By Sally White for Investor.ge

Infrastructure spending dominates the Georgian government’s budget and extends far beyond the flagship high-speed mega road projects aimed at transforming the South Caucasus and Central Asia into an attractive transcontinental East-West transport route. While it is often problems on the Rikoti Pass or other highway challenges that grab the headlines, Georgia’s infrastructure is being developed and rehabilitated in just about every sector of the economy, at a cost in 2024 of at least GEL 7 billion, or 9% of GDP.

Outside of the “connectivity” infrastructure projects for land, sea and air that seek to develop and improve the competitiveness of the country’s transport and logistics sector, there is a wide range of infrastructure projects currently underway in other industries.

Tourism will this year receive GEL 191 million, part of a new 5-year program costing a total of 1 billion GEL ($361.8 million) that aims to renovate central districts in tourist areas and create attractive spaces. Over 1.8 billion GEL has been allocated to rehabilitate municipal infrastructure, 450 million GEL is earmarked for financing school construction/rehabilitation, 267 million GEL for kindergartens, and 582 million GEL for water supply and drainage projects.

There are also new high-tech infrastructure projects in energy and for the internet. But more appealing for the population is probably the proposed new sports stadium for Batumi, which includes an ice rink slated to host the Youth Winter Olympics in 2025. Popular, too, for Tbilisi, with its aspirations of hosting the prestigious 2028 UEFA Champions League final, is a planned new 70,000 seater sports stadium (for football or rugby), cost currently undisclosed.

According to investment bank TBC Capital, in 2024 and 2025, expenditure will continue to rise as construction work on the latest phases of the major highways come to an end. These are the east-west S1 route (the Tbilisi-Senaki-Leselidze Highway, which began as long ago as 2005 as part of Europe’s E60, E97, and E117 and Asia’s AH5, due to finish in 2026) and the north-south Kvesheti-Kobi route (now nearing completion). Although fresh projects are regularly added to the list, Georgia has been under pressure to reduce its borrowings.

While new projects for infrastructure spending are muted, there is nothing currently on the agenda needing imminent funding that competes in size with the east-west highway’s 3 billion GEL, the 1.2 million GEL for Kvesheti-Kobi road and tunnels, or the 527 million GEL cost of the Kakheti highway. So, from next year onwards, according to a report from investment bankers TBC Capital, costs of “projected infrastructure projects are expected to decline.” After rising from around 2.4 billion GEL in 2021 to a peak not far short of 4 billion GEL in 2025, public expenditure on infrastructure, TBC Capital says, will fall by around 9% in both 2026 and 2027.

State funding for infrastructure projects

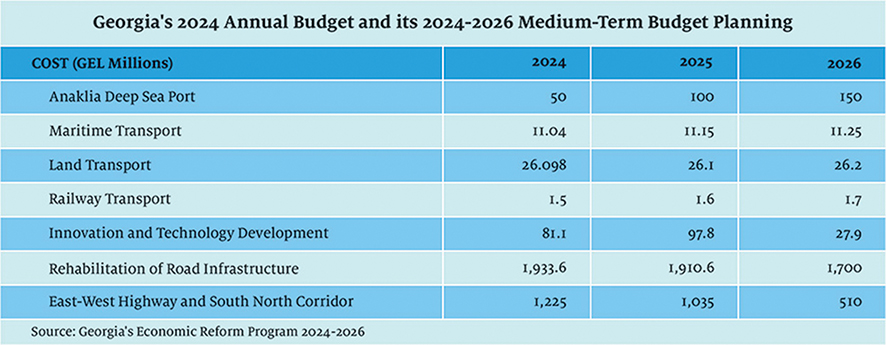

Keeping track of all the infrastructure projects, with their rolling programs and frequent re-presentations, is less than easy. However, Georgia’s Economic Reform Program (GERP) 2024-2026 presents medium-term macroeconomic and fiscal outlooks and includes information about major planned and ongoing structural reforms that are on the government’s agenda.

