In April 2021, the number of international visitors in Georgia reached its highest level since the start of the pandemic. Furthermore, since April, the following factors have given rise to more optimistic expectations than before: the curfew restricting outdoor movement after 9pm has been pushed back to 11pm, a special vaccination program for tourism sector workers has commenced, restaurants are now allowed to operate on weekends, various old and new air routes have been (re)introduced and, finally, land borders were re-opened on June 1. Thus, the overall expectations for tourism’s recovery in 2021 have shifted upwards. However, as entry requirements include either vaccination or a negative PCR test result, recapturing even half of the pre-pandemic scale of tourism is unlikely this year. In this issue, we examine the prospects regarding the number of visitors in 2021 by looking at the percentage of vaccinated people in Georgia’s key source markets.

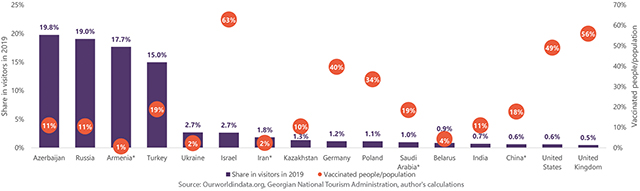

In 2019, 71% of all visitors to Georgia came from its four immediate neighbors: Azerbaijan (19.8%), Russia (19.0%), Armenia (17.7%), and Turkey (15.0%). As of May 23*, none of these four countries had vaccinated more than 20% of their population, with Turkey being the closest at 19%. In fact, the key source countries for Georgia to have vaccinated more than 20% of their population accounted for just 10.5% of visitors in 2019.

Countries that stand out in terms of vaccination performance among the top source markets include Israel (63% of people vaccinated), the United Kingdom (56%), and the United States (49%), followed by Germany (40%) and Poland (34%). Most other EU countries, while not having a significant share in visitors to Georgia, have vaccinated around 30-40% of their populations as well.

Looking at the breakdown of visitors to Georgia in April 2021, 12.2% of visitors were from Israel, while in 2019 this corresponding figure was only 2.7%. In fact, the number of visitors from Israel in April 2021 declined by just 29.6% compared to April 2019. It is expected that Israel will continue to rank fairly high in terms of share in visitors, at least over the course of 2021. Some other countries that stand out in terms of their high vaccination rates, and that could be worth targeting at least in the short term, include the United Arab Emirates (61%**), Hungary (52%), Bahrain (52%), Finland (41%), and Cyprus (41%).

* For some countries data were not available for May 23, so data from May 22, 21, or 20 were taken

** For some countries (indicated by a star on the graph) the number was estimated based on total vaccinations

Hotel Price Index

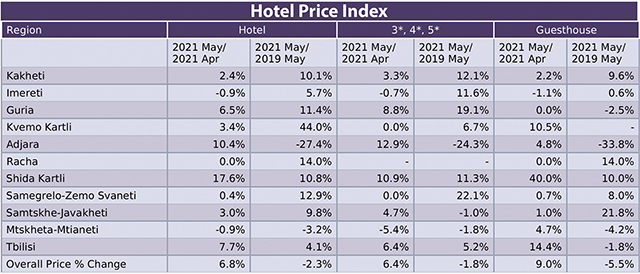

In May 2021, in Georgia, the hotel price index increased by 6.8% compared to April 2021. The 3-star, 4-star and 5-star hotel price index increased by 6.4%, while for guesthouses, the price index increased by 9.0%.

In May 2021, compared to May 2019, hotel prices in Georgia decreased by 2.3%. The prices of 3*, 4*, 5* hotels decreased by 1.8%, while the prices of guesthouses decreased by 5.5%.

Average Hotel Prices

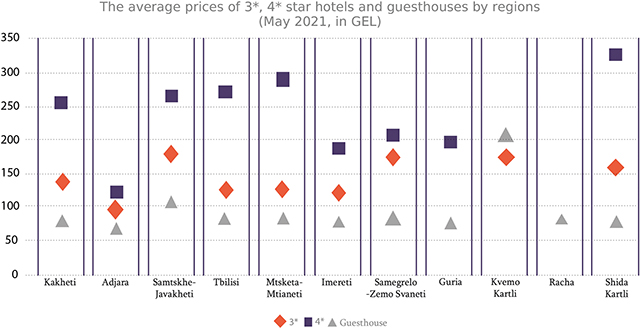

In Georgia, the average cost of a room in a 3-star hotel was 132 GEL per night in May 2021, while the average cost of a room in a 4-star hotel in Georgia was 246 GEL per night and the average cost of a room in a guesthouse3 was 82 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in May 2021 was 402 GEL per night. In Guria, the average price was 600 GEL, followed by Tbilisi – 509 GEL, Kakheti – 432 GEL and Adjara – 391 GEL.

![]()