Discussion surrounding the topic of rare earth elements became especially relevant after the 47th President of the United States, Donald Trump, emphasized the need for an agreement with Ukraine on such minerals; an agreement that would grant Washington access to reserves located on Ukrainian territory. Trump stated that such a deal would serve as “fair compensation” for the military aid provided to Kyiv by President Biden’s administration. After a series of tough negotiations, the agreement was signed on April 30 of this year.

The U.S.-Ukraine deal is gaining growing significance amid the ongoing trade confrontation with China. While Beijing has responded to Washington’s tariffs with retaliatory measures, Washington remains aware that tariffs are not the only tools at Beijing’s disposal to retaliate against the United States: China is a key player in the global rare earth minerals value chain, granting it considerable leverage over the United States.

Beginning April 4, Beijing imposed export controls on rare earth minerals destined for the U.S. According to recent reports, during negotiations between the United States and China held in Geneva on May 12 of this year, both sides agreed to a 90-day tariff reduction. The U.S. will lower its tariff on Chinese goods from 145% to 30%, while China will reduce its tariff on American goods from 125% to 10%. China has also temporarily suspended other non-tariff countermeasures, such as the export of critical minerals to the United States.

Rare earth elements are dispersed in small amounts throughout the Earth’s crust, making it nearly impossible to extract them in large quantities from a single ore

It is worth exploring what rare earth metals are and the key roles they play in modern technology. Equally important are questions such as: how does China maintain its dominance over the global supply of these critical resources? What are the implications of its newly imposed export controls for the United States? And, in this context, how might the recent minerals agreement signed with Ukraine influence Washington’s strategic position?

What are rare earth minerals and what are they used for?

Rare earth minerals are a group of 17 chemically similar elements that are essential to many high-tech industries. Although they are relatively abundant in the Earth’s crust, they are called “rare” because they are rarely found in concentrated and easily extractable forms. Their extraction and processing are complex, expensive, and often harmful to the environment. Rare earth elements are dispersed in small amounts throughout the Earth’s crust, or are mixed with other metals, making it nearly impossible to extract them in large quantities from a single ore.

