The hotel industry has been one of the sectors most negatively impacted by COVID-19. Despite the tourism industry already entering its recovery phase, it is crucial to evaluate the magnitude of the effect of the pandemic on the hotel industry to be able to estimate the period of full recovery andto develop relevant measures to ensure sustainable recovery.

Throughout the period of 2016-2019, before the pandemic, the hotel industry was enjoying steady growth. In particular, the number of hotels and hotel-type enterprises increased by 12.4% (rising from 1,496 in 2016 to 1,682 in 2019), while the total area covered by hotels in sq. meters showed a significant 35.7% increase (from 1,675 thsd to 2,272 thsd), and the number of hotel employees increased by 31.7% (from 15,628 to 20,575). However, the spread of COVID-19 halted and reversed these positive dynamics in major industry indicators. In 2020, the number of hotels decreased by 37.3% compared to the previous year, while the total area covered by hotels decreased by 19.6%, and the number of employees underwent a considerable 33.8% decline.

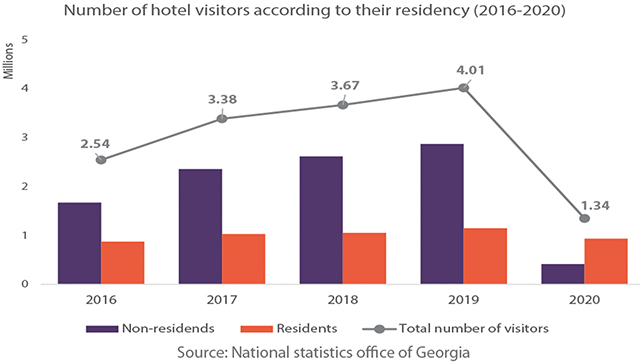

The number of hotel visitors also grew through the 2016-2019 period, peaking at 4.01 mln in 2019, of which the share of non-resident visitors was 71.5%. Of the latter, 35.3% of international visitors came from CIS countries and 15% came from EU member states, while residents of Georgia made up 28.5% of total visitors.

In 2020, the total number of hotel visitors declined by 66.5% compared to 2019, amounting to only 39.5% of the average level for the 2016-2019 period. The number of non-resident hotel visitors drastically decreased (by 85.7%) in 2020 compared to 2019, amounting to only 30.6% of total visitors. Of these, 34.5% of visitors were from CIS countries and 8.9% were from the EU. In 2020, the number of residents of Georgia visiting hotels decreased by 18.5% and amounted to 69.4% of total visitors, showing a reversal of the pre-pandemic dynamics of the shares of visitors according to their residency.

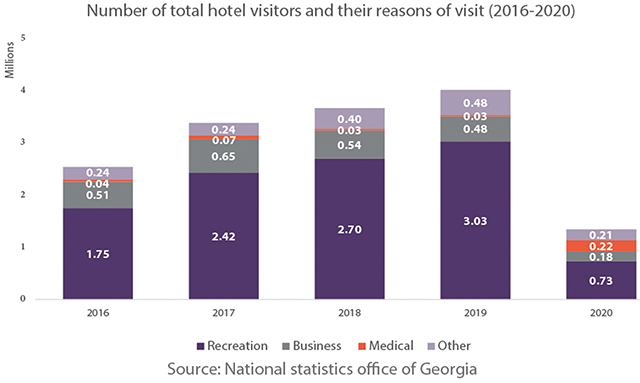

The pandemic has also seen a change in the breakdown of the reasons for hotel visits. Throughout the 2016-2019 period, the average share of hotel visits for medical purposes was equal to 1.3%, while in 2020 this figure increased to 16.2% of total hotel visits. It must be noted that 90.3% of hotel visits for medical reasons were by the residents of Georgia, which can be directly explained by the utilization of hotels as quarantine zones for those potentially infected and those actually infected with COVID-19.

Elsewhere, recreation was the major reason for hotel visits throughout the reporting period. However, in 2020 out of all categories, the most prominent year-over-year decrease (75.8%) was reported in recreational visits and the majority (62.9%) of visitors were residents of Georgia, thus highlighting the increased role of domestic tourism in the hotel industry during the pandemic.

Hotel Price Index

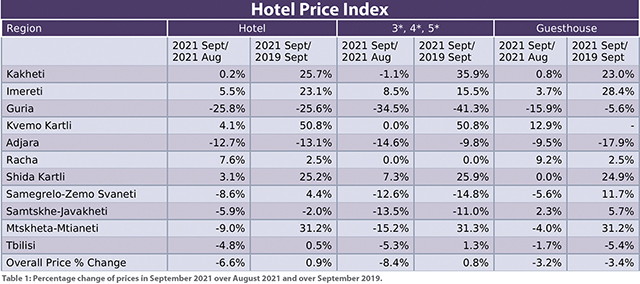

In September 2021, in Georgia the hotel price index decreased by 6.6% compared to August 2021. The 3-star, 4-star and 5-star hotel price index decreased by 8.4%, while for guesthouses, the price index decreased by 3.2%.

In September 2021, compared to September 2019, hotel prices in Georgia increased by 0.9%. The prices of 3*, 4*, 5* hotels increased by 0.8% and the prices of guesthouses decreased by 3.4%.

Average Hotel Prices

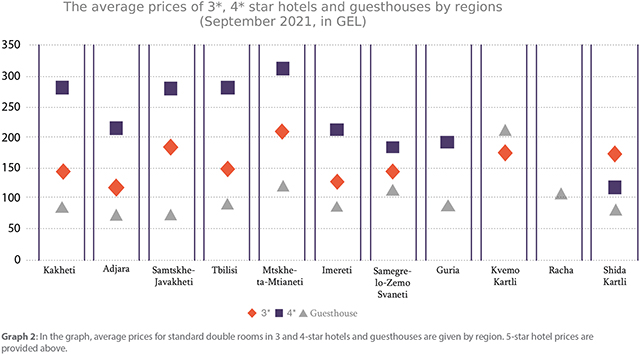

In Georgia, the average cost of a room in a 3-star hotel was 143 GEL per night in September 2021, while the average cost of a room in a 4-star hotel in Georgia was 263 GEL per night and the average cost of a room in a guesthouse was 85 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in September 2021 was 497 GEL per night. In Guria, the average price was 694 GEL, followed by Tbilisi – 642 GEL, Kakheti – 539 GEL and Adjara – 485 GEL.

![]()