A mere three years after its fractious launch, Georgia’s pension fund seems to have been accepted by the population. Internal dissent, which caused its first director to depart with the words “I’ll pray for it”, is history, and it has just reported a respectable set of figures. Now, with funds under management valued comfortably ahead of the agency’s own launch forecasts of GEL 2.3 billion, GEL 329 million more than at inception, it is embarking on its first foray into international markets under the guiding hand of major international investment bankers, New York-based JP Morgan Chase.

There are those who wish its funds would dally a little more at home and provide a badly needed boost to Georgia’s moribund equity market – regularly, no transactions are recorded there these days, unlike in earlier times – but this is not to be. Or at least, not yet. However, September 2023 could see the Pension Fund move into the small company end of the economy via local specialist investment funds. The fund should also be able to invest in long-term Lari bonds by the time local companies issue them. A start has already been made in that companies are opening brokerage accounts at Georgian broking houses.

Advocates push for investment in Georgia’s capital market

Among those advocating that the fund should be more active in local capital markets is Otari Sharikadze, managing director of investment bank Galt & Taggart. “Considering the amount of money already accumulated, I consider it necessary for the pension fund to become an active participant in the capital market.”

Of course, he adds: “It is necessary to follow certain rules that have already been introduced, for example, that the pension fund cannot invest money in non-rated companies. But we should give the pension fund more opportunity and freedom than it has today.” Discussion on ways in which the fund’s universe could be expanded are ongoing.

Included in Sharikadze’s suggestions is that the fund’s exposure to local issuers should continue to be limited and controlled, “maybe they should try to decrease the threshold of the required ratings,” he suggests, adding that he welcomes the progress indicated by discussion of the pension fund investing in Georgia alongside local IFIs.

Acknowledging the Pension Fund’s potential to strengthen local financial markets, Olivier Rousseau, Chairman of the Investment Board of Georgia’s Pension Agency, told BM.ge in December that: “It’s not our fundamental objective by the law to develop the Georgian capital markets, but it’s a logical necessary implication: to better serve the participants, we need more instruments in which to invest, and that is exactly developing capital markets. ….And, as the Pension Agency, being able to invest in long-term Lari financing, we will make a huge change to the capital markets in Georgia.”

In March the Pension Fund was showing a profitability rate that equals to an annual 11.6%, while the profitability since the launch of the fund system is at 35%

To help prepare companies to raise money in local capital markets (rather than through bank borrowings) and to widen the investments available there, education and practical help is being offered to them by Galt & Taggart, with accountancy firm BDO acting as its subcontractor. Long-term Lari bonds are one of the subjects being discussed.

Funding for this eighteen-month education program is coming from one of the leading advocates of strengthening the Georgian financial scene, the EBRD, although all the IFIs have frequently called for more backing and activity in Georgia’s markets. The program includes the possibility of qualifying for a hefty subsidy (GEL 100,000 – 200,000) to cover issue related fees.

Until this spring’s first diversification, the Pension Fund’s activities had been restricted in the interests of safeguarding its members’ money, investments being largely in Georgian bank deposits, CDs and interest-bearing current accounts, all of which are relatively high interest bearing.

Portfolio and performance

Now, with diversification started, at the end of April, according to the Pension Fund, the portfolio has widened: “At present, our NAV is at GEL 2.3 billion, of which, 61% is invested in Bank CDs, 32% in bank interest-bearing current accounts, 11% in iShares MSCI World ETF, and 4% in US T-bills. Fifteen percent of the portfolio is in USD and the rest is in Georgian Lari. So, that means 15% of the portfolio is in foreign assets, while 85% is in Georgia,” said Pension Agency Chief Investment Officer, Goga Melikidze.

