draft law aimed at regulating food prices (Business Media Georgia, 2023). Government officials have indicated that the draft legislation is being developed in accordance with the European Union’s Directive 633 of 2019, which focuses on promoting fair competition in the market.

According to the government, the purpose of the draft law is to optimize processes at various levels of supply chain, which should ultimately lead to reduced profit margins and prices (Business Media Georgia, 2023). The government has stated that the proposed draft law aims to address several key issues related to food pricing, such as setting standard payment terms for suppliers, including taxes and marketing expenses, promoting transparent sharing of stock information, and establishing guidelines for returnable products. The government has emphasized that these measures are directly linked to optimizing processes and maintaining reasonable profit margins.

In this policy brief, we compare the EU Directive 2019/633 to the GoG initiative, analyze price control mechanisms, and examine their potential impact on market economies. We also discuss alternatives to reduce food prices and their volatility.

THE EU DIRECTIVE 2019/633 ON UNFAIR TRADING PRACTICES

The European Union has taken steps to address unfair trading practices within the food supply chain, which can harm farmers and small operators due to imbalances of power between larger and smaller entities (European Commission, 2023). These practices deviate from good commercial conduct and violate principles of fair trading. To better protect farmers, as well as small and medium-sized suppliers, the EU has enacted mandatory rules that prohibit certain unfair trading practices. The EU Directive 2019/633 on unfair trading practices in the agricultural and food supply chain was approved by the European Parliament and Council on April 17, 2019, and requires EU member countries to adopt the Directive into their national laws by May 1, 2021, with enforcement beginning six months later.

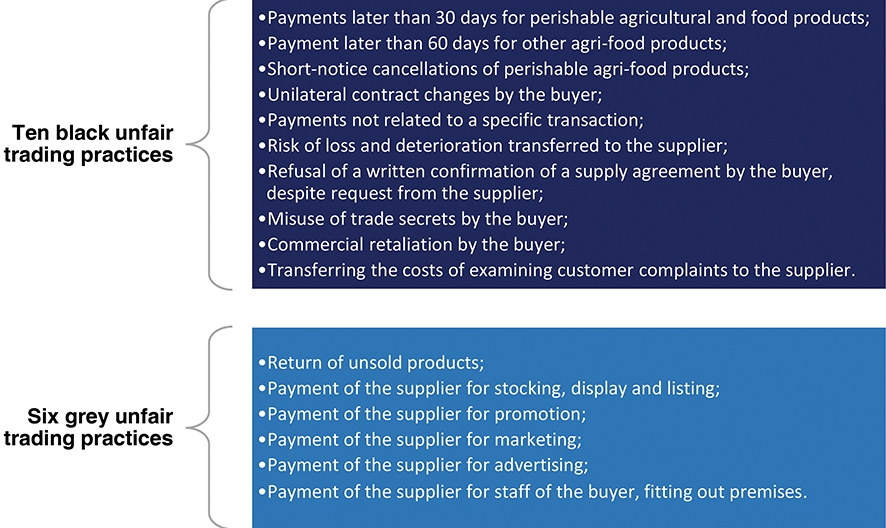

The Directive distinguishes between “black” and “grey” practices. Black practices are those that are always prohibited, regardless of the circumstances. These include practices such as late payments, cancellation of orders at short notice, and unilateral changes to contracts.

Grey practices, on the other hand, are those that may be allowed if they are agreed upon beforehand in a clear and unambiguous manner. These practices include things like payment for shelf space and marketing costs, provided that the terms are clearly agreed upon in advance and do not unfairly disadvantage the supplier.

By banning black practices and providing clearer rules around grey practices, the Directive aims to create a more level playing field for farmers and SMEs in the food supply chain, and to ensure that they receive fairer treatment from their larger trading partners (European Commission, 2019).

EU member states have the option to implement the Directive into their national laws with stricter regulations that exceed the Directive’s requirements. Nonetheless, they are not permitted to provide less protection than what is outlined in the Directive (European Commission, 2019).

Although the Directive may have an indirect impact on food prices, there are no predictions or assumptions about this matter. The Directive is more likely to have an impact on how value added and profits are distributed across the value chain. Contrary to the Directive, GoG’s proposed approach resembles price controls and is in conflict with the principles of competitive market economies, which Georgia aspires to be.

