The political and social turmoil surrounding the 26 October parliamentary elections and their aftermath have significant implications for Georgia’s business environment. The prolonged polarization, government-led violence against protesters, and the suspension of EU accession talks create uncertainty that can negatively influence the economic climate in multiple ways. The crisis has now extended beyond the realm of partisan politics, presenting Georgia with an unavoidable socio-economic threat. Over 2,000 and counting small, medium, and large businesses have voiced their concerns, issuing a united statement that underscores the urgent need for de-escalation. Their declaration emphasizes the gravity of the situation, advocating for the announcement of new elections and the release of those detained during recent protests . These business representatives, acknowledging their responsibility for the country’s future and its irreversible development, stress that their appeal transcends political preferences and is rooted in the shared goal of safeguarding Georgia’s stability and prosperity.

The instability and erosion of public trust in state institutions deter both domestic and foreign investment. The suspension of EU accession talks could diminish Georgia’s appeal as a business-friendly environment aligned with European standards. Key institutions, such as the National Bank and others, saw their independence threatened by state interference. Once a model of reform and civil society development, Georgia now faces a growing risk to the autonomy of its institutions, undermining years of progress in governance, economic stability, and alignment with the EU. The preservation of independent and inclusive institutions is crucial for the country’s future. This concern is intensified by a series of sanctions imposed by international partners. On December 12, 2024, the U.S. State Department introduced a new wave of visa restrictions targeting up to 20 Georgian citizens, including high-ranking officials from Georgian Dream, such as ministers, parliamentarians, law enforcement officers, security service officials, and private individuals, whose identities remain undisclosed. On December 19, the U.S. Department of the Treasury imposed Global Magnitsky sanctions on Interior Minister Vakhtang Gomelauri and the Deputy Director of the Special Tasks Department, Mirza Kezevadze. Finally, on December 27, the U.S. Treasury announced sanctions against billionaire and former Prime Minister Bidzina Ivanishvili, the founder and honorary chairman of Georgian Dream. Beyond the United States, Georgian officials have also faced sanctions from the United Kingdom, Lithuania, Latvia, Estonia, and Ukraine, reflecting widespread international concerns about governance and democratic standards in the country. Moreover, the United States has suspended $95 million in aid to Georgia, the European Union has frozen €121 million, and Sweden has ceased direct governmental cooperation, citing concerns over the country’s democratic trajectory.

The potential weakening of ties with the EU and US raises concerns over access to European markets, regulatory alignment, and eligibility for EU-funded programs, all of which are crucial for enhancing business competitiveness and economic integration. Moreover, businesses rely on predictable and stable political conditions to make strategic decisions, and the current crisis undermines investor confidence. This instability is further compounded by currency volatility, as exchange rate fluctuations increase the risks associated with cross-border investments. In addition, a potential downgrade in Georgia’s international credit ratings could further deter investors, increasing borrowing costs and reducing the country’s attractiveness as an investment destination. Moreover, this is particularly detrimental in sectors dependent on foreign direct investment (FDI), such as real estate, energy, and tourism, which are critical for Georgia’s economic growth. Furthermore, declining business confidence and weakened expectations signal reduced private sector activity and investment inflows.

CURRENCY VOLATILITY

In Georgia, the USD/GEL exchange rate is a key indicator of the health of the economy, reflecting both domestic and international factors. A stable exchange rate fosters confidence among investors and traders, while volatility can create uncertainty, impacting businesses and households alike. The USD/GEL exchange rate for 2024 reveals significant fluctuations throughout the year, with a notable depreciation in December (see Figure 1). This depreciation closely aligns with the political events surrounding the government’s announcement on November 28th to postpone the European Union integration process until 2028 and imposed sanctions. The widespread protests that followed the decision caused heightened political and economic uncertainty, leading to a depreciation of GEL.

The depreciation of GEL is expected to have several negative effects on the business environment. Firstly, it increases the cost of imports for businesses that rely on imported raw materials or finished goods. This can squeeze profit margins and make it more difficult to compete with foreign competitors. Secondly, it can erode the purchasing power of consumers, leading to decreased demand for domestically produced goods and services. This can hurt businesses that rely on domestic consumption. Finally, it can increase the cost of debt for businesses that have borrowed in foreign currency. This can make it more difficult for businesses to service their debt and invest in growth.

