On 17 December 2021, the Parliament of Georgia approved the state budget for 2022, with allocations of around 19.2 billion GEL. From this, the Ministry of Environmental Protection and Agriculture (MEPA) will receive 593.1 million (3.1% of the total budget allocation). MEPA will direct 14.5 mln. GEL towards the Environmental Protection and Agriculture Development Program (2.4% of MEPA’s total budget), with around 507.7 mln. (85.6% of their budget) to be allocated to agricultural development, and approximately 85.4 mln. GEL (12.0%) to be spent on environmental protection.

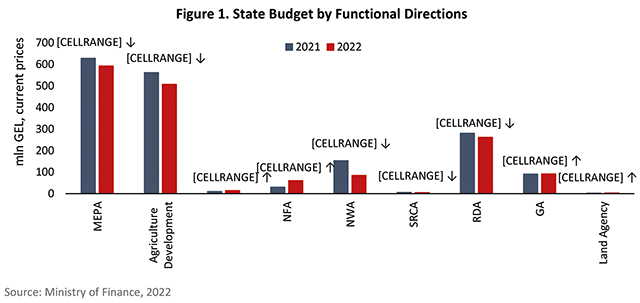

Compared to 2021, the budget for agricultural development will decrease by around 5.6%. Although additional state funds will be allocated to the National Food Agency (NFA) and the Agency for Sustainable Land Management and Land Use Monitoring (the so-called Land Agency), by 103.5% and 47.4%, respectively. The budget for Georgian Amelioration (GA) will also slightly increase, by 1.5%. While MEPA will direct further spending to the joint Environmental Protection and Agriculture Development Program (43.8% more than in 2021), the budget for the National Wine Agency (NWA) and the Scientific-Research Center of Agriculture (SRCA) will decline by 44.5% and 8.1%, respectively. The Rural Development Agency (RDA) will lose 6.8% of its budget from the previous year (Figure 1).

Although the redistribution of funds has changed slightly, as in previous years, the greatest share of MEPA’s funds will support the RDA (51.5%), GA (18.1%), and the NWA (16.7%). The RDA will continue financing around 20 programs; including “Concessional Agri Credit”, with the highest budget of 121 mln. GEL (46% of their total budget). Moreover 40 mln. (15%) and 27 mln. (10%) will be directed towards “Co-financing Agricultural Mechanization” and “Plant the Future”, respectively.

The State Budget for 2022 identifies the following core priorities for Georgian agricultural development:

• Supporting domestic production and improving the quality of locally produced agricultural goods;

• Improving access to financial resources for farmers and agricultural enterprises;

• Supporting land market development via the privatization of state lands and systematic land registration.

PRICE HIGHLIGHTS

DOMESTIC PRICES

On a monthly basis, the country’s price levels rose between December 2021 and February 2022. The Consumer Price Index (CPI) increased marginally in December 2021 (by 0.3%) compared to November. While in January 2022, prices increased by 1.1% from the previous month. The corresponding month-over-month price increase was 0.9% in February.

Between December 2021 and February 2022, the price for food and non-alcoholic beverages, measured by the Food Price Index (FPI), also exhibited an upward trend. In December 2021, food prices rose slightly – by 0.8% – from the previous month. While in January and February the corresponding month-over-month price changes were 2.5% and 2.1%, respectively.

From an annual perspective, the CPI continued to increase from December 2021 to February 2022. In December 2021, the CPI grew by 13.9% compared to December 2020; the corresponding YoY changes were 13.9% and 13.7% for January and February of 2022.

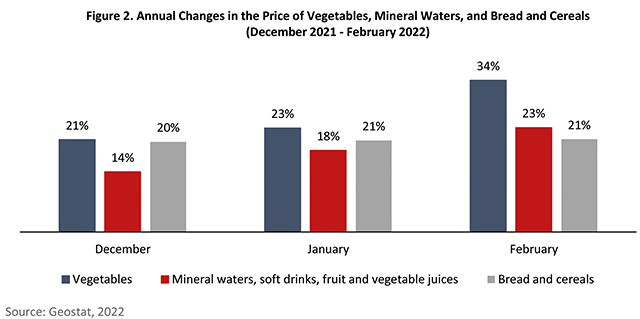

In February 2022, the year-over-year prices for food and non-alcoholic beverages also rose significantly, by 17.3%, contributing 5.61 percentage points to the change in total CPI. The main drivers were price increases in the following sub-groups: vegetables (+34%), Mineral waters, soft drinks, fruit and vegetable juices (+23.4%), and bread and cereals (+20.4%).

SPOTLIGHT

Over the last two years, food prices have been increasing; mainly due to international market trends that reflect concerns over decreased production, increased crude oil prices, as well as COVID-19 pandemic restrictions. In February 2022, the escalating tensions in the Black Sea region, followed by Russia’s full-scale invasion in Ukraine, increased pressure on international food markets already struggling with soaring prices. As Ukraine and Russia are both important trade partners for Georgia, such ongoing trends have quickly been transmitting into local prices, which increased most notably within the following categories:

Vegetables – In this category, the largest price rises were observed for cabbages (238%) and eggplants (81%). According to trade statistics, from December 2021-February 2022, the value of imported vegetables increased by 21% – from 8.7 mln. to 10.5 mln. USD. An increase in the value of imported vegetables may indicate that imports have become more expensive and, therefore, prices rose. As statistics on the corresponding quantity of imported vegetables as well as domestic production are unavailable, it is difficult to discern the exact reason for heightened vegetable prices.

