Since the spread of COVID-19 at the end of 2019, the ensuing pandemic has caused an economic crisis impacting global food availability and food security. The effects of the pandemic have been aggravated by the war between Russia and Ukraine, two prominent players in global food and agriculture.

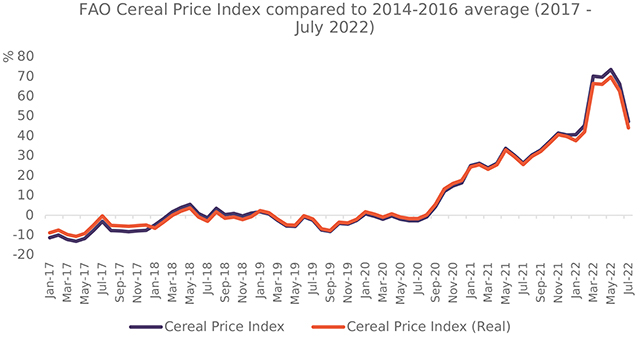

The FAO Cereal Price Index hit a record high in May 2022, a whopping 73.5% higher compared to the 2014-2016 average. However, by July, the FAO Cereal Price Index had fallen by 26.2 pp compared to the May peak, which could partially be attributed to an agreement being reached between Russia and Ukraine to unblock Ukraine’s main Black Sea ports, enabling Ukraine to export grain.

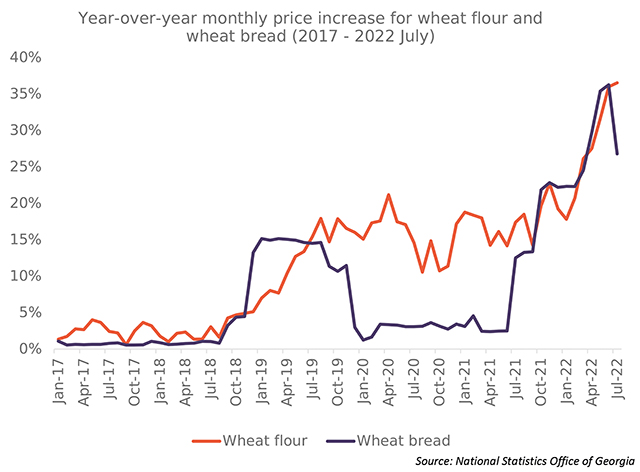

In Georgia, since July 2021, the YoY price increase for both wheat flour and wheat bread has shown a dramatic increase. The YoY price increase for wheat flour reached an all-time maximum of 36.5% in July 2022, while for wheat bread, it peaked in June 2022 at 36.3%.

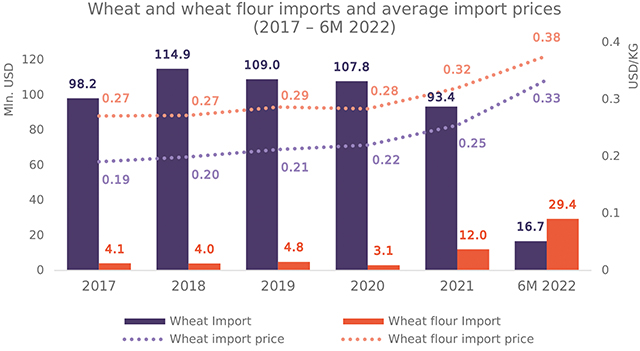

In the first half of 2022, wheat imports in Georgia declined by 55% compared to the first half of 2021, and amounted to USD 16.7 mln, of which 88.1% was attributed to Russia. On the other hand, in the first six months of 2022, wheat flour imports were 13 times higher compared to the corresponding period in 2021 and reached USD 29.4 mln, of which 98.1% was from Russia. Ultimately, Russian wheat flour imports mostly substituted Russian wheat in response to the barriers imposed on wheat trade by Russia.

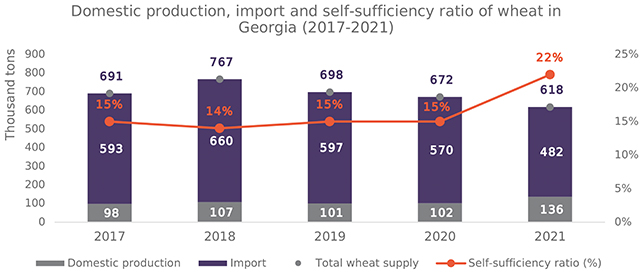

Throughout the 2017-2021 period, the majority of the total annual wheat supply in Georgia comprised imported wheat. In particular, on average, the share of imports in the total wheat supply was equal to 84.0%.

In 2021, following a rapid increase in domestic production, the self-sufficiency ratio increased from 15% to 22%, still indicating that the production of wheat in the country is a long way from being sufficient to meet domestic needs.

