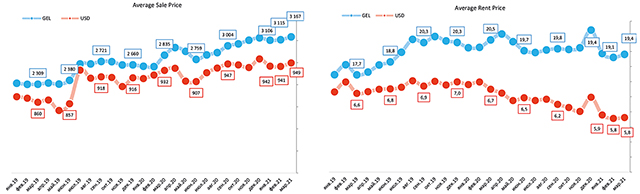

After a decline in January 2021 compared to December 2020, the Tbilisi Residential Sales Price Index (SPI) showed an upward trend in Q1 2021, increasing from 110.7 index points in January 2021 to 113.5 index points in March 2021 (the index equals 100 in the base period, January 2019). Nevertheless, compared to the first quarter of 2020, the SPI showed a decline in Q1 2021, with the highest drop of 2.4% (YoY) in February 2021.

Unlike the SPI, the Rent Price Index (RPI) was characterized by a consistent downward trend throughout Q1 2021, declining from 78.2 index points in January 2021 to 77.2 index points in March 2021. Similar to SPI, compared to the previous year, RPI presented a decrease in every month of the first quarter, with the highest decline in February 2021, 17.7% (YoY).

During Q1 2021, the Average Sales Price (ASP) in Tbilisi increased from 942 USD per m2 in January 2021, to 949 USD in March 2021 (monthly average), while the Average Rental Price (ARP) decreased moderately from 5.9 USD per m2 in January to 5.8 USD in March (monthly average).

In Q1 2020 on average, the most expensive districts by ASP were Mtatsminda-Sololaki (1,402 USD), Vera (1,215 USD), and Vake-Bagebi (1,159 USD), while the cheapest district was Lilo at 419 USD per m2. By ARP, the most expensive districts in Q1 2021 on average were Tsavkisi-Shindisi-Tabakhmela (8.8 USD), Mtatsminda-Sololaki (7.7 USD), and Kiketi-Kojori (7.0 USD).

COMMERCIAL PROPERTY PRICES

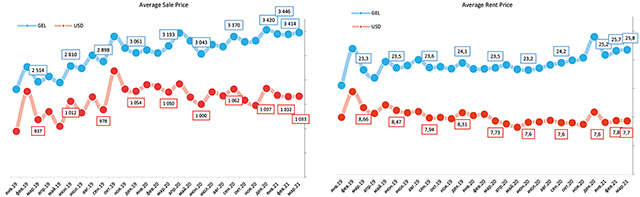

In Q1 2021 on average, commercial SPI for Tbilisi increased by 12.0% compared to Q4 2020 and amounted to 152.2 index points, while, compared to Q1 2020, SPI presented a decline of 6.1% (YoY).

The Rent Price Index (RPI) for commercial properties continued to decrease and presented a 2.8% decline in Q1 2021 on average, compared to the previous quarter.

During Q1 2021, ASP for commercial properties increased from 1,037 USD per m2 in January 2021, to 1,033 USD in March 2021 (monthly average). As for the ARP, it increased moderately from 7.6 USD per m2 in January to 7.7 USD in March 2021 (monthly average).

On average in Q1 2021, ASP decreased by 3.1% (YoY) and the ARP decreased by 3.8% (YoY).

TBILISI AND GEORGIA REAL PROPERTY SALES

In comparison to Q4 2020, the GEO real property market contracted moderately, by 4.3% in Q1 2021 (from 32,197 units sold in Q4 2020 to 30,825 in Q1 2021), while the annual increase is observed at 9.0% (YoY) compared to Q1 2020. This annual increase was mainly caused by a significant increase of 44.2% (YoY) in number of sales in March 2021 compared to March 2020 (from 8,796 units sold in March 2020 to 12,682 in March 2021).

Tbilisi dominated the real property market with a 39.3% share in total sales in Q1 2021 (Tbilisi held 41.3% of total sales in Q4 2020). The Tbilisi market was followed by Kakheti and Adjara, with a respective 11.0% and 10.3% of GEO sales.

In Q1 2021 Racha-Lechkhumi & Kvemo Svaneti experienced the highest increase (YoY) in sales (189.9%), followed by Guria (62.3%), Mtskheta-Mtianeti (57.6%), and Imereti (18.7%). In total, the market outside the capital grew by 12.4% (YoY). More than half (51.0%) of GEO sales were registered in the three largest cities: Tbilisi, Batumi and Kutaisi.

BATUMI & KUTAISI RESIDENTIAL PROPERTY HIGHLIGHTS

In Q1 2021, the real property market decreased by 7.4% (YoY) in Batumi and increased by 16.5% (YoY) in Kutaisi. As a result, there were 2,804 transactions registered in Batumi and 832 in Kutaisi.

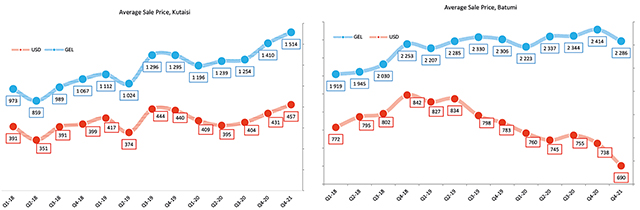

The SPI for Batumi residential properties decreased by 11.7% (YoY) and settled at 84.8 index points in Q1 2021. Compared to previous quarter, Batumi SPI increased by 3.8% (QoQ).

For Kutaisi, the SPI increased by 6.5% (YoY) and amounted to 135.1 points. Compared to previous quarter Kutaisi SPI also increased by 5.4% (QoQ).

In Q1 2021, the ASP of residential properties decreased by 9.3%, YoY, (-6.5% QoQ) in Batumi and increased by 11.7%, YoY, (6.0% QoQ) in Kutaisi, amounting to 690 and 457 USD per m2, respectively.