By Sally White for Investor.ge

Escalating hazards on the major Eurasian east-west trade routes are heightening international investment commitments to an alternative that is favorable for the Georgian economy. This is the Middle Corridor, the land and sea freight transport route from China to Europe first mooted in the 1990s but, until recently, considered low priority.

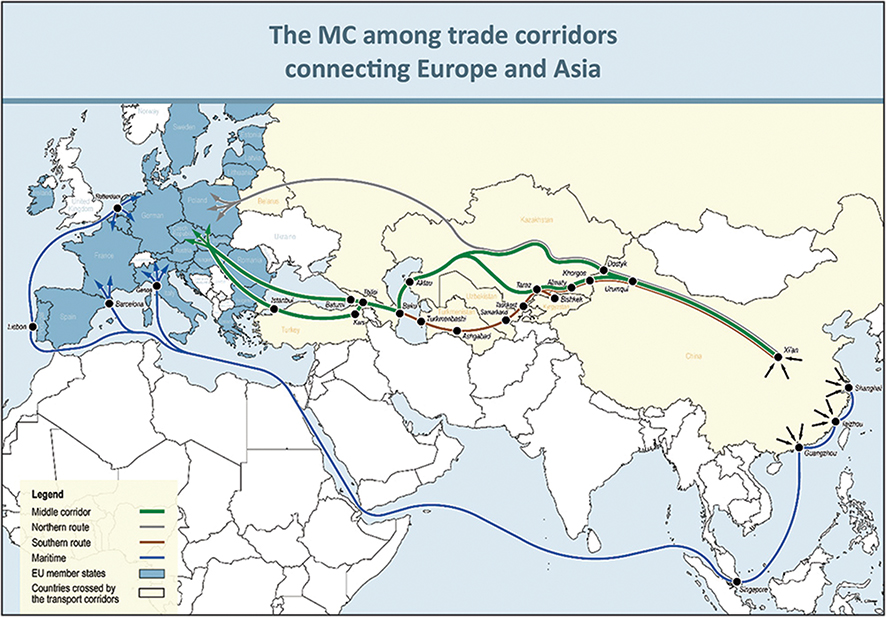

The busiest and fastest Eurasian land route, the Russian-dominated Northern Corridor, has become less attractive in the face of freight insurance challenges following its invasion of Ukraine – a conflict that is showing little indication of ending soon. Additionally, Yemen’s Houthi terrorists are attacking Suez Canal-bound ships on the key east-west sea route through the Red Sea, forcing shippers off a route used by roughly one-third of global container ship cargo. The main remaining option is the long maritime route around Africa.

All this puts the Middle Corridor in focus – a multimodal land and sea transport route from China that transits through Kazakhstan, Uzbekistan, and Turkmenistan and crosses the Caspian Sea through Azerbaijan and Georgia to the Black Sea. The route consists of around 4,250 kilometers of rail lines and 500 kilometers of seaway, then two paths lead to Europe – via Turkey or the Black Sea.

This is the site of many ancient Silk Road routes, but modern political divisions and wars and the greater ease of maritime routes caused most to be abandoned; they were never developed to offer smooth, price competitive transcontinental passage to rival the Northern Corridor. Although traffic along it has been growing – in 2021 there was a 29% increase in container trains – it still carries just a small percentage of total China-EU trade. An efficient Middle Corridor could offer, the consultancy German Economic Research Team suggests, a clear advantage in terms of transport time between China and Europe at 13 to 21 days compared to the sea route time of 35 to 45 days.

Although traffic has been growing – in 2021 there was a 29% increase in container trains – it still carries just a small percentage of total China-EU trade

Yet, says the World Bank, the Middle Corridor’s prime contribution to Georgia and its regional neighbors may not be as a trans-continental route, but as the catalyst for driving economic development from the new connections between them as well as the countries it traverses. This was its conclusion after a survey of the major stakeholders.

Money needed to make the necessary improvements to this trans-Eurasian route is vast. In a report for the European Commission (EC), the European Bank for Reconstruction and Development (EBRD) suggested a figure of around €19 billion, and that does not cover the whole. Financing is, however, not the main issue – this is a key theme of the multitude of publications on the Middle Corridor rushed into print in recent months.

