March 2020 marked the start of nationwide restrictions on movement in countries around the globe, with the aim of curbing the spread of the COVID-19 pandemic. Tourism has been hit hard by the combination of the pandemic itself and corresponding restrictions, which is reflected in tourism figures plummeting to 1990 levels, according to the UNWTO*. However, with the rollout of vaccines in the first quarter of 2021, the first glimpses of an end to the pandemic are emerging. To plan ahead and ensure the recovery of the tourism industry, countries are carefully selecting which markets to direct their marketing campaigns toward.

With this in mind, an analysis of the key source markets for tourism in Georgia in the pre-COVID era might offer some insights into how the country as a whole, and tourism industry stakeholders specifically, should position their marketing campaigns in order to attract the highest-spending visitors.

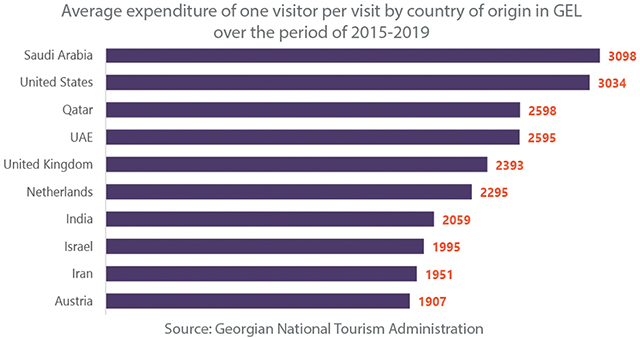

Graph 1 ranks the top 10 countries of origin when it comes to highest average expenditure by one visitor per visit over the period of 2015-2019 in Georgia. Several Gulf states, namely Saudi Arabia (ranked as #1), Qatar (#3), and United Arab Emirates (UAE) (#4) stand out, while the United States (#2) and the United Kingdom (#5) complete the top five.

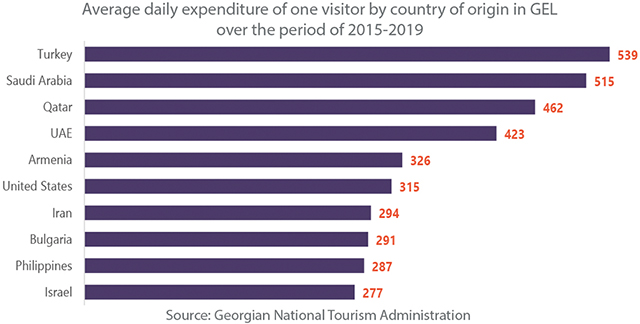

Graph 2 ranks the top 10 countries of origin when it comes to the highest average expenditure per day over the period of 2015-2019. It could be argued that this indicator more accurately captures high-value visitors, as expenditures are analyzed on the same scale (daily expenditure) for each country.

While all three Gulf states that were present in the abovementioned top five by average expenditure per visit still reside in this top five, visitors from Turkey emerged as the top per-day spenders in Georgia, with Armenia taking the place of the United States.

Contrary to popular belief, visitors from the EU do not seem to have been spending significant amounts in Georgia, at least when daily expenditures are analyzed (just 186 GEL spent daily on average). In fact, EU visitors ranked among the lowest daily spenders, along with those from China and Russia (both 179 GEL).

To make the most financial gain in the short term, visitors from Turkey, as well as the three aforementioned Gulf states, along with Armenia and the United States, should also be targeted by Georgian tourism marketing campaigns. In addition, the evidence gleaned by MasterCard from data for flight searches for March-May 2021, identified Turkey as having among the highest level of interest in flights to Georgia**. To further increase demand from consumers in Turkey, and to stimulate tourism inflows in the short term, opening up land borders for entry would be advised, as in 2015-2019, 78% of all visitors entered the country by land.

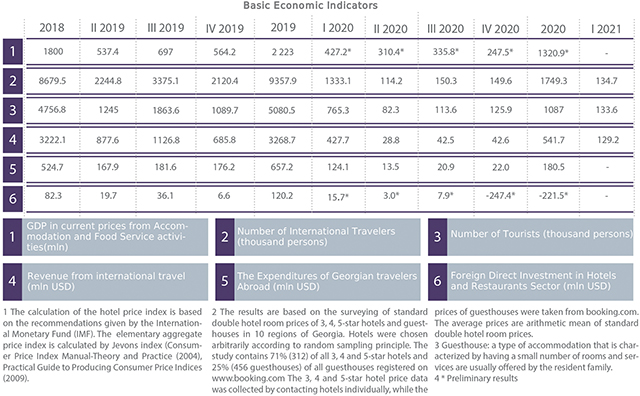

Hotel Price Index

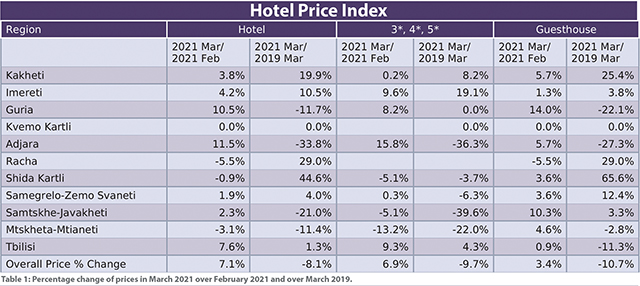

In March 2021, in Georgia the hotel price index increased by 7.1% compared to February 2021. The 3-star, 4-star and 5-star hotel price index increased by 6.9%, while for guesthouses, the price index increased by 3.4%.

Due to the abnormal impact of the pandemic on 2020 prices, we will use 2019 as the comparison year for the Hotel Price Index for the rest of 2021. In March 2021, compared to March 2019, hotel prices in Georgia decreased by 8.1%. The prices of 3*, 4*, 5* hotels decreased by 9.7%, while the prices of guesthouses decreased by 10.7%. It is worth noting that compared to March 2020, the hotel price index increased by 8.1%.

Average Hotel Prices

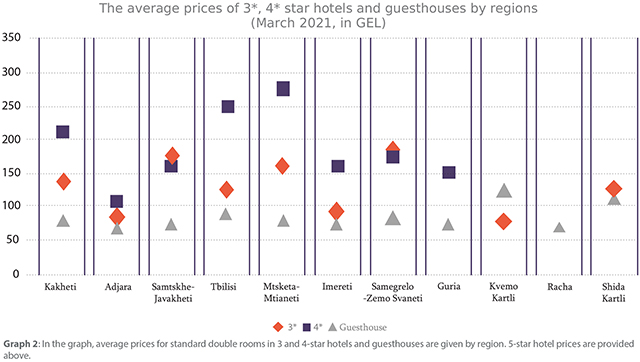

In Georgia, the average cost of a room in a 3-star hotel was 124 GEL per night in March 2021, while the average cost of a room in a 4-star hotel in Georgia was 219 GEL per night, and the average cost of a room in a guesthouse was 80 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in March 2021 was 332 GEL per night. In Guria, the average price was 587 GEL, followed by Tbilisi at 436 GEL, Adjara at 295 GEL and Kakheti at 293 GEL.

![]()