Summarizing key infrastructure spending in 2024, the GERP states: “Investing in Infrastructure (8.5% of GDP) includes: (i) up to 2.0% of GDP on road infrastructure, including the east-west highway; (ii) 2.5% for municipal infrastructure; (iii) water and sanitations systems; (iv) educational infrastructure; (v) energy transmission lines and preparation works for the undersea Black Sea cable; (vi) touristic infrastructure.” In addition, it notes that for “rehabilitation and construction of schools and kindergartens, around 0.8% of GDP will be allocated.”

Just keeping roads across Georgia’s challenging terrain open to facilitate the movement of farmers and tourists is a major task. For example, to rehabilitate the 72 kilometer-long mountain road from Pshaveli to Omalo, leading to Tusheti, is an on-going 100 million GEL project that is expected to be completed next year.

However, the government’s infrastructure costs are overrun. Since that GERP document was published at the end of last year, the Ministry of Regional Development and Infrastructure has announced that it exceeded its approved budget in the first quarter of 2024. Roads, municipal development, and water were the culprits, with outcomes of 130%, 112% and 135% over budgeted costs, respectively. A major driver of infrastructure project costs – raw materials – are becoming more expensive, from bitumen (imported) and concrete to fuels.

GERP published the Georgia’s 2024 Annual Budget and its 2024-2026 Medium-term Budget Planning (see below) to present costs. It notes that “highway road infrastructure and rural fiber projects are being financed through IFI loans with government co-financing.”

Developing as a transport and logistics hub

As the roads projects conclude, emerging into the limelight are projects which have been in the wings for years, waiting for momentum to win domestic advocates and international backers. There are several more in the transport sector, for rail, sea, and air. The first two have gained traction as Russian sanctions and Houthi rebel attacks on Red Sea transit cargo ships and tankers have encouraged exploration of possible alternative international east-west trade routes, and Georgia is ostensibly well-placed to compete.

However, as a World Bank report out last year revealed, Georgia’s logistics infrastructure needs an enormous amount of work before it can offer itself as a transit corridor, and Georgian port inefficiencies and costs are making its routes uncompetitive. As a result, multiple solutions are being explored and several infrastructure programs are now underway.

The flagship project in this sector of the economy is the plan for a new deep sea port in Anaklia, for which a Chinese company has won the contract. This year’s budget includes 50 million GEL for the construction of the port, according to Agenda.ge. Georgian Economy Minister Levan Davitashvili said in May that construction would take several years and that the total cost would be around $600 million. Work has already started.

The Minister also expressed support for the expansion and modernization of Poti Port, citing ongoing modernization and investment projects there. He said discussions were ongoing to select a model for a larger expansion project that would “benefit the state and investors.”

To increase the capacity of Georgia’s transport corridors and to diversify them, the rail system is also being modernized. Georgian Rail, while state-owned, makes good profits – GEL 400 million last year – so it is in a position to cover at least some of the costs of the planned expenditure. Apart from an acute need for new rolling stock, work is centering around digitizing railway services to speed cargo handling and make the processes more efficient, and new logistic centers are planned for Eastern and Western Georgia to create a multimodal logistics network.

Tourism, energy, and communications

As tourist numbers soar, new airport infrastructure is also underway. Named for work in 2024 are:

– the start of the re-construction and complete modernization of Telavi Airport.

– the design and construction of the new terminal at Mestia Airport.

– preparation for a new airport for Tbilisi in response to increasing tourist numbers. The development of a new airport at Vaziani (23 kilometers from Tbilisi) is projected to cost around $1.26 million and will enable the accommodation of more than 18 million passengers yearly. The drawing up of a master plan will be completed this year.

