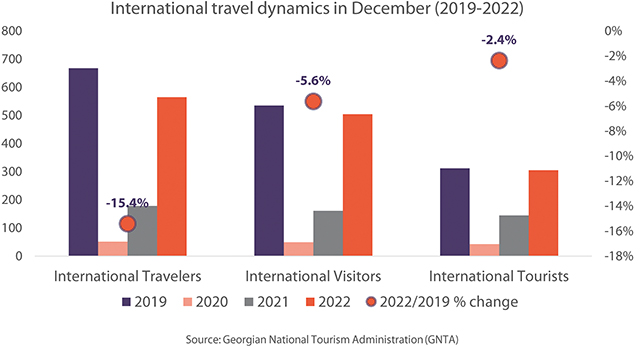

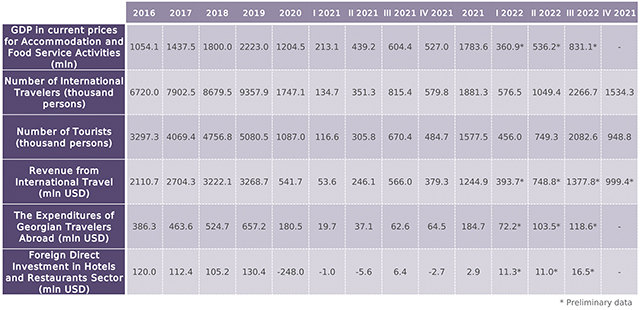

The number of international travelers increased by 216.9% in December 2022, compared to the same period of 2021, and declined by 15.4% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 213.9% (2022/2021) and declined by 5.6% (2022/2019), and the number of international tourists increased by 110.7% (2022/2021) and declined by 2.4% (2022/2019).

In December 2022, the top countries of origin of international visits were Turkey (199,124 visits), Russia (89,513 visits), and Armenia (76,181 visits). Throughout 2022, among the major tourism markets, the number of international visits from Belarus (96.5%), Saudi Arabia (59.6%), and Kazakhstan (16.3%), significantly exceeded the pre-pandemic figure (2019). Further, the number of international visits from neighboring countries: Turkey (-20%). Russia (-26.1%), Armenia (-45.6%), and Azerbaijan (-90%) remained well below the pre-pandemic number. The low recovery rate of visits from Azerbaijan could be attributed to the closure of the land border between Georgia and Azerbaijan since March 2020.

TURNOVER IN ACCOMMODATION SECTOR

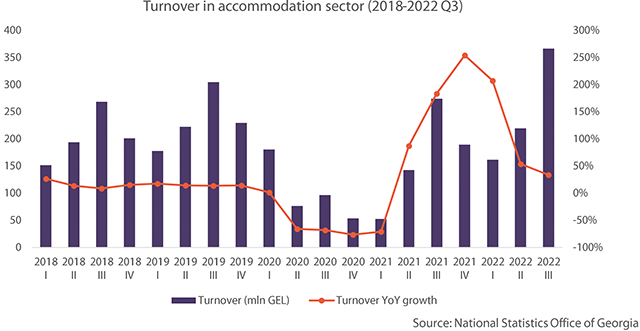

The accommodation sector recovered significantly in Q3 of 2022, with turnover showing a 20.1% increase compared to Q3 of 2019. Moreover, the turnover of the accommodation sector hit an all-time high of GEL 794.9 mln in Q3 of 2022, which could be attributed to the increased average length of stay for both international and domestic visitors, general inflationary trends, and the market distortions caused by mass migration after the outbreak of the Russia-Ukraine war.

Turnover in the accommodation sector increased markedly in the first three quarters of 2022 compared to the previous year. After staggering YoY growth early in the year for turnover in the accommodation sector, it slowed down in the second and third quarters. Due to the low base effect, in Q1 of 2022, the turnover of the accommodation sector was 207.5% higher compared to Q1 of 2021, while in Q2 and Q3 of 2022, the YoY growth rates were 54% and 33.6% respectively, compared to the corresponding periods of 2021.

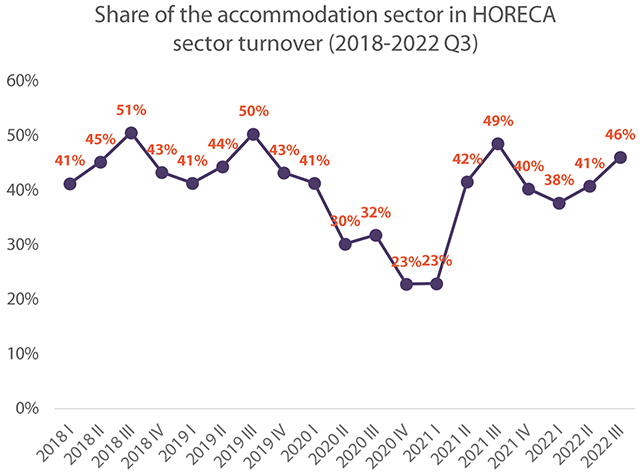

After a steep decline in the share of the accommodation sector in the total turnover of the HORECA sector throughout the pandemic, in the first three quarters of 2022 the quarterly shares of the accommodation sector almost returned to pre-pandemic levels, reaching 46% in Q3 of 2022, yet still behind the contribution of the food service sector to the total turnover of the HORECA sector.

