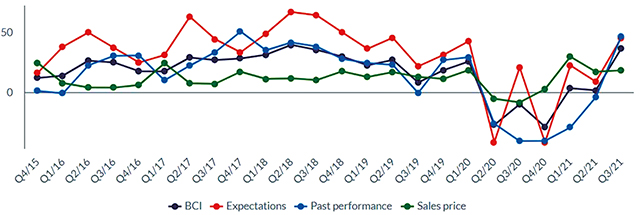

Following a slight decrease in the second quarter, BCI improved significantly (by 34.7 index points) and reached 36.4 for the third quarter of 2021. Expectations in the Georgian private sector have increased by 36.2 index points, reaching 45.2. As for business performance over the past three months, it has increased significantly, reaching 46.6 points, indicating an upturn in production, turnover, and sales. Compared to the previous quarter, the Sales Price Expectation Index has increased, showing growth in the market share of business owners who expect higher sales prices.

Compared to Q2 2021, BCI increased in all sectors. The biggest improvements are seen in retail trade (75.5), agriculture (55.9), and service (30.8) sectors.

Business confidence for the third quarter of 2021 has increased by 39.7 index points for large companies and by 17.9 for SMEs.

PAST PERFORMANCE

Businesses’ Past Performance Index, which shows the development of businesses’ production, turnover, and sales in the past 3 months, increased significantly compared to Q2 of 2021 and reached 46.6 for Q3 2021. It should be noted that until Q3 2021, Past Performance Index remained in negative territory for 5 consecutive quarters.

Significant improvements were observed in the agriculture (119.7), retail trade (108.7), service (56.0), and manufacturing (17.1) sectors.

EXPECTATIONS

The Expectations Index increased sharply by 36.2 index points for Q3 2021 and settled at 45.2. Prospects for the next three months have improved for all sectors except for the financial sector, for which the index remains unchanged. The highest increase is observed in retail trade (114.5), followed by agriculture (44.1), construction (30.2), manufacturing (20.8), and service (15.4) sectors.

Business expectations have increased for both, large firms (10.2) and SMEs (43.7).

60% of the surveyed businesses do not expect any changes in employment over the next three months, 13% of firms stated that they would hire fewer employees in the future, and 27% think that they would hire more.

46% of the firms surveyed expect the economic condition of their businesses to improve over the next three months. 35% do not predict any changes, and 19% of businesses believe their business conditions will worsen.

SALES PRICE EXPECTATIONS

The Sales Price Expectations Index increased slightly from 17.2 points (Q2 2021) to 18.4 points for Q3 2021. The manufacturing sector (79.2 points increase) is the sole driver of this change since the index decreased in all other sectors. The overall Sales Price Expectations Index has increased for large companies and decreased for SMEs.

Around 66% of all firms surveyed do not intend to change their prices over the next three months. 27% of firms expect to higher prices, and the remaining 7% will consider decreasing their prices in the future.

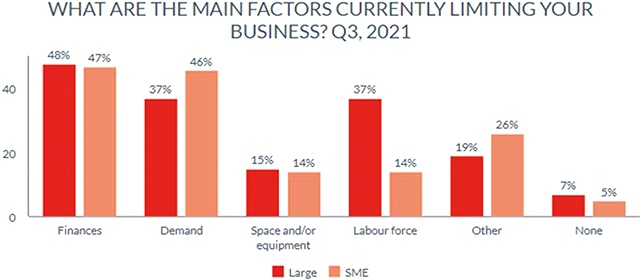

Limited access to financing and a lack of demand continues to be one of the most significant obstacles for both large companies and SMEs. A lack of demand turns out to be a more important problem for SMEs compared to large companies, while large enterprises indicate problems with finding qualified labor force. For Q3 2021 “other” factors became less important for both, large companies and SME’s (average of the last four quarters was 35% and 31%, respectively), which could indicate relative mitigation of Covid-19 restrictions for businesses.

It should be noted that the present BCI results may be overestimated, as the survey only covers businesses currently operating and not those that have already exited the market. Firms which exited the market are, to some extent, more likely to demonstrate a negative outlook.