The global honey market is expected to grow from $8.53 billion in 2022 to $12.69 billion by 2029. The demand for honey is being driven by consumers’ growing preference for natural and organic sweeteners. Beekeeping in Georgia has a long history. Georgia is known as the land of the oldest honey specimen discovered, dating back to 4300 BC, making Georgian honey about 2,000 years older than the honey found in Egypt, which was previously considered the oldest. Natural conditions and biodiversity in Georgia contribute to the great potential of the honey production sector in Georgia.

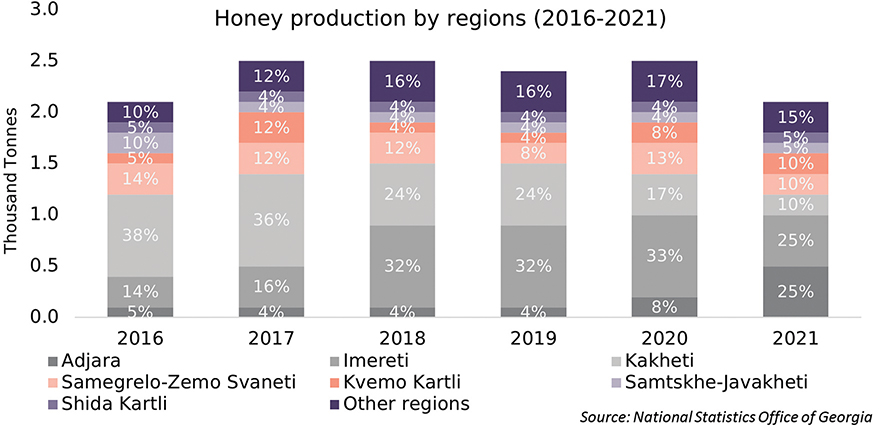

According to the Georgian Beekeepers Union, there are an estimated 14,000 operating in Georgia. Almost all production of honey comes from family holdings, while agricultural enterprises on average cover just 6% of total production. Throughout the 2016-2021 period, the top honey-producing regions in Georgia were Imereti, Kakheti, and Samegrelo-Zemo Svaneti, followed by Adjara. Between 2016 and 2020, the annual average growth rate of honey production was 4% in Georgia, while the average annual production over the same period was equal to 2,400 tons. In 2021, honey production showed a significant decline of 16.7% compared to the previous year, which was caused by the spread of honeybee mites. Despite that, it must be noted that the development of the honey production sector in Georgia still gave momentum to increasing exports to EU countries in 2021. The situation was further improved in 2022 as the issue of mites was suitably addressed, and honey production subsequently recovered.