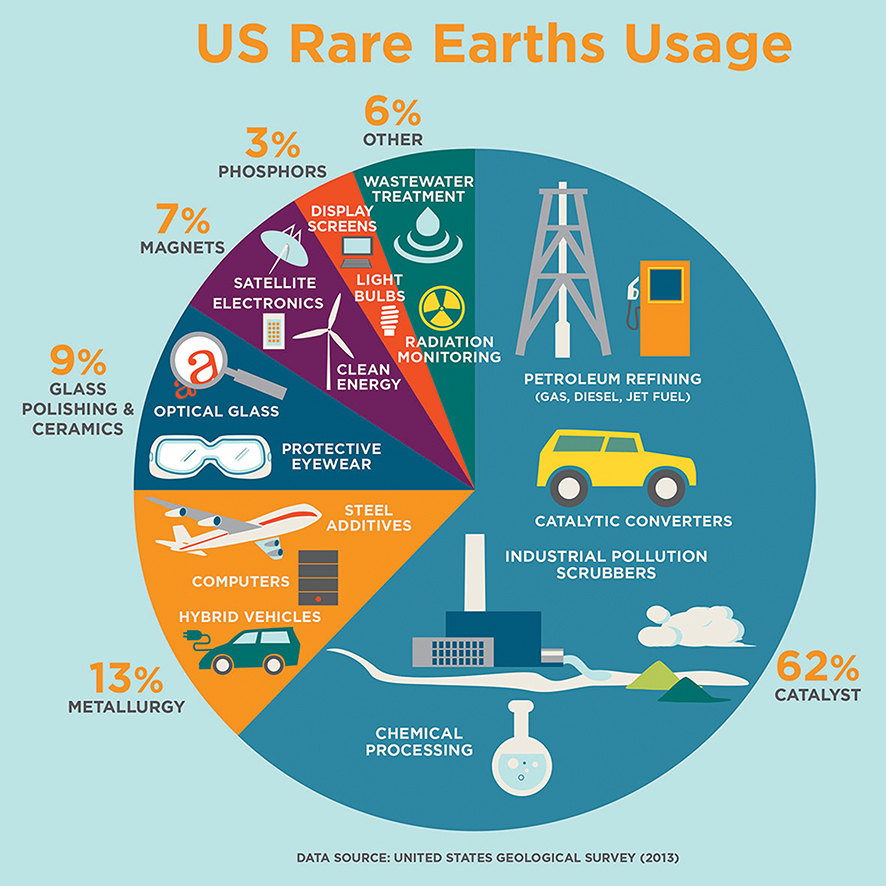

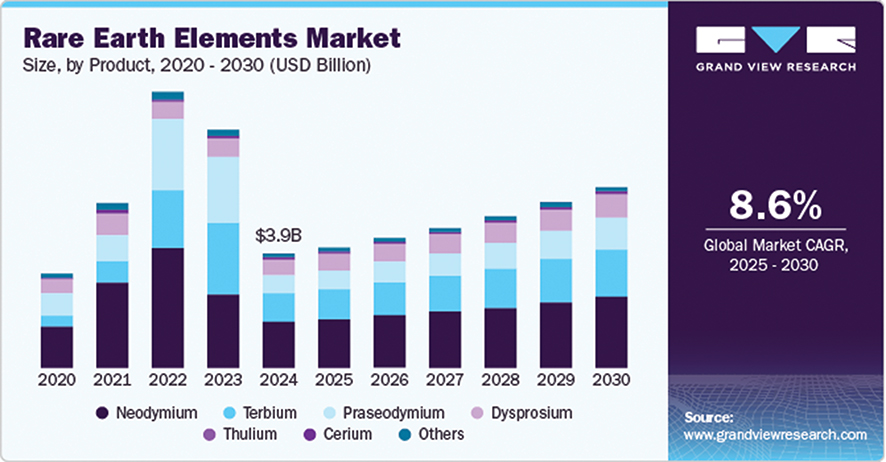

The names of these earth minerals may be unfamiliar to many, but the products made using them are well known. For example, neodymium is used to create powerful magnets found in computer hard drives, speakers, electric cars, and jet engines; yttrium and europium are used in the production of television and computer screens because of their unique ability to reproduce vibrant colors.

Rare earth minerals play a crucial role in medical technologies like laser surgery and magnetic resonance imaging (MRI), as well as in defense applications, including electronic displays, lasers, radar systems, and ultrasonic equipment.

In the energy sector, rare earth minerals are essential components in the production of solar panels, wind turbines, and energy-efficient lighting, making them vital to green energy transition efforts.

Who holds control over the global supply of rare earth minerals?

China holds a monopoly over both the extraction of rare earth minerals and their processing – the complex procedure of separating these elements from other minerals. According to estimates by the International Energy Agency (IEA), China is responsible for about 61% of rare earth element production, and dominates 92% of their processing worldwide. This means that China currently dominates the rare earth minerals supply chain and holds the power to determine which companies can access these critical materials, and which cannot.

China’s dominance in the rare earth element supply chain did not happen overnight: it is the result of decades of strategic policies and investments by the Chinese government

Mining and processing rare earth minerals are both expensive and damaging to the environment. Additionally, many rare earth minerals contain radioactive elements, which is why numerous countries, including those in the European Union, are hesitant to engage in their mining. Radioactive waste generated during production requires safe and permanent disposal according to strict regulations, posing an additional challenge for countries involved in rare earth mineral extraction and processing.

China’s dominance in the rare earth element supply chain did not happen overnight: it is the result of decades of strategic policies and investments by the Chinese government. Back in 1992, during a visit to Mongolia, then-Chinese leader Deng Xiaoping, who was guiding China’s economic reforms, famously stated, “The Middle East has oil, and China has rare minerals.”

In the late 20th century, China prioritized expanding its rare earth mineral extraction and processing industries, often at the expense of environmental standards, and doing so by leveraging low labor costs. This strategy enabled China to outpace global competitors and consolidate its monopoly across the entire value chain – from mineral extraction and processing to the production of finished goods.

How did China restrict the export of rare minerals?

In early April, in response to tariffs imposed by Washington, China implemented export controls on seven types of rare earth elements to the United States, most of which are classified as “hard” rare earth minerals vital to the defense sector.

These seven elements are less common and more difficult to process than the “light” rare earth elements, which makes them more valuable. According to the Chinese authorities, starting April 4, all companies are required to obtain special export licenses to export rare earth minerals from the country. Because China is a signatory to the international treaty on the non-proliferation of nuclear weapons, it has the authority to regulate the trade of “dual-use items.” Following negotiations on May 12 of this year, China temporarily suspended its export controls on rare earth minerals to the United States for 90 days.

The US position and the rare earth minerals agreement with Ukraine

According to a report by the U.S. Geological Survey, between 2020 and 2023, the United States imported over 70% of its rare earth minerals from China. As a result, the new restrictions present significant challenges for the U.S. supply chain and strategic industries. According to a report by the American organization Center for Strategic and International Studies (CSIS), U.S. defense technologies – including F-35 fighter jets, Tomahawk missiles, and Predator drones – along with other military production equipment, rely heavily on rare earth minerals. The report also highlights that China is simultaneously “significantly increasing its ammunition production and acquiring modern weapons systems and equipment, at a pace that is 5 to 6 times faster than the United States.” Of course, this issue extends beyond defense: U.S. industries, particularly those that former President Trump aims to revive through tariffs, are also facing serious challenges. According to the same report, American manufacturers – most notably those in the defense and high-tech sectors – could face mineral shortages due to constrained supplies, potentially causing significant delays in production processes.

The United States has one operational rare earth minerals mine, but it lacks the capacity to extract and process “heavy” rare earth elements. As a result, these materials must be sent to China for processing. Around 50 years ago, the United States was home to several companies that produced rare earth minerals and was, in fact, the world’s largest producer of rare earth elements until the 1980s. However, as China expanded its dominance in the sector – offering larger scale and lower production costs – these American companies were gradually pushed out of the market and ceased operations in the U.S.