Mineral waters, soft drinks, fruit and vegetable juices – In February 2022, prices rose for all products within this sub-category. The most notable increases were observed for still (29%) and sparkling (25%) mineral water. Trade statistics highlight that the export of mineral waters (both still and sparkling) increased in quantity as well as value between December 2021 and February 2022. This may be a sign of firmed external demand pushing prices upwards.

Bread and cereals – Within this category, the price of wheat bread and wheat flour increased the most in November 2021, by 22% and 21%, respectively. As Russia is the main wheat supplier for Georgia, the country’s trade-restrictive measures have influenced swelling prices in the bread and cereal category (Figure 2).

INTERNATIONAL PRICES

Between December 2021 and February 2022, international prices exhibited an upward trend on an annual basis. In February 2022, the Food Price Index, measured by the Food and Agriculture Organization (FAO), rose sharply (by 20.7%) compared to February 2021, and marked its all-time high. The largest price increase was observed within the vegetable oil (36.8%) sub-index. Such a sharp leap in the cost of vegetable oil was driven by rising palm and sunflower oil prices. International palm oil prices grew due to sustained global import demands, accompanied by reduced availability from Indonesia, a major exporter.

Meanwhile, concerns over disruptions in the Black Sea region drove international sunflower oil prices up.

TRADE HIGHLIGHTS

Total Georgian exports increased significantly in January-February of 2022, amounting to 760 mln. USD – 55% higher than the same indicator in 2021 (492 mln. USD). Agricultural exports increased as well, however at a more moderate rate (14%) – from 140 mln. in 2021 to 159 mln. USD in 2022. Therefore, the share of agricultural exports in total export decreased from 29% in 2021 to 21% in 2022.

A notable increase of 47% is also observable in total import; from 1,210 mln. USD in January-February of 2021 to 1,781 mln. in the respective period of 2022. A similar growth trend is seen in agricultural imports – from 152 mln. in 2021 to 218 mln. USD in 2022 (43%). While the share of agricultural imports in total import stands at a similar level, maintaining just a small decrease from 13% in 2021 to 12% in 2022.

Depreciation of the Georgian lari in February might have contributed to, and will further affect, increased exports if this trend continues, while equally placing downward pressure on imports. Overall, the year has started with a positive trend for Georgian exports, and this will hopefully be sustained throughout the year.

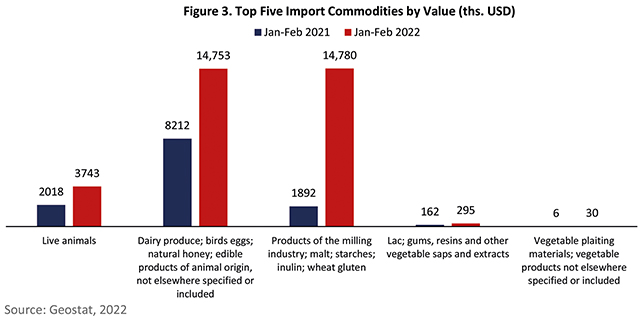

It would be interesting to understand the driver behind the strong agricultural importation. Closely monitoring the commodity categories, the strongest growth can be seen in the following:

• Products of the milling industry; malt; starches; inulin; wheat gluten (HS code 11);

• Vegetable plaiting materials; vegetable products not elsewhere specified or included (HS code 14);

• Live animals (HS code 01);

• Lac; gums, resins, and other vegetable saps and extracts (HS code 13);

• Dairy produce; bird eggs; natural honey; edible products of animal origin not elsewhere specified or included (HS code 04).

The highest growth is seen for milling industry products, which increased almost seven times – from 1,892 ths. to 14,780 ths. USD (681%). This can be explained by rising international wheat prices and the ongoing war in Ukraine, both hindering import from Georgia’s main trade partners. A significant jump was also seen in vegetable plaiting materials, from 6 ths. to 30 ths. USD (369%), and followed by an increase in the import of live animals, by 85% from 2,018 ths. to 3,743 ths. USD. For vegetable saps and extracts, it stands at 82% growth, from 162 ths. to 295 ths. USD. Lastly, the respective changes in import values for edible products of animal origin showed an 80% rise, from 8,212 ths. to 14,753 ths. USD (Figure 3).

POLICY WATCH

The Government of Georgia will subsidize loans for annual crop production

The Georgian government will subsidize the interest rate on bank loans issued to farmers with the purpose of cultivating annual crops. This sub-component will be added to the Concessional Agri Credit project, within which the Rural Development Agency will co-finance the 12-month interest rate on a sub-component loan at 9 percent per annum. The maximum annual interest rate of the loan is set at 18 percent. Farmers will be able to finance the cash resources needed for the cultivation of annual crops, such as seed and planting materials, labor, rental fees and fuel for agricultural machinery, and refining of existing equipment.

For more information follow this link: https://mepa.gov.ge/Ge/News/Details/20722

The Rural Development Agency will implement a new program supporting Agriculture Cooperatives

Within the scope of the Co-Financing of Warehouses for Agriculture Cooperatives initiative, the Rural Development Agency of Georgia will provide co-financing for crop storage and cooling infrastructure; designed solely for vegetables – predominantly potatoes. The volume of co-financing for a warehouse facility with a capacity of 500 tons will be in percentage terms – up to 80% of the total, and up to 450,000 GEL in absolute terms.

For more information follow this link: https://www.gov.ge/index.php?lang_id=ENG&sec_id=579&info_id=81494