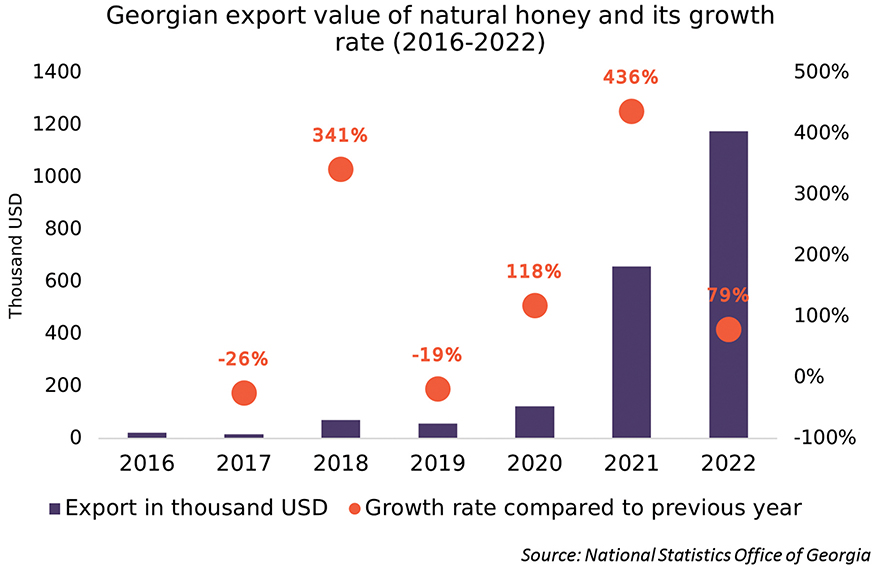

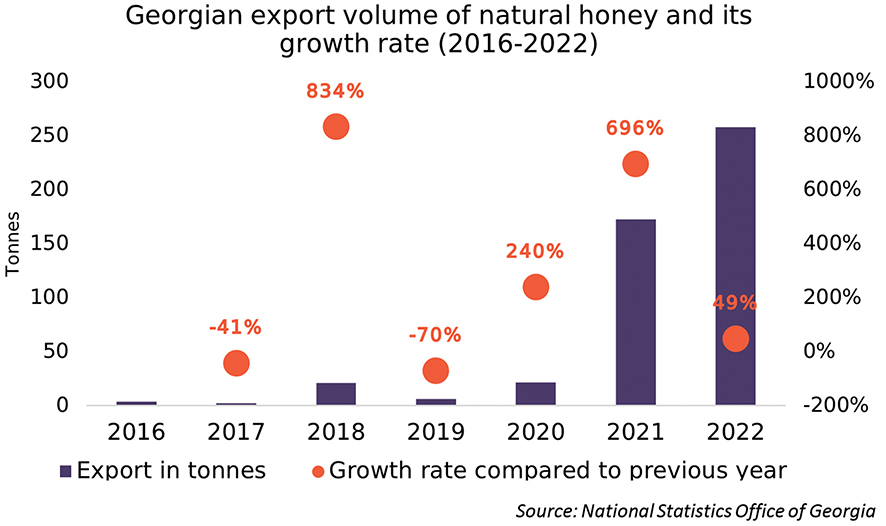

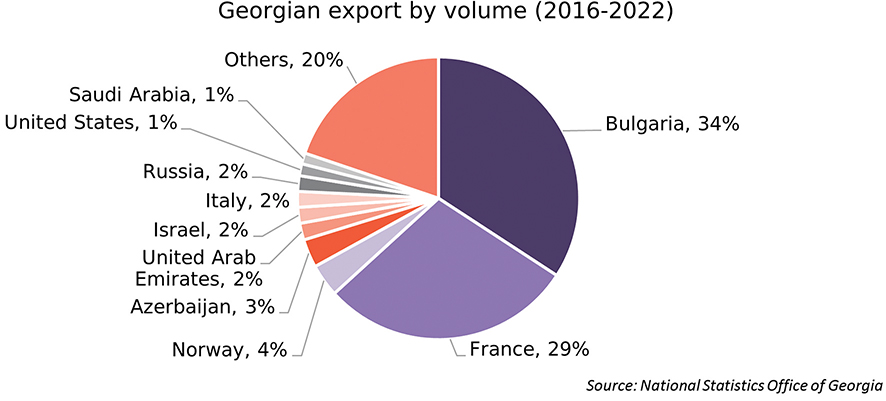

In 2022, compared to 2021, the export value of Georgian honey increased by 79% and the export volume by 49%, which indicates that the price of exported honey increased significantly. This could be attributed to the improvement of honey quality in the country and the popularization of Georgian honey in international markets, especially the EU. Among all countries, France had the highest share in the export value of Georgian honey during the period of 2016-2022, at 32%, with Bulgaria – second at 19%, and Norway third at 4%. Throughout 2016-2022, among the leading countries to which Georgia exported honey, Russia had the lowest average export price ($0.75/kg), while for the EU the average export price was equal to $5.5/kg.

Recent developments in the honey production sector in Georgia, and expectations for the near future, reveal its immense potential. To ensure this is fulfilled, tackling existing challenges and weaknesses, such as skills gaps, infrastructural issues, and lack of cooperation, and seizing opportunities such as product diversification, bio-certification, and increasing the productivity of honeybee hives, can all help to ensure the sustainable economic development of the sector.