In addition to these direct effects, the depreciation of GEL can also have indirect effects on the business environment. For example, is expected to lead to increased inflation, which can further erode the purchasing power of consumers and make it more difficult for businesses to plan and invest for the future. It can also lead to increased uncertainty among investors, which can discourage foreign investment and make it more difficult for businesses to access capital.

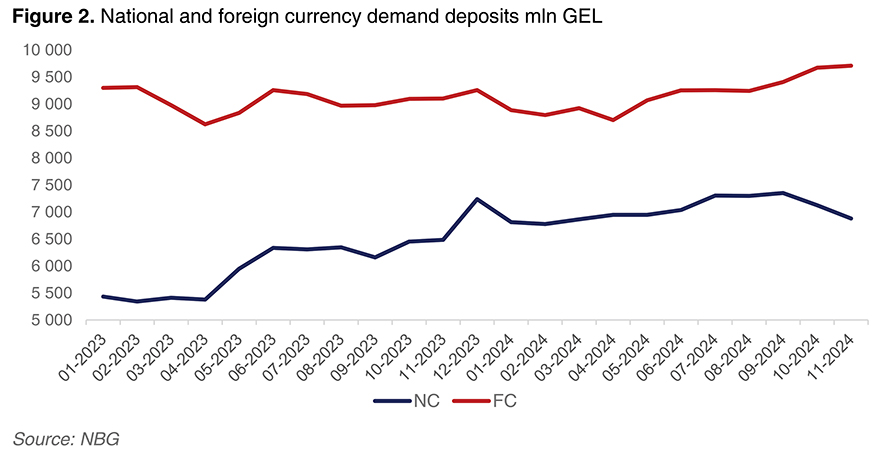

This uncertainty is further reflected in recent trends in deposits. Over the past two months, demand and time deposits in the national currency have decreased, while deposits in foreign currency have increased (Figure 2 and 3). This shift highlights a growing lack of confidence in the stability of the GEL, as both businesses and households appear to be hedging against further depreciation by favoring foreign currency. Such trends can amplify the economic challenges, reducing liquidity in the national currency and increasing dollarization, which complicates monetary policy and further exacerbates economic vulnerabilities.

INTERNATIONAL RATINGS

Fitch Ratings has downgraded the Outlook on Georgia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from Stable to Negative, while affirming the IDR at ‘BB’ (Fitch Ratings, 2024). This negative change in outlook reflects several key factors, including increased political risks, deteriorating relations with external partners, challenges to the policy framework, and weaker international reserve coverage (see Table 1).

The primary concern driving the negative outlook is the sharp rise in political risk, represented by large-scale protests and ongoing legal challenges. Fitch views political risks in Georgia as remaining very high, as the potential for a prolonged political crisis could weaken the institutional framework, undermine investor and domestic confidence, and place pressure on external liquidity and the exchange rate. This, combined with diminishing trust in public institutions, is likely to erode Georgia’s governance indicators, which had previously been a relative strength compared to its peers.

Another significant factor contributing to the downgrade is the deterioration in relations with external parties. As after the elections, Georgian government announced a delay in its EU accession negotiations until at least 2028. If the unrest escalates, it could strain relations with key Western allies, potentially resulting in a decline in foreign direct investment (FDI) inflows and reduced multilateral financial support.

Macroeconomic state is an additional factor that contributed to the worsening of Georgia’s position in the Fitch ratings. Georgia’s international reserves have dropped significantly, falling by 13% month-on-month (USD 627.5 million) to USD 4.1 billion in October (see Figure 4). This sharp decline in reserves was primarily driven by the National Bank of Georgia’s USD 591 million foreign exchange sales in the lead-up to the elections, likely aimed at curbing potential volatility in the GEL exchange rate, as well as increased demand for foreign currency from corporations, particularly for currency forwards. However, reserves have slightly recovered to USD 4.12 billion by the end of November. Moreover, the National Bank of Georgia’s governance-related safeguards remain inadequate, with international reserves falling below key adequacy thresholds. Gross International Reserves (GIR) declined from 102.2% of the ARA metric in 2022 to 94.8% in 2024 and are projected to remain below 100% in the coming years. While reserves still covered 3.3–3.4 months of imports in 2023–2024, exceeding the minimum threshold, further deterioration amid political instability could undermine Georgia’s capacity to absorb future economic shocks (NBG, 2024).