With Georgia’s high interest rates, the performance has held up well and very comfortably above inflation levels until recently. The agency’s report to the government in March stated that the Pension Fund was showing “a profitability rate that equals to an annual 11.6%, while the profitability since the launch of the fund system is at 35%…”

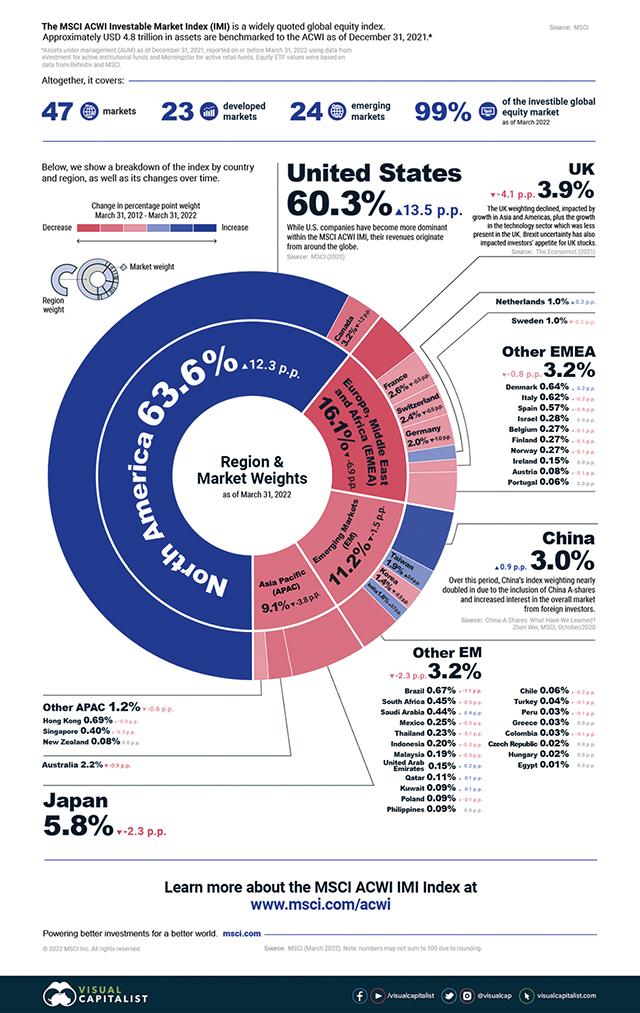

The new international phase has begun to take the fund into foreign currency instruments, although there is a maximum exposure of 20%. The Pension Fund, describing the MSCI World index and EFT to BM.ge, said: “This is a rather diversified index. It includes 23 developed economies. For example, the US share in the index is 68%, Japan 6%, Great Britain 4%, Canada 3.5%, France 3.2%, etc … The index includes 1,539 companies. Companies such as Apple, MicroSoft, Google, Amazon, Tesla, Facebook, JOHNSON & JOHNSON, etc. This index covers 12 different sectors, where technologies occupy 22%, financial services 14%, and the health sector 12.6%.”

Currently, 1.2 million people are enrolled in the pension scheme and 169,000 have exercised their right to exit (39% of those entitled to do so). There are a total of 1,809 pensioners.

Both the fund and the National Bank of Georgia say they are not worried about this inevitable exodus – it is not seen as large in the scheme of things and, in fact, was less than feared. The concept is that the population will gradually join, as they can see that this is a safe way to invest; and indeed, average monthly enrolment has been running at around 10,000.

Given the relatively low level of financial knowledge in Georgia, the Pension Agency has also been busy with various initiatives to keep the public informed of its operations and achievements through the media, initiatives, meetings, and conferences. As Melikidze outlined, “… we actively use social media platforms (Facebook, LinkedIn) in order to raise public awareness on the details of our activities (both operational, and investment) and deliver clear and exhaustive information on the issues of interest.” That includes monthly performance figures.

Although hard times seem likely to lie ahead, there has been no exploration, as yet, anyway, of lowering contribution rates. Giorgi Nakashidze at the National Bank explained: “No such discussion has taken place yet. In general, the 2% contribution level for a mandatory pension scheme is already a low rate when compared internationally.” Indeed, according to Melikidze, “… the recent trend has clarified the opposite, that is the average monthly contribution has increased compared to recent years.”

Help in formulating a long-term organizational strategy for the agency is coming from USAID, but meanwhile, on the investment front, what is next for the pension fund? In terms of capital markets, it can now move as much as 20% of its money into global equities, and there is a new whopping 60% limit for bank certificates of deposit. “Although, we may invest in local GEL denominated corporate bonds aggressively,” Melikidze says.

The mandate for the first five years of the Pension Fund is that it should create a low-risk portfolio. In 2022, financial market gyrations internationally have conspired to inject risk into almost all investments, and as Georgian inflation rates soar above 12%, the population’s focus on the agency’s so far excellent performance will inevitably sharpen.

By Sally White for Investor.ge