Donald Trump’s interest in signing a rare earth minerals agreement with Ukraine was likely driven by a strategic goal to reduce U.S. dependence on China in this critical sector. Another area of interest for Trump is Greenland, which ranks 8th globally in rare earth mineral reserves. The rest of the rankings are as follows: China (44 million tons), Brazil (21 million tons), India (6.9 million tons), Australia (5.7 million tons), Russia (3.8 million tons), Vietnam (3.5 million tons), USA (1.9 million tons), Greenland (1.5 million tons), Tanzania (890 thousand tons) and South Africa (860 thousand tons). Ukraine is estimated to hold about 5% of the world’s rare metals, although the exact quantity remains unknown. According to unofficial data, Ukraine has approximately 500,000 tons of lithium reserves. Additionally, it contributes around 6% of global titanium production and ranks as the world’s fifth-largest producer of gallium.

Ukraine has approximately 500,000 tons of lithium reserves, contributes around 6% of global titanium production, and ranks as the world’s 5th largest producer of gallium

On April 30, 2025, the United States and Ukraine signed an agreement to establish a joint investment fund aimed at supporting Ukraine’s reconstruction efforts. The fund will be partially financed by revenues from future natural resource extraction, with both countries managing it on the basis of equal partnership.

Under the agreement, Ukraine will retain full ownership of its natural resources and infrastructure, including sole authority over decisions related to their extraction. Ukraine will contribute 50% of the revenue generated from new mineral, oil, and natural gas projects to the fund. Existing projects, including Ukraine’s largest oil and gas producers, Naftogaz and Ukrnafta, will be exempt from the requirement to contribute to the fund. This means the fund’s profitability will rely heavily on the success of new investments in Ukraine’s natural resources. The fund aims to stimulate private sector interest in investing in Ukraine’s resources, and to attract the capital needed for the country’s reconstruction and natural resource development.

Additionally, the U.S.-Ukraine agreement stipulates that future U.S. military assistance to Ukraine, including weapons, ammunition, and training, will be considered part of the U.S. capital contribution to the Ukraine Reconstruction Fund. The new agreement does not require Ukraine to repay the “debt” to the United States in monetary terms: Trump stated that the United States would “get back much more” than what his predecessor had provided to Ukraine. On the same day the agreement was signed, the U.S. renewed military support and approved the sale of $50 million worth of weapons to Ukraine.

Although the security guarantees President Zelensky sought are not included in the agreement, the document affirms the “long-term strategic alignment” between Ukraine and the United States, as well as the U.S.’s commitment to supporting Ukraine’s security, prosperity, reconstruction, and integration into the global economic framework. Additionally, the text of the agreement takes a much firmer stance on Russia compared to earlier versions, explicitly referring to a “full-scale Russian invasion.” The U.S. Treasury Department states that “no state or individual that has financed or supplied the Russian war machine will benefit from Ukraine’s reconstruction.”

Just hours after the U.S.-Ukraine agreement was signed, Russia launched new missile attacks on Ukrainian territory, underscoring the ongoing security risks that continue to deter potential investors. Most of Ukraine’s richest resource regions, including two of its four lithium deposits, are located in the eastern part of the country – areas currently occupied by Russia. Without lasting peace and secure property rights, long-term investments like developing a mineral deposit carry significant risks. On average, it takes around 18 years and $1 billion to fully develop a deposit – an endeavor that demands a stable political and economic environment. Without such stability, attracting private investment to Ukraine’s natural resources sector will be extremely challenging.

The Trump administration is clearly leveraging the “investment for minerals” approach as a strategic tool within its broader foreign policy framework. As reported, following the U.S.-Ukraine agreement, Washington is preparing a similar deal with the Democratic Republic of Congo, which holds substantial reserves of cobalt, copper, lithium, and other vital resources. The agreement could diminish China’s influence in the Congolese mining sector while boosting American investment.

* * *

The tariff war initiated by U.S. President Donald Trump has largely been paused, albeit temporarily – especially with China, whose trade relationship, particularly in critical minerals, remains vital to the U.S. If the U.S.-China trade deal expires within 90 days of the May 12 agreement without a new consensus on trade rules, high tariffs and Beijing’s export controls on rare earth minerals to the U.S. are expected to be reinstated, likely driving up the prices of critical elements. This, in turn, will quickly drive up the prices of a wide range of products – from smartphones to military equipment – due to the vital role these elements play across various industries. Besides Ukraine and the Democratic Republic of Congo, the U.S. is likely to pursue similar agreements with other countries so as to reduce its reliance on China and diversify its supply chains, although this strategy is clearly a long-term endeavor. On the other hand, if both sides reach an agreement and ease tariffs and countermeasures, the U.S. will be able to continue to expand its influence in critical minerals, enabling it to make more assertive political and economic decisions in the future. In Ukraine’s case, signing an agreement with the U.S. clearly marks a significant step toward long-term, successful cooperation. However, ending Russian aggression and securing lasting peace are essential prerequisites for attracting investment in Ukraine’s natural resources.

By Davit Shatakishvili