Finally, considering Georgia’s high dependence on imports from Russia and low self-sufficiency in terms of domestic wheat production, it is crucial that the dialogue between potential trade partners, such as Kazakhstan and Turkey, be intensified in the long run to diversify the wheat market and ensure food security for Georgia.

Global Trends in the Wheat Industry

In recent years, global economic disruptions have posed a serious threat to global food security. Since the spread of COVID-19 at the end of 2019, the subsequent pandemic and economic crisis have impacted global food availability and food security, especially in poorer countries1. Due to supply chain and food trade disruptions and trade restrictions aimed to ensure domestic food security, food prices have risen sharply.

The effects of the pandemic have been aggravated by the Russia-Ukraine war, especially as Russia and Ukraine are prominent players in the global trade of food and agricultural products.

Global food commodity prices hit an all-time high in March 2022 after Russia’s invasion of Ukraine on February 24th with the FAO Food Price Index reaching 59.7%2.

According to the FAO, in 2019, Russia and Ukraine together accounted for 13.4% of global wheat production and 23.1% of global wheat exports, with nearly 50 countries depending on Russia and Ukraine for at least 30% of their wheat import needs3. Meanwhile, in 2019 the share of Russia and Ukraine in global production and exports of wheat flour was 4.2% and 4.9%, respectively.

The FAO Cereal Price Index reached a record high in May 2022, being 73.5% higher compared to the 2014-2016 average. By July, the FAO Cereal Price Index had fallen to 47.3%, still staying well above the 2014-2016 average.

The decline of the FAO Cereal Price Index could partially be attributed to the agreement reached between Russia and Ukraine to unblock Ukraine’s main Black Sea ports in July 2022. The grain corridor deal is valid for three months, but it could be extended. Under the agreement, Russia has committed to allowing food exports from Ukrainian ports, including grains and sunflower oil. However, Ukraine still faces challenges such as finding enough ships to carry the stocked grain and insuring their operation4.

Wheat Flour and Wheat Bread Prices in Georgia

The prices for wheat products in Georgia have been showing similar dynamics to those of global wheat prices.

From January 2017 to November 2018, prices of wheat flour and wheat bread were relatively stable. During this time period, the YoY price increases for wheat flour fluctuated between 1%-5%, and for wheat bread, it ranged from 1% to 4%.

Before the pandemic, in 2019, a marked annual price increase was visible for both wheat products. In the case of wheat flour, the increase was gradual and equaled 16% by the end of 2019. On the other hand, for wheat bread, the YoY price increased significantly in December 2018 and peaked in January 2019, reaching 15.2% and remaining at a high level throughout 2019. In 2020, the price of wheat bread remained approximately at the same level as in 2019, not showing significant YoY increases.

Notably, a low YoY price increase for wheat bread has been maintained even during the pandemic. From the beginning of 2020 until July 2021, the average YoY price increase for wheat bread stood at 2.9%. In the same period, the average YoY price increase for wheat was much higher (15.8%), despite the imposed subsidies on wheat flour by the Government of Georgia in November 20205 and the further increased subsidy in January 20216 with an aim to tackle increasing prices of wheat bread.

Since July 2021, the YoY price increase for both wheat flour and wheat bread jumped notably. This could be attributed to the tariffs and, consequently, quotas imposed on wheat exports by Russia, the major wheat importer for Georgia, since June 20217. The YoY price increase for wheat flour reached a period maximum of 36.5% in July 2022. Meanwhile, the YoY price increase for wheat bread peaked in June 2022, reaching 36.3%, followed by a sharp 9.5 pp drop the following month.

International Wheat Trade in Georgia

After a 17% YoY increase in total wheat imports in Georgia in 2018, wheat imports have been declining at an annual average of 6.5%. However, it must be mentioned that wheat imports dropped sharply (13.3%) in 2021 compared to 2020, which could be explained by the export restrictions imposed by Russia. In the first half of 2022, wheat imports were equal to only USD 16.7 mln, of which 88.1% was attributed to Russia, followed by Kazakhstan with 7.6% of total imports.

On the other hand, wheat flour imports have been fluctuating between USD 3.1 mln and USD 4.8 mln. In 2021, compared to 2020, the exports of wheat flour increased abruptly by 292.7% and reached USD 12.0 mln. In only the first six months of 2022, the wheat flour imports had already exceeded the total imports of 2021 by reaching USD 29.4 mln. Notably, 98.1% of total imports of wheat flour in the first six months of 2022 came from Russia.

It must also be mentioned that in 2021, compared to 2020, the absolute volume of wheat imports from Russia declined significantly by 18.6%. Meanwhile, wheat flour imports showed a drastic increase (YoY 343.6%) in the same year. Therefore, Russian wheat flour imports mostly substituted Russian wheat in response to the barriers imposed on wheat trade by Russia.