WHAT DOES ECONOMIC THEORY SAY ABOUT PRICE CONTROLS?

Price controls are a policy tool that can take mainly two forms: price floors and price ceilings. Price floors refer to minimum prices set by the law – minimum wages are the most well-known example of price floor.

Unlike price floors which prevent the prices from being too low, price ceilings are typically implemented to prevent prices from becoming too high and involve setting a maximum price that sellers can charge for a product or service. In the context of government intervention, the regulation of prices suggests the imposition of a price ceiling on certain goods such as food products or petrol. This would mean that sellers of these products would be prohibited from charging a price above a certain limit set by the government. While they might not be officially prohibited from charging the prices they want, the government “indirectly hinting” the need to reduce the price still implies the government using price controls to regulate the market.

According to economic theory price controls have several negative consequences. First and foremost, they often lead to shortages, as the price of a product is artificially lowered below its market equilibrium point, creating excess demand. Additionally, price ceilings can result in a reduction in the quality of the product, as manufacturers may cut corners to keep costs down. Sellers can evade the law by cutting quality rather than raising price. Consumers may also experience search costs, such as long lines or wasted time trying to find a product that is in high demand but in short supply. Usually, given that paying higher price is illegal, buyers find other ways to pay more through bribes which eventually leads to higher levels of corruption. Furthermore, price ceilings can cause a loss of gains from trade, as sellers may be unable or unwilling to produce goods at the artificially low price. With price controls, some profitable trades will not be made. This creates a deadweight loss, which is the total of lost consumer and producer surplus when not all mutually profitable gains from trade are exploited. Lastly, price ceilings can lead to a misallocation of resources, as producers may shift their attention away from the affected market and towards more profitable areas, leaving consumers with fewer choices and lower-quality products.

Moreover, controlling profit margins might eventually result in higher prices on some food products. That is because a relatively low-quality product usually sells for a lower margin and a high-quality product – for a high margin. If a cap is placed on the margin, even a low-quality product could become more expensive because sellers of high-margin products will not be able to make enough profit. Vulnerable groups who cannot afford higher quality products tend to buy lower quality ones, so setting limits on margins could disproportionately affect this vulnerable population.

Since market in the economy are interlinked, price controls imposed on one market affect other markets as shortages in one market create breakdowns and shortages in other markets. Therefore, effect of price controls expands into markets without price controls eventually distorting those whole economy.

OTHER COUNRTRIES’ EXPERIENCE WITH PRICE CONTROLS

Some of the most common examples of price controls include rent control, where governments set a maximum amount of rent that a property owner can charge and limit the yearly rent increase, as well as the regulation of drug prices to increase the affordability of medication and healthcare. Throughout the history price controls have been also applied to fuel and food prices.

As a result of rent control, when prices are too low for housing, there may not be enough supply, thereby increasing unmet/excess demand. For instance, landlords may let the condition of their properties deteriorate because they are not making enough to maintain them. Therefore, buildings deteriorate and become unsafe for living. For example, this is the case in India, where rent controls exacerbate real estate market crisis.

In case of prices for drugs, lower prices lead to lower revenues, which force the producers to find ways to reduce costs. This typically results in lower investments in research & development and therefore less innovative products appearing on the market. The US has experience in controlling medicine prices. The federal government enacted a law in 1990 that restricted the expenses of medications for state Medicaid programs (American Legislative Exchange Council, 2022). When pharmaceutical companies were obligated to offer Medicaid the same discounted prices as their lowest price to any other customer, they decreased the discounts they provided. Therefore, this law caused drug costs to rise for numerous private purchasers (CATO Institute, 2001).

Regarding energy markets, the US government began significant involvement in the 1930s and continued until the 1970s. A set of laws and executive measures were introduced to regulate energy prices, limit competition, and control imports. In 1970s, policymakers deregulated the market and did not apply price controls since then even during the 2008 crisis.

An examination of the fuel markets in 97 nations indicates that in 60% of them, fuel markets are deregulated, and the prices of retail fuel are determined by market forces (Global Petrol Prices, 2023). The majority of countries that fall under this classification have a high degree of economic advancement. In the remaining 40% of the countries, wish are less developed countries, the government is involved in the retail fuel pricing with a price ceiling or a fixed price.

