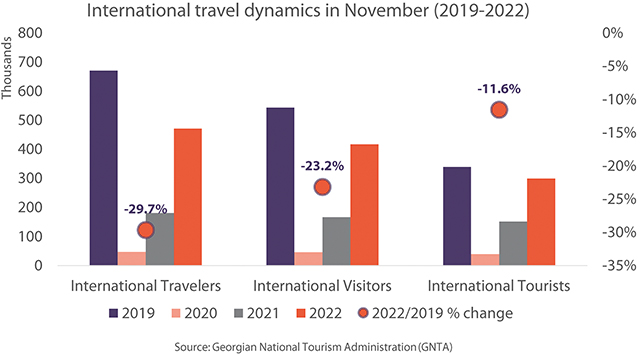

The number of international travelers increased by 160.4% in November 2022, compared to the same period of 2021, and declined by 29.7% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 150.5% (2022/2021) and declined by 23.2% (2022/2019), and the number of international tourists increased by 97.9% (2022/2021) and declined by 11.6% (2022/2019).

In November 2022, the top countries of origin of international visits were Russia (108,247 visits), Turkey (101,940 visits), and Armenia (71,785 visits). Among the major tourism markets, the number of international visits from Belarus (84.4%), Russia (24.7%), Turkey (24.7%), and Israel (15.8%) significantly exceeded the pre-pandemic figure (November 2019). Besides, the number of international visits from other neighboring countries: Armenia (-38.5%) and Azerbaijan (-89.2%) was still well below the pre-pandemic number. The low recovery rate of visits from Azerbaijan could be attributed to the closure of the land border between Georgia and Azerbaijan since March 2020.

INTERNATIONAL VISIT DYNAMICS

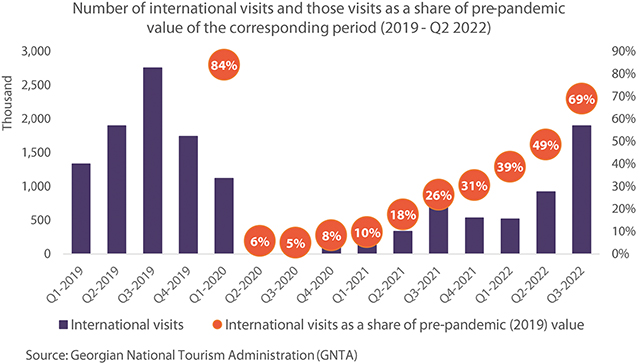

Since 2021, international visits have been showing signs of significant recovery, with a notable acceleration in Q3 of 2022 when the number of international visits reached 69% of the corresponding figure in Q3 of 2019. In the third quarter of 2022, similar to previous periods, most international visits were from neighboring countries: Russia (28% of total visits), Armenia (17%), and Turkey (15%). However, notably, in Q3 of 2022 compared to Q3 of 2019, the share of Russians in total visits increased by 9 pp.

Compared to Q3 of 2019, in Q3 of 2022, among the main countries of origin of tourists, international visits from Russia exceeded the pre-pandemic number by 4%. Meanwhile, visits from Israel (96% of the value in Q3 of 2019), Iran (93%), Armenia (71%), Turkey (69%), and Ukraine (69%) also recovered significantly.

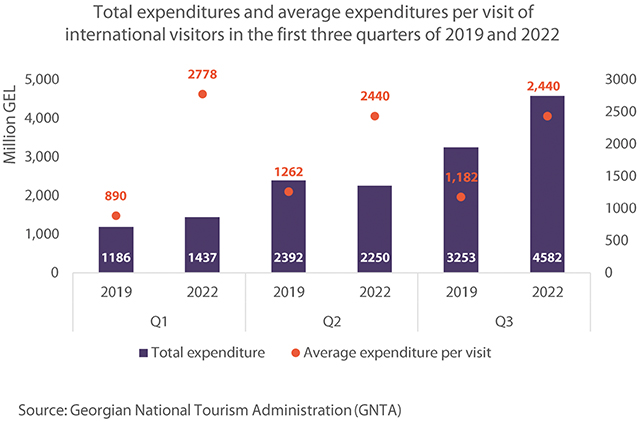

Despite only a partial recovery in the number of international visits, in Q3 of 2022, the total expenditure of international visitors exceeded the pre-pandemic (Q3 of 2019) value by 41%, reaching GEL 4.6 billion.