Officials seem unsure whether it is good or bad news that the major challenges are soft issues, such as aligning national visions, coordination of planning, harmonizing standards to ensure interoperability, enhancing the PPP environment, liberalizing markets, and integrating border management. Both the EBRD and the World Bank believe that progress is being made on these issues.

The list of what needs to be done solving bottlenecks, mostly caused by infrastructure deficiencies, is long: at ports, a lack of capacity in shipping, goods-handling infrastructure, and IT; at sea, a shortage of maritime services; and on land, an insufficient modern rolling stock for rails, uncoordinated border crossing points, and unstandardized information technology, resulting in inefficient flows of data between service providers and regulators.

Adding value

While benefits to Georgia are less than for other countries along the corridor, they could still be substantial. A World Bank report released in November 2023 suggests a range of gains, from increased exports of food products and construction materials to transport fees. By 2030, says the report Middle Trade and Transport Corridor: Policies and Investments to Triple Freight Volumes and Halve Travel Time by 2030, should the Middle Corridor be operational, Georgia’s export tonnage could rise by over 3% as new markets become accessible, along with a gain in demand for higher-added value food products. Georgia could enjoy an increase in the value of exported goods of as much as $107 a ton overall.

Georgia could enjoy an increase in the value of exported goods of as much as $107 a ton overall

“Georgia stands to gain notably from increased exports of prepared foodstuff, especially beverages, mineral waters and wines (particularly as exports to China via the Middle Corridor). Georgia’s mineral exports are to grow, notably for construction materials and non-ferrous ores,” the report asserts.

Another Middle Corridor development from which Georgia could benefit, says the World Bank, is the growth in “logistic clusters and concentration of specialist activities” as the cargo base of the region (i.e., Georgia, Kazakhstan and Azerbaijan) grows. The building of “agglomeration hubs” will “help foster the development of higher value-added goods,” says the World Bank, forecasting a 44% rise in the cargo base between 2021-2030.

Shippers’ attempts to shift unprecedented volumes to the Middle Corridor in the immediate aftermath of the Russian invasion threw into stark clarity its current limits. With its numerous border crossings, container trans-shipments between ships, trains and lorries, and operational inefficiencies, the time taken is threefold that to traverse the Northern Corridor, and is comparable to the cheaper maritime route.

While the Middle Corridor’s current technical full operating capacity is yet to be reached, despite a 33% rise in 2022 container traffic (as China rerouted much of its EU-bound traffic), the very high level of transport delays drove shippers back in 2023 to alternative corridors, predominantly to sea routes. Not only do bottlenecks make the Middle Corridor take far longer than the Northern Corridor, mostly due to inadequate Caspian and Black Sea shipping and port capacity, but tariffs are uncompetitive and costs fluctuate. Thus, the gain in container traffic was severely reversed, with the first eight months of 2023 seeing, according to the World Bank, a decrease of 37%. While the likes of international logistic giants Maersk, Rail Bridge Cargo, and CEVA Logistics initially rushed to the Middle Corridor after Russia’s invasion of Ukraine, they have since held back.

International interest and investments

Fortunately, for the transit countries likely to benefit, the wide appeal of an efficiently functioning Middle Corridor as a land bridge between China and Europe and its geopolitical importance is bringing growing support from the World Bank, the European Union, the EBRD, the Asian Development Bank (ADB), and other multinational development banks.

To international eyes, a major factor is not the boost to trade alone, but the reduction of risks, as achieving an efficient Middle Corridor will require, says the Geopolitical Monitor, “the establishment of strong institutional frameworks, harmonization of trade policies, and the crafting of transnational (and regional) agreements.”

The extent of global interest in the Middle Corridor was evident in Tbilisi in October of 2023 when 2,000 international delegates attended the Silk Road Forum to discuss the huge array of challenges ahead and the opening of opportunities. As described at the Silk Road Forum, an “economic development corridor” is how the World Bank predominantly sees the Middle Corridor. Governments of the countries along it are very aware of the potential and have already begun to work together. Georgia, Azerbaijan, Kazakhstan, and Turkey signed a “roadmap” in 2022 listing priority investments and actions needed. Last June, an agreement was reached between Georgia, Azerbaijan, and Kazakhstan on the creation of a joint logistics operator, and at the same time, the World Bank, EU, ADB, and other international organizations confirmed their support and interest in providing technical assistance and investments.