The reduction in Georgia’s credit rating by Fitch Ratings is likely to have a significant negative impact on the business environment. The downgrade will likely diminish investor confidence in Georgia, discouraging foreign direct investment (FDI) inflows. The economy will be removed of much-needed capital and expertise, further slowing down economic development. The negative change in the international ratings will damage Georgia’s reputation as a stable and attractive investment destination, making it more difficult to attract foreign investors and tourists in the future.

FOREIGN DIRECT INVESTMENT

Foreign Direct Investment (FDI) serves as a critical driver of Georgia’s economic growth, fostering innovation, creating jobs, and enhancing productivity. However, the ongoing political instability poses a significant challenge to maintaining investor confidence. Prolonged political uncertainty that has escalated into political crisis – manifested through public protests and perceptions of weakened governance – negatively affects Georgia’s business environment. Such instability not only deters potential investors but may also prompt existing ones to reconsider their commitments. The impact is further compounded by potential downgrades in international ratings, signaling heightened risks to global stakeholders.

In recent years, there has been a noticeable decline in FDI inflows into Georgia. In 2023, FDI amounted to 1,902.2 million GEL, which represents a 15.6 percent decrease compared to 2022. During the first three quarters of 2024, Georgia received 966.3 million GEL in FDI, reflecting a significant reduction of 39.9 percent compared to the same period in the previous year (see Figure 5). This decline highlights growing challenges in attracting foreign investments, likely influenced by both global economic conditions and domestic political uncertainties.

High regulatory risk, which arises from unpredictable government actions, is closely linked to reduced FDI inflows. Analysis of an investor location decisions indicates that regulatory uncertainties can discourage multinational enterprises from entering or expanding operations in a host country (Hebous, Kher, & Tran, 2020). In addition, utilizing a novel measure of political risk at the firm level, reveals that fluctuations in political risk significantly influence firms’ investment and hiring decisions. These findings highlight that mitigating country-level risks can lead to improved macroeconomic performance (Hassan, Hollander, Lent, & Tahoun, 2019).

Furthermore, political stability plays a pivotal role in shaping investor confidence, and its absence can significantly deter foreign investments. Government instability, corruption, and frequent protests create a perception of heightened risk (Kiptoo, 2024). Henceforth, the challenging political situation in Georgia is expected to hinder the inflow of FDI. This would add pressure to the business environment. A reduction in investment could have a negative impact on the Georgian economy, as it may lead to reduced capital availability for businesses, limiting growth opportunities. In addition, this decline in investment could also put downward pressure on the exchange rate of GEL, leading to the country’s economic instability and creating further uncertainty for both domestic and international markets.