The average expenditure per visit tripled in Q3 of 2022 compared to Q3 of 2019 and reached GEL 2,440. This could be explained by a combination of factors, such as the increase in the average number of nights spent per visit, inflationary trends, and other changes in travelers’ behavior. In Q3 of 2022, a large share of the expenditure of international visitors went on accommodation (40.9%), followed by food and drinks (29.8%). Notably, the share of accommodation in total expenditures increased by 16.3 pp compared to Q3 of 2019. Apart from that, the share of food and drinks declined significantly when compared to the first half of 2022 (36%).

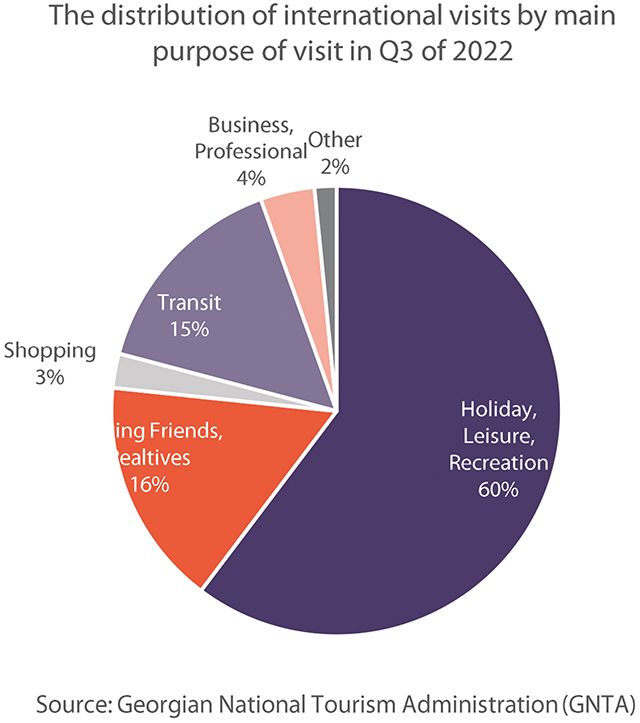

PURPOSE OF INTERNATIONAL VISITS

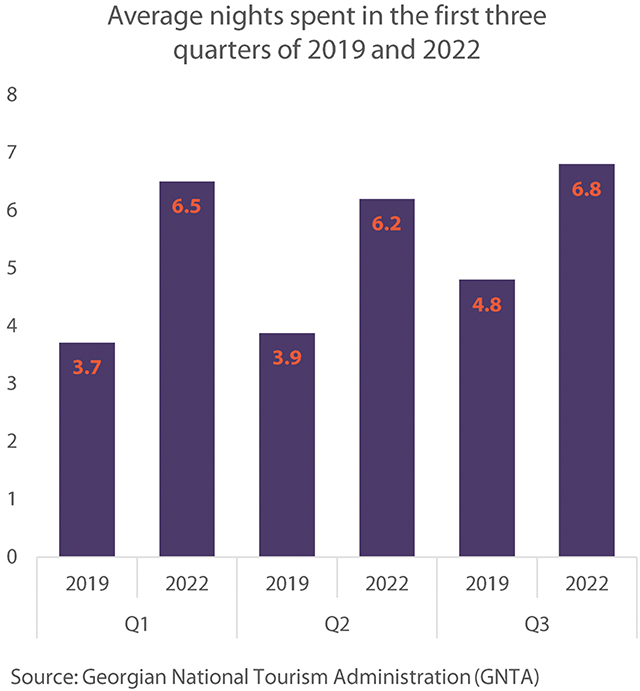

Similar to the first half of 2022, the average number of nights spent per visit increased significantly (42%) in Q3 of 2022, compared to Q3 of 2019, reaching 6.8 nights. Apart from the general post-pandemic changes in the behavior of visitors, this could also be attributed to the fact that a larger share of visitors are choosing a personal home or apartment as their accommodation (12 pp higher in Q3 of 2022, compared to Q3 of 2019).

Observing the distribution of international visits according to the main purpose of the visit, in Q3 of 2022, the share of leisure/recreation in total visits increased by 7.5 pp compared to the pre-pandemic figure. It must also be noted that in Q3 of 2022, the share of visiting friends and relatives in total visits was similar to the pre-pandemic figure, while in the first half of 2022 it showed a significant increase (6.1 pp). When looking at the conducted activities, the top activities were tasting local cuisine and wine (83%), sightseeing (61%), and shopping (58%). Similar to the first half of 2022, the share of visitors going to the beach increased considerably compared to the pre-pandemic period.