Inter-regional trade between Azerbaijan, Georgia, and Kazakhstan is predicted to increase by 37%, and trade between them and the EU to grow by 28%

Contrary to the “New Silk Route” headlines, the Middle Corridor is likely to “remain mostly a regional corridor, with transcontinental trade representing a small fraction of volumes,” the World Bank states in its report. The reason for this local focus is the “enhanced connectivity for Azerbaijan, Georgia, and Kazakhstan.” The Middle Corridor will always have limited capacity with its many maritime crossings, and intercontinental trade has the option of deep-sea shipping: the deep sea routes through the Suez Canal and around Africa are estimated to carry 80-85% of all EU-China trade volumes.

Nor will the Middle Corridor be able, says the EBRD, to supplant the 10,000 kilometer Northern Corridor, on which the train network has been developed and coordinated over decades to run smoothly and which on average takes 14 days. Even at its 2021 peak, the Middle Corridor was moving less than 10% of traffic on the Northern Corridor. Also, Russia’s Trans-Siberian railway transits through large Russian and Belarussian industrial and population centers, which add cargo volume and help to defray costs and keep down prices. And it does not have to battle the red tape that hampers the Middle Corridor, with its many borders; the U.S. Foreign Policy Research Institute expects it will be at least five years before the new Road Map eliminates this problem.

Opportunities and challenges for Georgia

Steady progress is being made on improving infrastructure, although the tally looks small compared to the remaining task. For “hard” investment in Georgia, the UK-US think tank the International Institute of Strategic Studies (IISS) lists the upcoming tender to construct the Anaklia deep sea port, the reconstruction of sections of the Baku-Akhalkalaki-Kars railway, plans for creation of a logistics and industry park near Poti, and a logistics center in Akhalkalaki. APM Terminals has proposed capacity expansion at Poti Port to help ease congestion, and Georgia has intensified work to finish the new east-west road highway connecting its ports to the Caspian Sea.

Georgia is also reforming the Georgian Railway by raising money for new rolling stock and bringing in a new ownership structure to aid cost and investment funding for expansion and modernization. The country will also continue to develop the Middle Corridor, the IISS notes, by establishing a consistent system for prioritizing investments.

All this is likely, on precedent, to roll out in slow motion; so, to help improve trade flows for Georgia as soon as possible, the World Bank recommends a list of operational actions of “quick wins” – for example, to reform its expensive port services. These include reducing its high port tariffs: for a 1,500 TEU vessel, a sole ship-call in Poti costs $38,800 (around $97 per 40-foot box, on average). Altogether for a 40-foot box, it says, crossing the whole port costs $275 in Poti and $430 in Batumi, which is “significantly higher than in Aktau or Baku ($148), or a European or Asian port.”

The World Bank also suggests that Georgia find ways to ensure predictable final transport services, a feasible transition to electronic documents applicable both to its railway and the Caspian sea, and provide traceability of cargo movement.

A prize for the Middle Corridor would be to gain a greater share of rising trade volumes. Forecasts are for a 30% rise in EU-China trade by 2030, and the IISS notes that “Inter-regional trade between Azerbaijan, Georgia, and Kazakhstan is likewise predicted to increase by 37% by the same year, and trade between these countries and the EU is anticipated to grow by 28%.”

China and the Middle Corridor’s European supporters are strongly in its favor, even if there are divergent views on who should get the infrastructure construction contracts. Russia, on the other hand, has long sought to be the dominant influence in the countries traversed by the Middle Corridor and control trade. Currently it is distracted by events in Ukraine, but should it win decisively, says the IISS, Russia is likely to “direct resources towards disrupting the corridor” to protect the Northern Corridor’s role in transcontinental trade and its regional mastery. So, for the Middle Corridor, much remains predicated on the outcome of the war in Ukraine.

By Sally White for Investor.ge