Global Trends

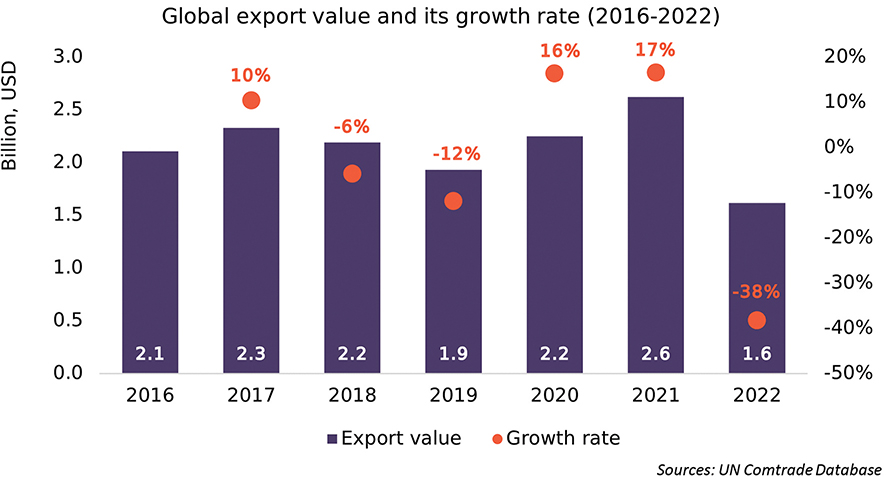

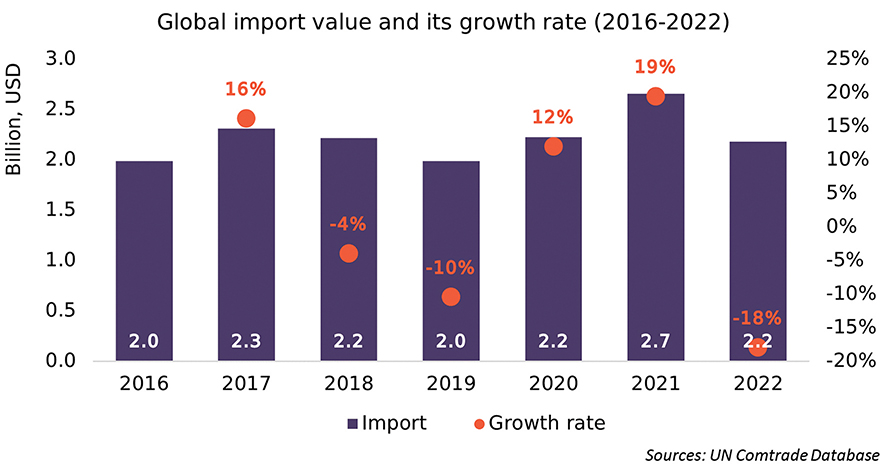

The global honey market is expected to grow from $8.53 billion in 2022 to $12.69 billion by 2029, at a CAGR of 5.83% in the forecast period. The demand for honey is being driven by consumers’ growing preference for natural and organic sweeteners over sugar and other health-damaging artificial substitutes. High demand for natural honey is also demonstrated by global trade statistics. Throughout 2016-2022, the average value of global exports amounted to $2.2 billion. In addition to that the value of imports, on average, has been increasing by 2.5% annually. Throughout 2016-2021, the average volume of exports and imports showed a stable annual growth rate. In particular, before 2022, the average annual growth rate of exports was equal to 5.1%, while for imports this indicator stood at 6.6%.

The export value and volume of honey declined in 2022 compared to 2021 by 38% and 52% respectively. A similar declining trend was observed in imports, where the value declined by 18% and the volume dropped by 22% compared to 2021. This decline in the trade of honey in 2022 could be explained by supply chain deteriorations due to Russia’s war in Ukraine, as the latter is one of the world’s biggest exporters of natural honey.

