By Josef Gaßmann for investor.ge

There has long been talk of building an underwater transmission line to connect the shores of Georgia and the EU, but ambiguity over project benefits has held the project back. That’s changing following Russia’s invasion of Ukraine, which has had the EU scrambling to secure more green power both at home and from its neighbors. EU Commissioner for Neighborhood and Enlargement Olivér Várhelyi announced at the end of December 2022 that as part of a new €17 billion economic and investment plan for the countries of the Eastern Partnership, the EU would financially back the €2.3 billion submarine transmission line. If built, it would be the largest in the world.

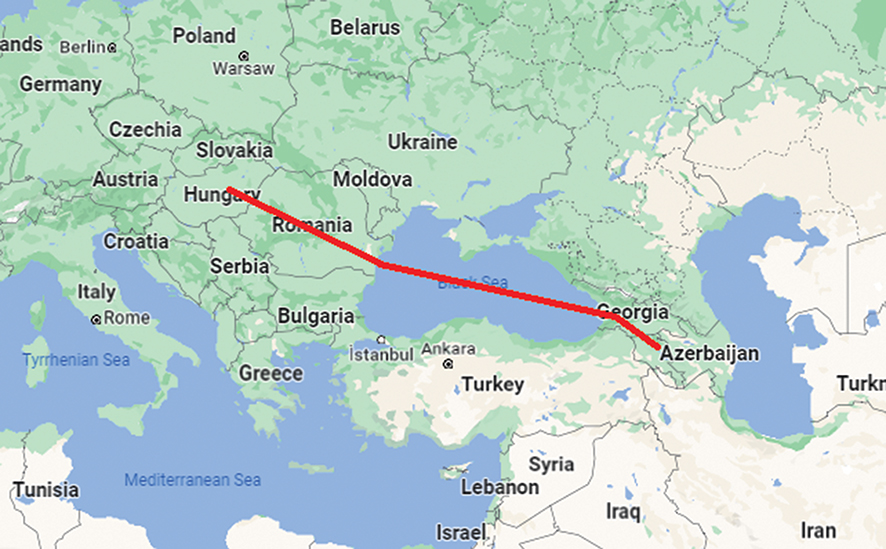

A little bit of squinting is necessary to see the utility of the cable in the short term. Spanning 1100 kilometers from Azerbaijan through Georgia, under the Black Sea and into Romania and Hungary, the primary purpose of the line for the EU is to secure green energy partially from Georgia but primarily Azerbaijan, a country which aims to generate 30% of its power consumption from renewables by 2030 – a figure that currently comes in at just 17%. Azerbaijan intends to carry out this ambitious upgrade to its grid through a recent agreement with the UAE’s state-owned energy developer Masdar, which foresees the development of 4 gigawatts (GW) of onshore wind and solar projects in the near term. For Georgia and Azerbaijan, the line would open up European export markets.

The prospects for the long term are somewhat less fuzzy. The Norwegian Water Resources and Energy Directorate, a Norwegian government agency, estimated that in exploiting all its hydro resources, Georgia could produce between 30-56 TWh / year, more than four times the volume of electricity the country currently consumes. Azerbaijan, meanwhile, is eyeing the potential of the Caspian Sea, which the World Bank said in its Offshore Wind Roadmap for Azerbaijan, published in June of 2022, has “technical offshore wind resources of around 157 GW” – about 20 times more than the country currently has in installed capacity.

Varying capacities between 1-3 GWs are being discussed for the cable. At 1 GW of capacity, the line could transmit approximately 8.76 TWh (if in constant use) per year. To contextualize – the EU’s total net electricity generation in 2021 was 2,785 TWh. Romania currently consumes about 60 TWh of power annually. Translated into gas, the potential power transport capacity of the proposed line is equivalent to about 220 million cubic meters of natural gas, of which Azerbaijan already exports about 20 billion cubic meters per year. For reference, Romania consumes 12 billion cubic meters per year.

So while for the Caucasus these volumes are large, for the EU these numbers are but a drop in the bucket of the extra power the bloc needs to bring online to reach its net-zero carbon emission goals. But something is better than nothing, and power from the Caucasus is a great deal cheaper than Europe’s current energy sources, making the €2.3 billion a not-so-hefty price tag to make a bet on access to power that isn’t entirely there yet. Financially, the cable may thus best be viewed as a proof of concept of tapping energy sources further afield on Europe’s periphery.

Geopolitically, there are aspects to the cable which make the project more interesting. For the EU, pulling in closer the countries of the Eastern Partnership secures its political investments of the past decade and contains Russian influence. Most importantly for Georgia, perhaps, is the symbolic importance of a direct, physical connection with the EU. Political commentator and director of the Georgian Institute for Politics Korneli Kakachia summed this up succinctly in a recent interview with RFE/RL, noting “[geography] has always been considered Georgia’s Achilles’ heel…and this project significantly reduces that vulnerability.”

By Josef Gaßmann for Investor.ge