BUSINESS CONFIDENCE AND EXPECTATION ON DECLINE

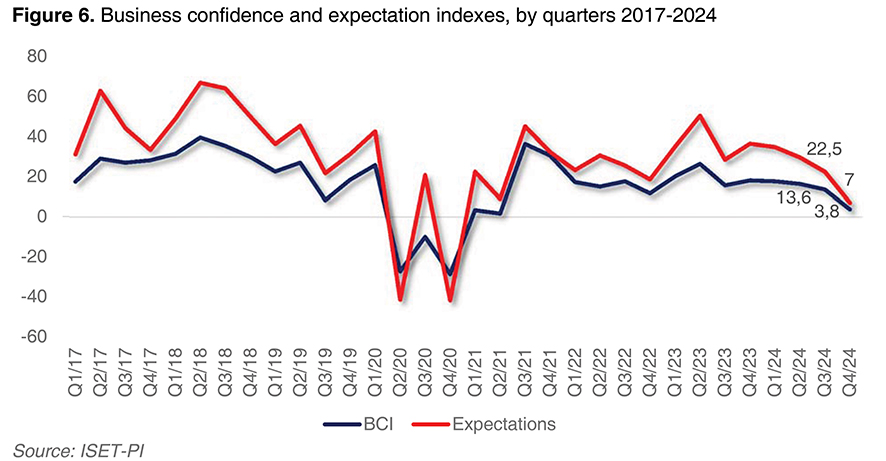

The present political situation is reflected in local business and changing the current environment that is reflected into the degrow of Business Confidence Index (BCI) (Figure 6). In the fourth quarter of 2024, business confidence in Georgia declined by 9.7 index points, dropping to 3.8. The sharpest decline was observed in the finance sector, which saw a decrease of 22.1 points. This downturn in the BCI was primarily driven by weaker past performance and diminished optimism for the future. The Expectation index, which measures business sentiment about upcoming conditions, fell to 7.0 points. Expectations for Q4 2024 significantly worsened in the manufacturing (-40.0) and agriculture (-30.0) sectors (ISET Policy Institute, 2024).

The decline in the Business Confidence Index (BCI) highlights the growing uncertainty among businesses regarding Georgia’s economic and political landscape. The significant downturn in the finance, manufacturing, and agriculture sectors reflects a broader concern about the stability and predictability of the operating environment. Reduced confidence in future conditions suggests that businesses are becoming increasingly cautious about investments, hiring, and expansion plans. This could lead to slower economic growth, reduced job creation, and lower overall productivity in the coming quarters. In November 2024, the total number of vacancies published on jobs.ge, a leading Georgian vacancies portal, amounted to 6,218, which was 20.6% lower compared to October 2024 and 9% lower compared to the same period in the previous year (PMCG, 2024). This decline in job vacancies indicates a decrease in business activity and hiring intentions. Hence, the argument about the negative impact of the political situation on the business environment is strengthened.

CONCLUSION

The ongoing crisis in Georgia will not subside unless new, transparent, and impartial elections are held, restoring faith in the democratic process. A repeat election must take place with independent, unbiased, and secret ballots to ensure legitimacy and political stability. Additionally, releasing those arrested during the protests would be a crucial step toward restoring public trust and ensuring social peace. If these fundamental measures are not met, the crisis is likely to deepen further, undermining both political and economic stability. A prolonged period of uncertainty will erode investor confidence, exacerbate social unrest, and hinder the country’s ability to secure international partnerships. Without a genuine commitment to democratic principles and the rule of law, Georgia risks falling into a prolonged period of instability that will stifle economic development.

This document has been produced with the financial support of Sweden. The contents are the sole responsibility of the authors and can under no circumstance be regarded as reflecting the position of Sweden.

BIBLIOGRAPHY

Fitch Ratings. (2024). Georgia – Rating Action Report. Fitch Ratings. Retrieved from https://www.fitchratings.com/research/sovereigns/georgia-rating-action-report-06-12-2024

Hassan, T. A., Hollander, S., Lent, L. v., & Tahoun, A. (2019). Firm-level political risk: Measurement and effects. NBER. doi:10.3386/w24029

Hebous, S., Kher, P., & Tran, T. T. (2020). Regulatory Risk and FDI. In W. B. Group, Global Investment Competitiveness Report 2019/2020 (pp. 128-168). Washington DC: World Bank Group. Retrieved from https://pubdocs.worldbank.org/en/433411591134538669/211536-Chapter-4.pdf

ISET Policy Institute. (2024). Business Confidence Index. Tbilisi: ISET Policy Institute. Retrieved from https://iset-pi.ge/storage/media/other/2024-11-06/1461b470-9c2d-11ef-91ab-d1c9175ae8e3.pdf

Kiptoo, J. (2024). The influence of political stability on foreign direct investment (FDI). International Journal of Developing Country Studies. doi:https://doi.org/10.47941/ijdcs.2165

PMCG. (2024). Employment Tracker Georgia. PMCG. Retrieved from https://pmcg-i.com/research/employment-tracker-november-2024/

By TORNIKE SURGULADZE, TAMAR BLIADZE FOR ISET