Notably, based on the latest statistics, the world’s biggest exporters by value in 2022 were New Zealand (17%), followed by Germany, Ukraine, and Brazil (each amounting to 9% of total exports). Only in 2022, those top countries exported honey worth $698.2 million. In comparison, exports from Georgia amount to only 0.07% of the total export value, while by volume it amounts to 0.01% of total exports, indicating the potential positioning of Georgian exported honey as high quality, rather than high quantity product. Meanwhile, in 2022, the biggest importers were the USA (36%) and Germany (14%), followed by Japan (8%) and the United Kingdom (6%). Those countries together imported honey worth $1.4 billion in 2022.

Introduction to Georgian honey production sector

Georgian forests’ biodiversity of flora (including the existence of endemic plants), several subtropical climate zones, and being home to of a unique breed of Caucasian grey mountain honeybee all make for ideal conditions and great potential for the production of mono-floral and poly-floral honey. Furthermore, the variety of honey in Georgia is also diverse, with the following eight types all produced there: Chestnut, Alpine, Blossom, Acacia, Linden, Solidago, Matrobela (toxic honey), and Jara wild honey.

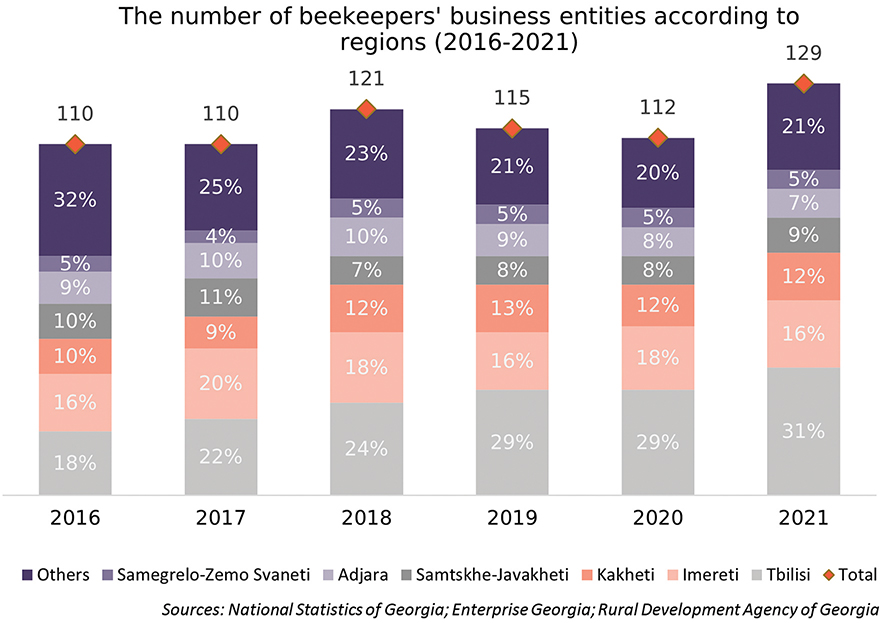

The number of beekeeping business entities on average increased by 3.5% yearly throughout the 2016-2021 period. Most of the business entities are registered in Tbilisi, Imereti, Kakheti, and Samtskhe-Javakheti regions. Notably, beekeepers are often registered as cooperatives, where several individual beekeepers are united under one business entity. According to the latest statistics from the Business Register of Georgia, currently, 115 business entities are operating under the beekeeping sector, of which 11 are registered as cooperatives, 73 are registered as individual enterprises, 30 are LLCs, and one is a non-profit (non-commercial) legal entity (Georgian Beekeepers Union). It is worth noting, that many beekeepers or beekeeping entities operate without official registration, and according to the Georgian Beekeepers Union, there are an estimated 14,000 beekeepers operating in Georgia.