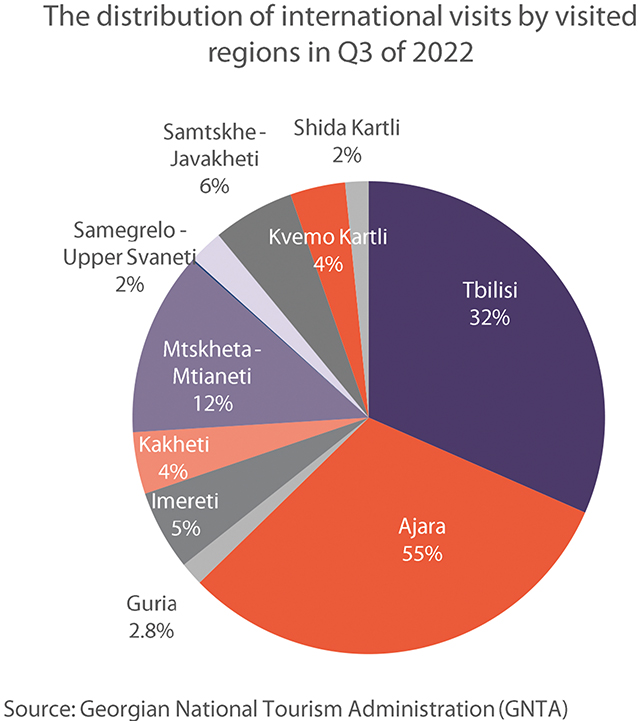

During Q3 of 2022, the share of international visitors going to Adjara increased sharply by 12.7 pp compared to the pre-pandemic period. On the other hand, visits to the Kvemo Kartli region declined considerably (by 7 pp), similar to the first half of 2022, which could be attributed to the closure of the land border with Azerbaijan.

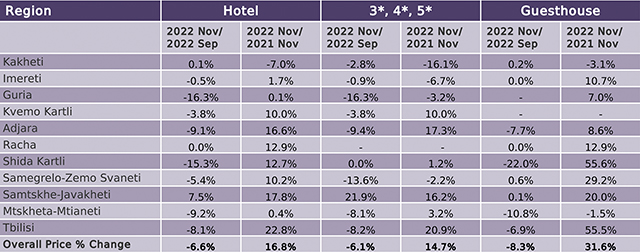

HOTEL PRICE INDEX IN GEORGIA

In November 2022, in Georgia, the hotel price index decreased by 6.6% compared to September 2022. The 3-star, 4-star, and 5-star hotel price index decreased by 6.1%, while for guesthouses, the price index decreased by 8.3%. The monthly HPI was the highest in Samtskhe-Javakheti (7.5%) and the lowest in Guria (-16.3%).

In November 2022, compared to November 2021, hotel prices in Georgia increased by 16.8%. The prices of 3*, 4*, 5* hotels increased by 14.7% and the prices of guesthouses increased by 31.6%. The yearly HPI was the highest in Tbilisi (22.8%) and the lowest in Kakheti (-7.0%).

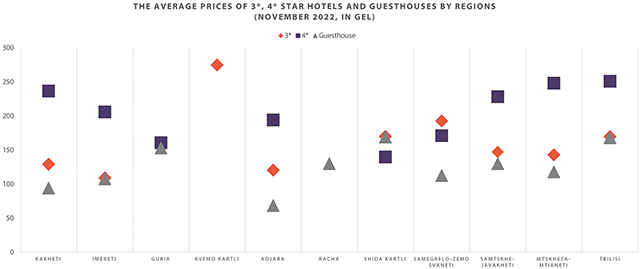

THE AVERAGE HOTEL PRICES IN GEORGIA

In Georgia, the average cost of a room in a 3-star hotel was 155 GEL per night in November 2022, while the average cost of a room in a 4-star hotel in Georgia was 233 GEL per night and the average cost of a room in a guesthouse was 114 GEL per night. The average cost of a room in a 5-star hotel in Georgia in September 2022 was 419 GEL per night. In Kakheti, the average price was 575 GEL, followed by Tbilisi – 554, Guria – 381, and Adjara – 344.

Analysis provided by PMCG Research