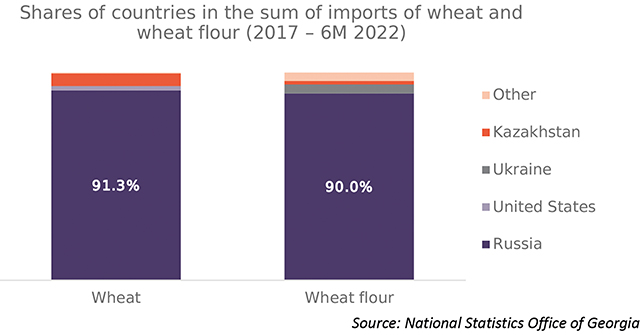

An analysis of the sum of imports throughout the last decade shows a similar picture of high dependence on Russia and a high concentration of the import market. Since 2017, Russia has accounted for 91.3% of total wheat imports and 90% of the total wheat flour imports in Georgia.

The exports of wheat and wheat flour are minuscule compared to imports. Throughout 2017-2021, wheat exports ranged between USD 0.01-4.95 mln, while wheat flour exports were between USD 0.01-6.52 mln. The major export partner of Georgia for wheat during this period was Armenia (92.3% of total exports since 2017), and for wheat flour, it was Angola (90.1%).

Wheat Production in Georgia

It is also pertinent to analyze the domestic production of wheat in Georgia and its self-sufficiency. According to the Georgian Business Register, in 2021, the number of registered companies producing wheat showed a 17% increase compared to the previous year and amounted to 83 companies. Of those, none were large companies, and all were small in size. The number of wheat-flour-producing companies also increased by 5% compared to 2020, reaching 132, of which only two companies were large in size, eight were medium, and 121 were small (91.7% of all registered companies).

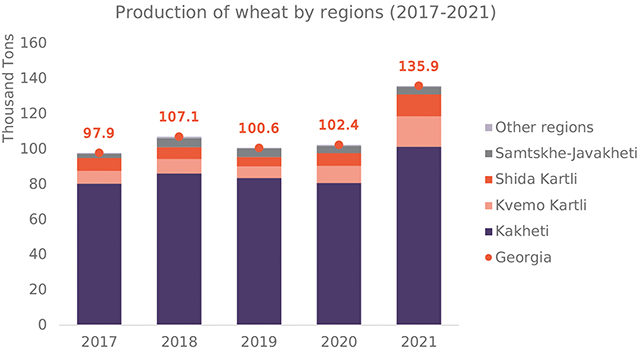

Since 2017, the production of wheat has, on average, been increasing by 9.5%, showing a rapid jump of 32.7% in 2021, reaching 135 900 tons of produced wheat, which could partially be attributed to the increased number of wheat-producing companies and increased productivity. By regions, in 2021, compared to 2020, wheat production increased sharply in Kvemo Kartli (78%) and Shida Kartli (71%), followed by Kakheti (26%).

The majority of wheat produced in Georgia is produced in Kakheti. In particular, throughout the 2017-2021 period, on average, 79.8% of total wheat was produced in Kakheti, followed by Kvemo Kartli (8.8%) and Shida Kartli (7.0%).

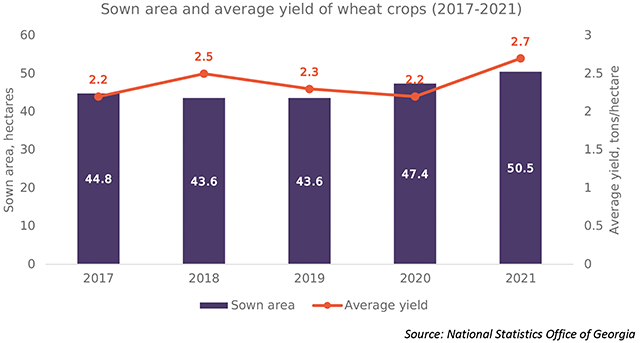

Since 2017, similar to the production level, the sown area has also shown an upward trend, with a considerable YoY increase in 2020 (8.7%) and 2021 (6.5%). Meanwhile, despite the declining average yield per hectare since 2018, the average yield increased significantly by 22.7% in 2021 compared to 2020, hinting at the increased productivity on the part of wheat-producing companies.

Wheat Consumption and Self-sufficiency

Since 2018, the sum of domestic production and imports of the given year has been declining steadily with an average annual decline of 7%.

Throughout the 2017-2021 period, the majority of the total annual wheat supply8 in Georgia comprised of imported wheat. In particular, on average, the share of imports in total wheat supply was equal to 84.0%. However, it must also be noted that following a rapid increase in domestic production in 2021, the share of imports declined to 78%.