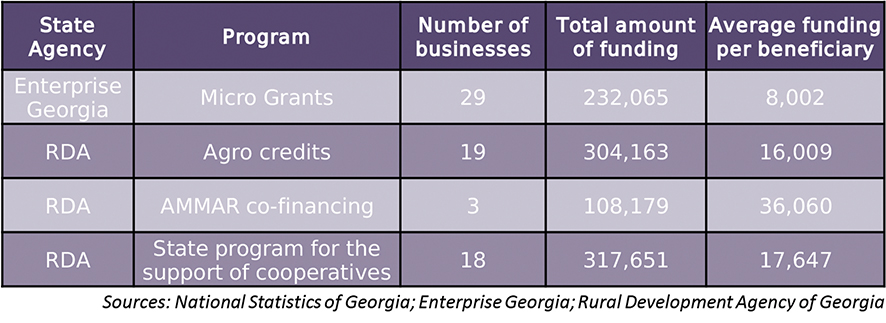

The beekeeping sector is also supported by the Government of Georgia. Throughout the 2014-2022 period, beekeepers have received some financial support from government entities, namely Enterprise Georgia (EG) and the Rural Development Agency (RDA). Under EG’s micro credit program, 29 businesses operating in Guria, Mtskheta-Mtianeti, and Kakheti received a total of GEL 232,100. Meanwhile, the RDA financing to the sector amounted to GEL 730,000 and benefited 40 businesses, mainly from Imereti, Kakheti, Samtskhe-Javakheti, and Racha-Lechkhumi and Kvemo Svaneti regions.

Honey Production in Georgia

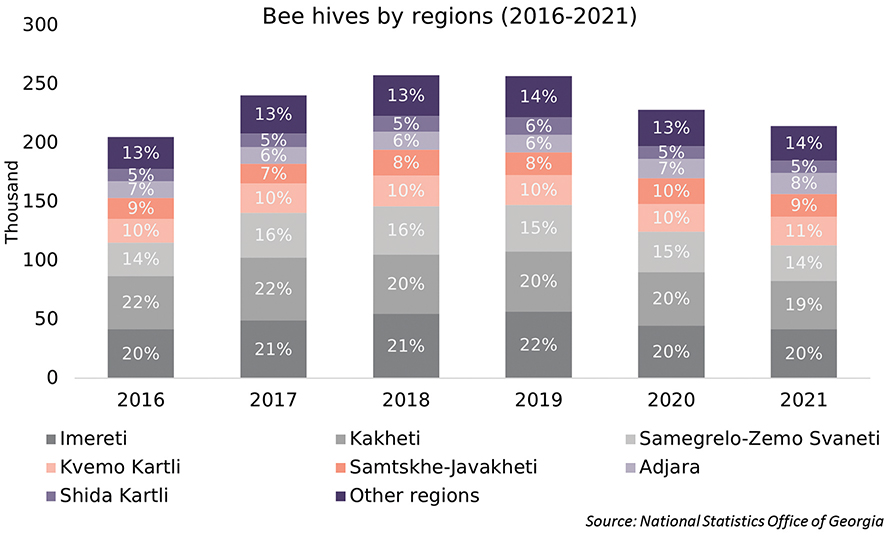

According to the National Statistics Office of Georgia, almost all production of honey comes from family holdings, as between 2016 and 2022, agricultural enterprises on average covered just 6% of total production. Between 2016 and 2021, the number of beehives on average increased by 1.9% annually. Imereti and Kakheti were the leading regions in terms of the number of beehives in this period, followed by Samegrelo-Zemo Svaneti, Kvemo Kartli, and Samtskhe-Javakheti.

Despite the decline in the number of beehives in 2020 (11.1%), the level of production was not affected, indicating an increase in the productivity of beehives. In addition, throughout the 2016-2020 period, the annual average growth rate of honey production was 4%, while the average annual production was equal to 2,400 tons.

In 2021, honey production showed a significant decline of 16.7%, which was caused by the spread of Varroidae (a new species of mites), and their development of immunity against existing drugs. By the spring of 2021, because of the large-scale elimination of bees, the sector had suffered a year-on-year loss of approximately GEL 5 million. This issue was consequently addressed through a combination of mechanisms deployed by public and private entities, such as developing the skills of beekeepers, identification of infected beehives, laboratory analyses, and the introduction of new methods to repel honeybee mites.

