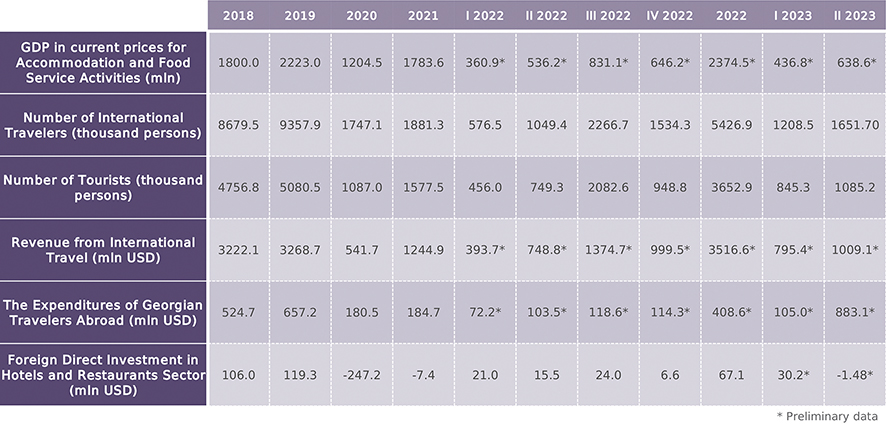

In the first half of 2023, the number of domestic visits amounted to 9.2 million which was 15% higher compared to the corresponding period of 2022. Notably, in Q2 of 2023, compared to the same period of 2022, growth in the number of domestic visits (25%) was much more pronounced than in Q1 of 2023 (6%). This marked a notable turnaround from the decline recorded in domestic visits observed throughout Q2-Q4 of 2022.

In the first half of 2023, the number of domestic visits was 38% higher than for the same period of 2019, while the number of international visits was still short of the pre-pandemic level, reaching 78% of the figure for the corresponding period of 2019.

In the first half of 2023, the average number of nights spent per visit was equal to 1.3, which is 11% lower than in the first half of 2022 (1.4 nights). Notably, in the periods after the COVID-19 pandemic first broke out, the average number of nights spent per visit were higher in 2020 (2.1) and 2021 (1.7).

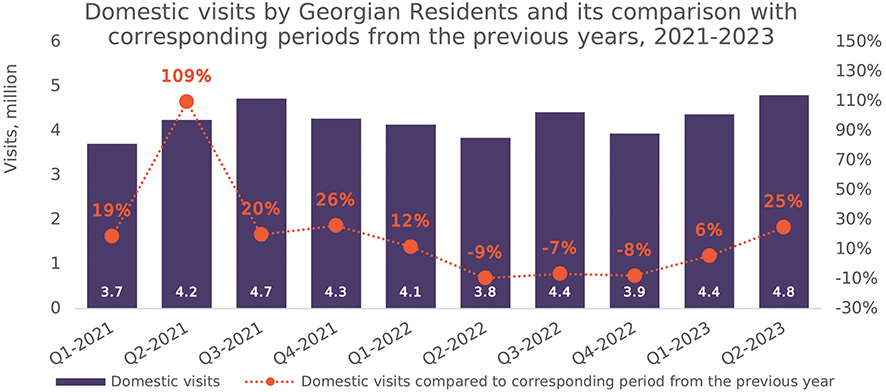

The distribution of domestic visitors by visited region in the first half of 2023 was similar to previous periods. In particular, the main destination for domestic visits was Tbilisi (24% of total visits), followed by Imereti (18%), and Adjara (10%). To compare the dynamics, the number of visitors decreased in Shida Kartli (by 12%) and Samegrelo-Zemo Svaneti (7%), while the number increased in Samtskhe-Javakheti (by 23%) and Tbilisi (11%).