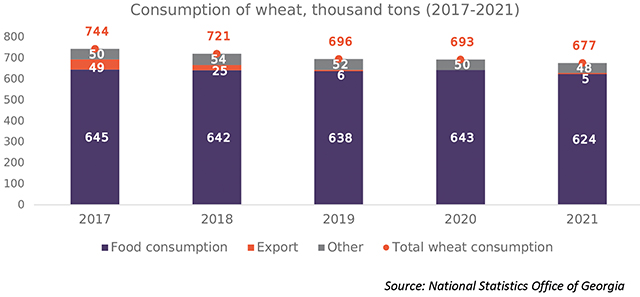

Throughout the 2017-2021 period, the consumption of wheat, which includes food, seed, and animal feed consumption, processing into alcohol, waste, and export, has also been declining with an average annual decline of 2.3%.

The majority of the total wheat consumption is attributed to food consumption. On average, in 2017-2021, food consumption accounted for 90.5% of total wheat consumption annually. This was followed by animal feed consumption (2.8%), export (2.3%), waste (1.9%), seed (1.8%), and processing into alcohol (0.7%).

Throughout the 2017-2020 period, the self-sufficiency ratio, which calculates the percentage of wheat consumed and produced domestically, was relatively stable at around 15%. In 2021, the self-sufficiency ratio increased and reached 22%, however, still well short of meeting domestic needs.

Wheat Market Diversification and Food Security

Finally, considering Georgia’s lack of import diversification of wheat and wheat flour, high dependence on imports from Russia, lower price of wheat and wheat flour imports from Russia compared to other trade partners due to ease of transportation, and low self-sufficiency of domestic wheat production, it is crucial to overview other major global wheat and wheat flour exporting countries and identify potential trade partners.

According to FAOSTAT, in the case of wheat, the USA and Canada follow Russia as the top exporting countries; however, for logistical reasons, other less globally prolific exporters could be more relevant to Georgia, including Kazakhstan, Romania, Bulgaria, Poland, and Hungary. For wheat flour, Turkey is among the top exporting countries, followed by Kazakhstan, both of which could be appropriate sources for the Georgian market.

The attractiveness of Turkey as a trade partner to stabilize local market conditions is somewhat diminished by the temporary export restrictions imposed in March 2022 on a number of products, including wheat and wheat flour, which remain in place9.

On the other hand, positive dynamics can be noticed in the trade relationship between Kazakhstan and Georgia. In particular, an agreement has been reached between Kazakhstan, Azerbaijan, and Georgia regarding rail transportation tariffs within the development of the Trans-Caspian International Transport Route linking Asia to Europe. In addition, discussions are ongoing regarding tradable products between Kazakhstan and Georgia10. Therefore, Kazakhstan represents a viable alternative source of wheat imports, both by Kazakhstan being the direct importer of wheat to Georgia and Georgia potentially receiving wheat from Kazakhstan due to being the transit country of Kazakh wheat export to Turkey.

Apart from market diversification, according to the Georgian Wheat and Flour Producers Association, to ensure food security, especially during winter, it is critical to replenish the carryover stocks of wheat instead of wheat flour as the expiration period of wheat flour is only a few months, compared to years for wheat11.

To conclude, the policy recommendations to alleviate the risks regarding food security due to trade dependencies on Russia and Ukraine are as follows:

• Identification of new and more diverse wheat supplier countries;

• Strengthening dialogue with potential trade partners;

• Supporting trade transparency;

• Ensuring the existence of reserve stocks of wheat in Georgia.

Footnotes:

1 https://www.ifpri.org/publication/covid-19-and-global-food-security

2 The FAO Food Price Index compares current prices to the 2014-2016 average of the corresponding period. Therefore, in March 2022, the food prices were 59.7% higher compared to the average of 2014-2016 March.

3 https://www.fao.org/3/nj164en/nj164en.pdf

4 https://www.bloomberg.com/news/articles/2022-07-22/ukraine-and-russia-reach-deal-to-unblock-grain-stranded-by-war

5 https://matsne.gov.ge/ka/document/view/5041446?publication=0

6 https://matsne.gov.ge/ka/document/view/5084134?publication=0

7 https://bm.ge/ka/article/ruseti-marcvleulis-eqsportze-kvotirebis-meqanizms-aamoqmedebs-/101831

8 Throughout the publication, the term supply stands for the sum of domestic production and imports in the given year.

9 https://www.fas.usda.gov/data/turkey-update-turkeys-export-ban-select-ag-products

10 https://bm.ge/ka/article/quotyazaxur-bizness-saqartvelodan-eu-shi-vachrobis-shesadzlebloba-edzlevaquot—yazaxetis-elchi-saqartveloshi-/106305

11 https://bm.ge/ka/article/mnishvnelovania-xorblis-gardamavali-maragebis-shevseba—levan-silagava/115092/

![]()