By the Editorial Board of Investor.ge

The idea of building a new Black Sea Port in Georgia has a storied history that reaches far back into Georgia’s Soviet past. Today, it is seen by some as a vital piece of new transport and logistics’ infrastructure; particularly since the Russian war with Ukraine re-routed cargo traffic to Russia’s south. Now, the project is mired in controversy, because the Georgian government has selected a consortium led by a Chinese state-controlled entity.

It is argued by advocates that this proposed $2 billion deep-sea port would allow larger ships to transport increased volumes at a more efficient rate, and could significantly improve the Middle Corridor’s prospects as an alternative trans-Eurasian route that bypasses Russia. As an additional route, it may be attractive for China, which is in the throes of building global commercial maritime networks for its exports and raw material needs.

Most of the current outcry is based on Georgia’s choice of Chinese finance to be arranged for the government by state-controlled China Communications Construction Company (CCCC) as the leader of the construction consortium. The plan is for CCCC to hold 49 percent of the project, investing and constructing it, alongside its Singapore-based subsidiary China Harbor Engineering. The Georgian government will hold 51 percent of the project.

First Vice Prime Minister Levan Davitashvili has downplayed the concern, announcing in July that part of the Anaklia project, a construction contract, had gone to Jan De Nul, one of the world’s “Big Four” port construction companies, which owns 80 percent of the global dredging fleet.

“We have completed the selection process for the port construction company. Jan de Nul possesses the world’s largest dedicated fleet for port construction, including both dredging and breakwater installation. This is the core, universal maritime infrastructure that will be useful in different configurations as the port develops,” the minister said. “Construction work is due to start in September, and the hope is that the port will be taking in container traffic in 2029.”

Although Jan De Nul is a Belgian international port constructor, its involvement “does not change or reduce the risks associated with the Chinese consortium as investor for the port project,” says Georgian Tbilisi State University-based think-tank ISET-PI. Flashing warning lights in a policy paper, it says that while details of the Chinese financing were unclear, it sees dangers in “several high-risk and high-impact uncertainties” on the project. A key reason is the expected financial structure.

Specifically, ISET-PI warns that the port may not secure sufficient cargo volume to generate the foreign exchange cash needed to meet its obligations to cover finance servicing. It says the extent of stress-testing studies on potential cargo volume flows “remain unclear.”

The money needed is substantial. The first phase in Anaklia will cost $600 million, encompassing the construction of a wharf that can handle an annual seven million tons of cargo and be operational three years from commencement of work. The whole $2 billion project is envisioned to span 49 years.

If it does not generate enough revenue, it is unclear who will bear the costs. Generally, the Chinese push for revenue guarantees and, if this happens, losses could be shouldered by Georgian taxpayers, according to ISET-PI.

“China debt financing through the SOE [state-owned enterprise] and the contingent liabilities stemming from utilizing off-take guarantees and asset pledges could result in direct debt obligations for the state budget, potentially leading to Georgian taxpayers covering the debt service using the NBG foreign exchange reserves. These fiscal risks could intensify if the pension fund opts to invest in the Anaklia project,” ISET-PI said in the brief.

Or—as in the case of Sri Lanka, which failed to service a Chinese debt for port-construction—a solution might be a debt-for-equity swap. In Sri Lanka’s case, such a deal led to its granting of a 100-year lease on the port to China. This deal gives China freedom of movement, which commentators say possibly threatens Sri Lanka’s sovereignty and independence.

Sri Lanka’s experience has been raised in US warnings from Ambassador to Georgia Robin Dunnigan as a cautionary tale. She also pointed out that China is a major financier of the Russian military and that the CCCC “does not have a good reputation globally.”

Other diplomats have raised concern about the opportunities the Georgian port opens for China.

“If you have China building such a key point, then you are giving them the capacity and opportunity to control a very important route for trade between Europe and Asia,” noted Romana Vlahutin, a fellow at the German Marshall Fund and former European Union ambassador-at-large for connectivity, in an interview with Radio Free Europe. “This is not good news for the EU, and I think the fact that [China is now building] the port shows a lack of strategic thinking in Brussels.”