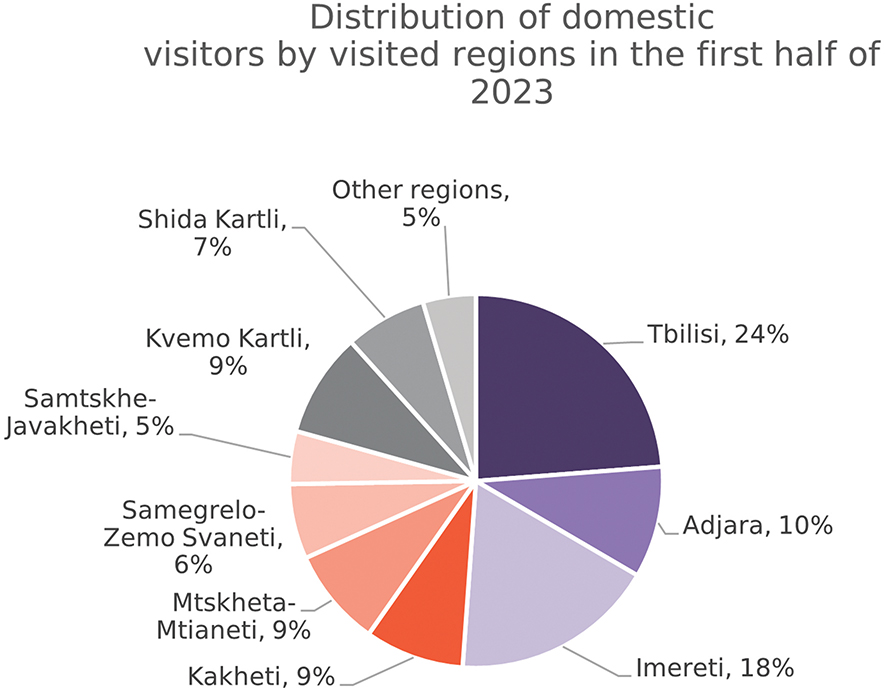

In the first half of 2023, the main purpose of visits (48%) was visiting friends/relatives, followed by shopping (18%), and staying in a second/holiday home (10%). Notably, compared to the first half of 2022, the share of visitors who named shopping as the main purpose of their visit increased by 6 percentage points, exceeding the share of those who cited staying at their second/holiday home.

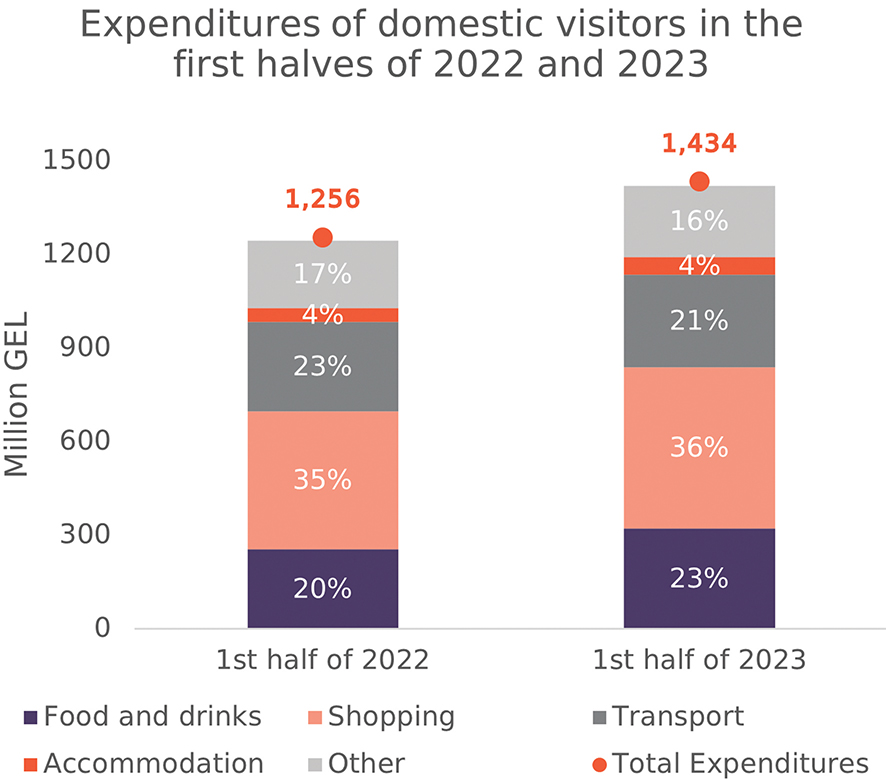

In the first half of 2023, the total expenditure of domestic visitors amounted to GEL 1.4 billion, which is 14.2% higher compared to the same period of 2022. However, that increase in expenditure by domestic visitors is comparatively modest when contrasted with the 45.9% increase recorded for total expenditure by international visitors during the same period in 2023.

The expenditure distribution in the first half of 2023 was similar to recent years with most expenditure going on shopping (36% of total expenditure), food and drinks (23%), and transport (21%). In the first half of 2023, compared to the first half of 2022, there were significant increases in the expenditure of domestic visitors on shopping (by 17%) and food and drinks (25%).