While most of the economists believe that limiting prices charged by companies, distorts the markets through shortages and other supply chain problems, some countries still consider applying measures that can indirectly regulate food prices (CNN Business, 2022). For example, Bulgaria is going to introduce a mechanism to monitor and control food prices across the entire supply chain (CNN Business, 2022).

According to Bulgarian government officials, they are not going to violate the established rules of free competition, but are going to work towards increasing customers’ awareness on price differences between supply chain actors. The German capital of Berlin, for example, has sought to set price ceiling on rent. Regulators in the United Kingdom impose restrictions on the amount of money that consumers can be charged for energy and certain types of rail fares (CNN Business, 2022). The latter markets are more of a natural monopoly where public intervention might be beneficial. Food markets, on the contrary, are mostly competitive markets where government intervention leads to distortion.

In spite of the history of failure, regulating prices seems tempting to many policymakers including the GoG.

ARE THERE ANY ALTERNATIVES TO PRICE CONTROLS?

Combating food price inflation is a challenging task that involves gathering and meticulously examining data to develop solutions that align with the principles of a market economy.

To stabilize food prices and prevent market distortion, the following options can be explored:

Increase competition: Encouraging competition among food producers and retailers can help to lower prices. To promote competition GoG can support new market entrants, encourage innovation, prevent monopolies, provide market information to consumers and support international trade.

Increase agricultural productivity: Increasing agricultural productivity through better farming practices, improved agricultural inputs, and modern irrigation systems can help to increase food supply and reduce the impact of price shocks. Investing in agriculture and improving farming techniques can increase productivity, which can lead to lower production costs and ultimately lower food prices.

Enhance storage and transportation infrastructure: Developing storage and transportation infrastructure can help to mitigate the impact of supply shocks and price fluctuations. Having adequate storage facilities can allow for the temporary storage of excess food during times of high supply, which can then be released into the market during periods of low supply, helping to stabilize prices. As to the transportation infrastructure, improving transportation infrastructure can facilitate the movement of food from areas of surplus to areas of deficit, reducing regional imbalances in food availability and price fluctuations.

Reduce food waste: A significant amount of food is wasted each year, which contributes to higher prices. Reducing food waste through better storage, transportation, and distribution can help to lower food prices.

Promote risk management tools: Government can promote the use of risk management tools, such as contract farming, insurance or forward contracts, to help farmers and other stakeholders manage the risks associated with food price volatility.

Promote market transparency: Improving market transparency through the collection and dissemination of information on food production, demand, and prices can help to reduce the uncertainty and volatility in food prices. Collecting information on the distribution of value added among the actors of supply chain can be helpful in designing policies related to fair trade practices in the supply chain.

Diversify import markets: Diversification of import markets can provide greater resilience to food price volatility by reducing dependence on any one supplier or region, increasing competition, providing access to alternative sources of food products, and reducing the impact of local supply shocks and price fluctuations. It can help to reduce the dependence on a single supplier or a market, which can cause prices to spike due to any disruption to the supply chain (e.g., Georgia depends on imports of wheat flour and sunflower oil from Russia and the trade restrictive measures taken by Russia put and upward pressure on food prices). In addition, import diversification can increase competition among suppliers, leading to more stable prices over time. Furthermore, diversification can create opportunities for price arbitrage, allowing buyers to take advantage of price differentials between different markets and reduce the impact of price volatility.

Reduce reliance on traditional energy sources: Prioritizing alternative energy sources is crucial for the sustainable development of economy in the long-term. Regulating energy prices may impede the adoption of alternative energy sources, making it even more challenging in Georgia, where the adoption of alternative energy sources is slow.

Overall, while some degree of regulation may be necessary to ensure fair competition and protect consumers, a market economy is generally seen as the most efficient and effective way to allocate resources and promote economic growth. That why is it essential to remain on a right track and design government policies in line with the principles of market economy.

DISCLAIMER: This document has been produced with the financial support of Sweden. The contents are the sole responsibility of the authors and can under no circumstance be regarded as reflecting the position of Sweden.

By SALOME GELASHVILI and SALOME DEISADZE