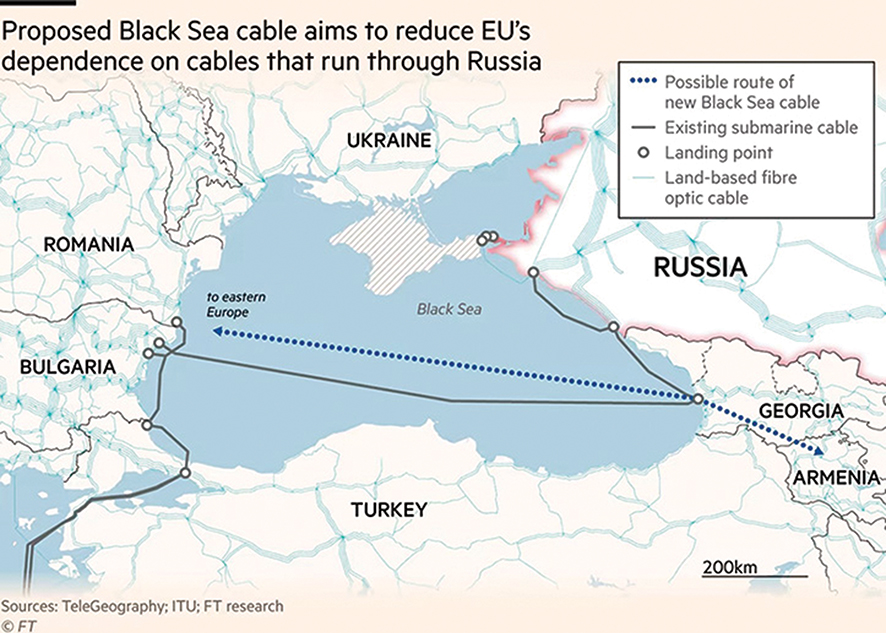

Energy and communication are also among the priorities in the government infrastructure programs. Strengthening of Georgia’s domestic power transmission system as well as its digital connectivity should result from the Black Sea Submarine Cable Project, and the World Bank approved a $35 million loan in May for the first phase. To give its full name, this project is the Enhancing Energy Security through Power Interconnection and Renewable Energy (ESPIRE). Initiated by Georgia, the ESPIRE Program consists of “three phases with a potential financing envelope of up to $500 million that seeks to improve Georgia’s institutional capacity for the development of submarine cable projects, strengthen Georgia’s domestic power transmission system, and establish a direct electricity interconnection between the South Caucasus and Southeast Europe, aiding Georgia’s energy exports.” Additionally, a parallel digital interconnection would reduce internet connection costs, improve bandwidth, and generally enhance international digital connectivity across the Black Sea.

The Black Sea Submarine Cable project aims to connect the South Caucasus Region directly to Eastern Europe via a submarine cable crossing the Black Sea, with an approximate length of 1,195 kilometers (1,100 kilometers of underwater cable and 95 kilometers onshore). The World Bank says its development will “contribute to the energy security of the EU and the Caucasus Region, support development of Georgia’s renewable energy sector, and increase transit opportunities/back-to-back trade options between the EU and the South Caucasus Region.” The Agreement on a Strategic Partnership in the field of Green Energy Development and Transmission between the Governments of the Republic of Azerbaijan, Georgia, Romania and Hungary was signed in Bucharest in December 2022.

In energy, the Economy Minister reported in April that more than 1,000 kilometers of power lines and infrastructure would be built in the coming years, with the prospect of more hydro and wind power projects. Other infrastructure work ongoing is the upgrade of irrigation and drainage systems to help boost the agriculture industry.

So, in all aspects of Georgia’s economy and regions, there is activity to improve or expand infrastructure. However, change is not painless, and for much of Tbilisi’s population, “infrastructure” is a bad word, with experience causing it to take a decidedly jaundiced view. For years, Tbilisi’s residents have endured log-jammed, central city traffic as first Chavchavadze and Melikishvili and then Tsereteli Avenue were refurbished, followed by a GEL 36 million scheme for a bridge and new traffic lanes connecting Bagebi district and University Street in Saburtalo. However, just as the latter opened to help free up traffic flows, a new “improvement” has inevitably been revealed. Up next, the Tskneti Highway and Amirejibi Street are to be closed for four months – for infrastructure work and road widening.