HOTEL PRICE INDEX IN GEORGIA – SEPTEMBER

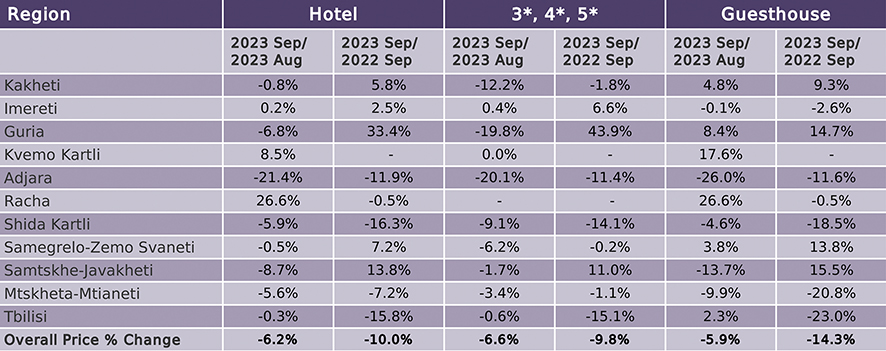

In September 2023, in Georgia the hotel price index decreased by 6.2% compared to August 2023. The 3-star, 4-star, and 5-star hotel price index decreased by 6.6%, while for guesthouses, the price index decreased by 5.9%. The monthly HPI was the highest in Racha (26.6%) and lowest in Adjara (-21.4%)

In September 2023, compared to September 2022, hotel prices in Georgia decreased by 10.0%. The prices of 3*, 4*, 5* hotels decreased by 9.8% and the prices of guesthouses decreased by 14.3%. The yearly HPI was the highest in Guria (33.4%) and lowest in Shida Kartli (-16.3%).

THE AVERAGE HOTEL PRICES IN GEORGIA – SEPTEMBER

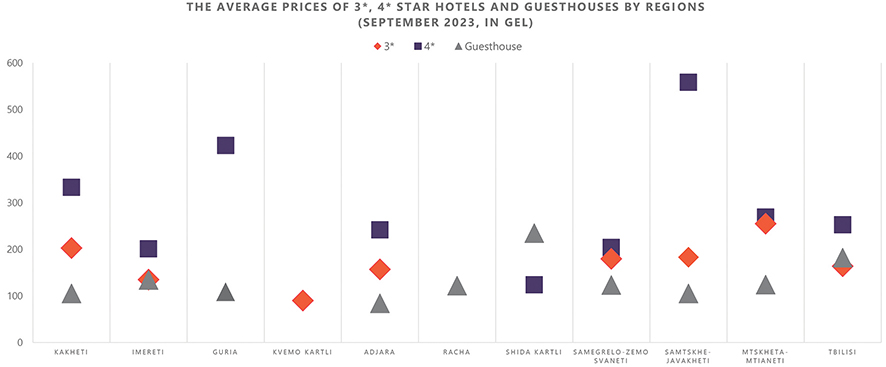

In Georgia, the average cost of a room2 in a 3-star hotel was 168 GEL per night in September 2023, while the average cost of a room in a 4-star hotel in Georgia was 268 GEL per night and the average cost of a room in a guesthouse3 was 124 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in September 2023 was 495 GEL per night. In Guria, the average price was 780 GEL, followed by Tbilisi – 623, Kakheti – 514, and Adjara – 460.

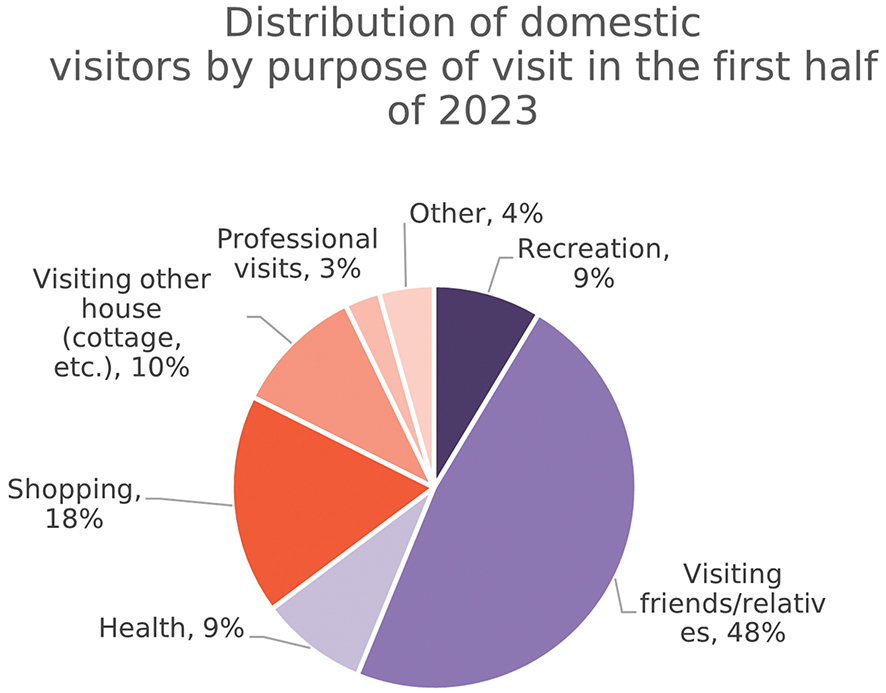

BASIC ECONOMIC INDICATORS IN GEORGIA