Between 2016 and 2021, the top honey-producing regions in Georgia were Imereti, Kakheti, and Samegrelo-Zemo Svaneti. However, the share of Kakheti in total honey production has been declining since 2018, while the share of Imereti was increasing up until 2021. Meanwhile, in 2021, Adjara became one of the top three honey-producing regions.

International Trade of Honey in Georgia

Since 2019, its export value as well as the export volume of honey has been steadily increasing in Georgia. In 2022, compared to 2021, the export value increased by 79% and the export volume rose by 49%, which indicates that the price of exported honey has increased significantly. This can be attributed to the improvement of honey quality in the country and the popularization of Georgian honey in international markets, especially in the EU. It must also be mentioned that the international demand for Georgian honey has risen markedly, resulting in honey stocks running out and Georgian exporters being unable to export until May 2023.

Export price, which is calculated as value divided by volume, fluctuated throughout the reporting period, peaking in 2019 at $8.8/kg, while declining to $4.6/kg in 2022. The high volatility here is explained by differences in the countries to which natural honey was traded in different years.

Trade in the EU has been increasing sharply and, compared to 2016, the export value has increased from $100 to $888,500, and the export volume went from 0.01 tons to 210.93 tons. Export value to EU countries increased by 75% and volume rose by 48% in 2022 compared to 2021. For CIS countries, value, as well as volume, declined by 68% and 93%. It is important to note here that the export value to EU countries was approximately 86 times greater than to CIS countries. Notably, The demand from EU countries is expected to increase further, especially for light-colored Acacia honey.

Since 2021, imports have been negligible compared to exports. Prior to that, in 2016, the import value represented 79% of the total trade value, and the import volume was 88% of the total trade volume. However, in the later years (2020-2022) the share of imports in total trade declined significantly. For instance, in 2022, the import value was 7% of the total trade value, and the import volume was 11%.

Due to the development of trade relations with the EU and the development of the Georgian honey sector towards the production of high-quality honey, the trade structure was modified significantly throughout the last few years. In particular, European countries were among the top exporting countries for 2016-2022, despite the active and high volume of trade occurring only in 2021 and 2022.

France had the highest share in terms of export value during the period of 2016-2022 (at 32%), with Bulgaria coming in second at 19% and Norway third at 4%. Notably, the majority of France’s and Bulgaria’s trade occurred in 2021-2022, while Norway’s trade activity was only in 2022 during the observed period. Exports to France were recorded in 2019, 2021, and 2022. In 2022, exports to France showed a rapid increase. In particular, export value increased by 80% compared to 2021, albeit compared to 2019, the export of natural honey to France was minimal. To Bulgaria, exports started in 2020, and in 2022 the export value grew by 72% compared to 2021 and increased 92-fold compared to 2020.

The highest export volume in 2016-2022 was observed in Bulgaria (34%), followed by France (29%) and Norway (4%). Notably, as Germany is among the top importers of Honey globally, it can be considered to be the potential market for Georgian exporters in the following years.

Of the top 10 countries by export value and volume, Russia had the lowest export price ($0.75/kg) and the USA had the highest ($8.9/kg), followed by the United Arab Emirates ($7.7/kg) and Hong Kong ($7.6/kg). On the other hand, among the top three countries by natural honey export from Georgia, the average prices were as follows: for France – $5.3/kg; Norway – $4.9/kg; and Bulgaria – $2.7/kg.

SWOT Analysis of the Honey Production Sector

Based on a qualitative and quantitative data overview, a SWOT analysis of the honey production sector was conducted, summarizing the main strengths, weaknesses, opportunities, and threats of the industry, reflecting the latest situation and trends, as well as the expectations/prognoses of the relevant stakeholders. Despite some existing weaknesses, most of the listed challenges have been partially addressed through different private and public initiatives, and the dynamics in terms of the development of the honey production sector in Georgia are very positive.