China’s growing maritime reach

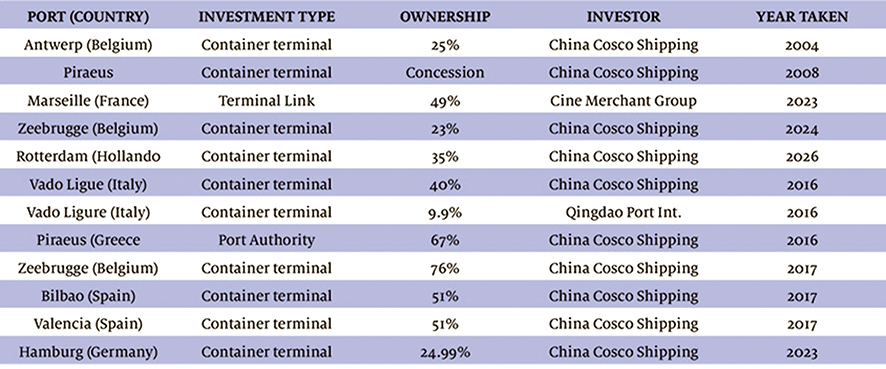

Ironically, the controversy over Anaklia has escalated at a time when Western business is just waking up to the fact that China is the world leader in commercial shipping, controlling movement of goods as well as leading on port automation, shipping IT systems and ship financing. Despite the widespread international reservations about China, it has succeeded in investing in two-thirds of the world’s largest container ports, including holding a majority stake in two key European ones.

Securing control of ports is a key factor in China’s global commercial strategy. It has made “investing in overseas ports a top priority for the twenty-first century,” states international news platform Modern Diplomacy. As they continue, “China plans to use outward port developments to create an efficient and well-coordinated transport-trade system, harnessing its dominant position in international shipping.”

“The world’s largest trading country, and second-largest economy, China conducts about 95 percent of its international trade by sea,” says Christopher R. O’Dea, a fellow at the Washington research center Hudson Institute and author of the book Ships of State: China’s New Maritime Empire. Writing in the Diplomat, he refers to a much lesser known component of China’s Belt and Road Initiative (BRI): the 21st Century Maritime Silk Road. This is where the ports come in.

The Maritime Silk Road launched at the 2013 summit of the Association of Southeast Asian Nations (ASEAN). The announcement stated that to accommodate expanding maritime trade traffic, China would invest in port development along the Indian Ocean, from Southeast Asia all the way to East Africa and parts of Europe. Ten years later the Maritime Silk Road connects 50 marine countries. It traverses from Hanoi to India, then East Africa, through the Suez Canal to the Mediterranean and on to the northern Italian hub of Trieste, with its international free port and its rail connections to Central Europe and the North Sea.

Driving China’s export strategy is the need to create overseas market growth to keep its factories going. Its high levels of production result from the country’s economic model, with supply-side targets set out in five-year plans causing factories to produce more than the Chinese themselves can buy. “To continue its domestic growth trajectory, currently around five percent annually, China must sell overseas the goods it can’t consume at home,” states Intereconomics. However, rising Chinese imports mean lower sales of other foreign goods, as well as domestically produced items, and there have been recurring conflicts.

Jürgen Matthes at the German Economics Institute, writing on China’s Trade Surplus for Intereconomics, states that “China’s merchandise trade surplus has reached an all-time high and is likely to rise further. A key driver appears to be a policy push to further bolster Chinese domestic manufacturing production, implying the danger of significant overcapacities.”

Another assessment of China’s maritime strategies, published in a recent paper from the Greenberg Center of Geoeconomic Studies, part of the US Council on Foreign Relations, states that without being a global naval power, China “has become a leading commercial power that wields significant geoeconomic influence over international sea lanes and commercial ports, underpinning the global flow of goods.”

To date, closer relations with Beijing have had a limited impact on the Georgian economy. Chinese exports to Georgia are expanding, and are five times higher than Georgia’s exports to China. Georgia’s exports to China, currently at $145 million, are declining and have very little local added value—mainly raw materials (metals ores, herbs, and spices).

By the Editorial Board of Investor.ge