EMPLOYMENT AND SALARIES IN ACCOMMODATION SECTOR

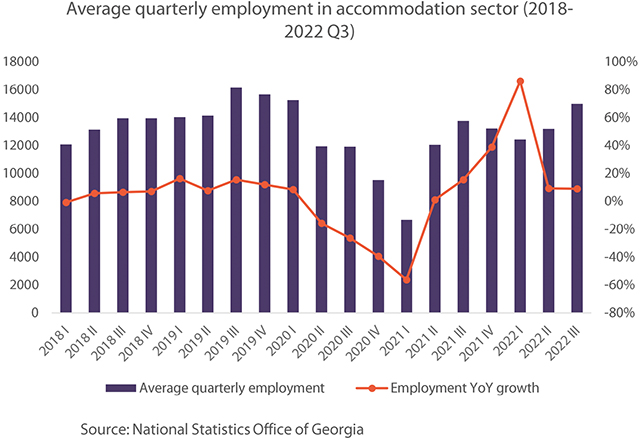

In the first three quarters of 2022, employment in the accommodation sector demonstrated a considerable recovery and increase compared to 2021. Notably, in Q3 of 2022, average employment was only 7% lower compared to Q3 of 2019. Meanwhile, the YoY growth rate of employment slowed down over the course of the first three quarters of 2022, with a 9% YoY increase in Q3 of 2022. By the end of that quarter, average employment was 15,000 employees.

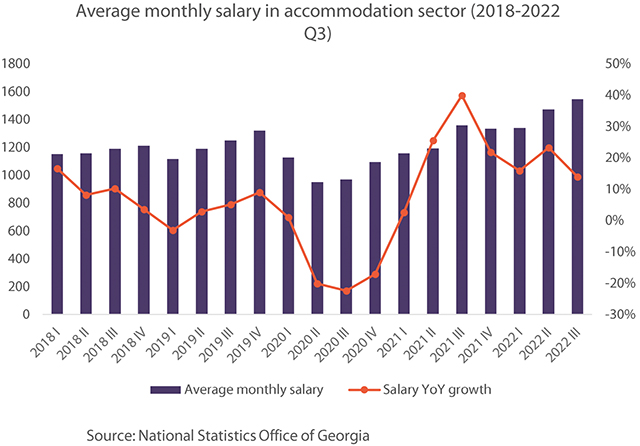

The average monthly salary in the accommodation sector showed a gradual increase after the sharp decline experienced initially at the beginning of the pandemic. Notably, in the first three quarters of 2022, the average monthly salary in the accommodation sector exceeded the pre-pandemic (2019) values significantly, with an average increase of 22.5%.

Total salaries also demonstrated a significant increase, reaching a total of GEL 23.2 million in Q3 of 2022, which is 24.2% higher compared to Q3 of 2021 and a 14.8% increase compared to the pre-pandemic figure (Q3 of 2019).

HOTEL PRICE INDEX IN GEORGIA

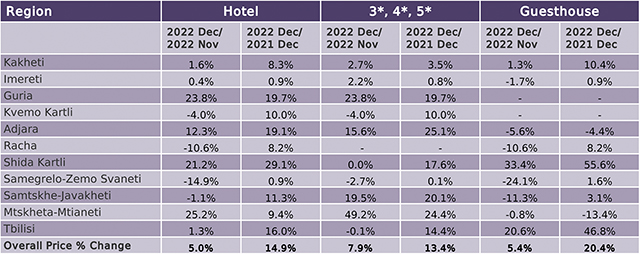

In December 2022, in Georgia the hotel price index increased by 5.0% compared to November 2022. The 3-star, 4-star, and 5-star hotel price index increased by 7.9%, while for guesthouses, the price index increased by 5.4%. The monthly HPI was the highest in Mtskheta-Mtianeti (25.2%) and the lowest in Samegrelo-Zemo Svaneti (-14.9%).

In December 2022, compared to December 2021, hotel prices in Georgia increased by 14.9%. The prices of 3*, 4*, 5* hotels increased by 13.4% and the prices of guesthouses increased by 20.4%. The yearly HPI was the highest in Shida Kartli (29.1%) and the lowest in Imereti (0.9%) and Samegrelo-Zemo Svaneti (0.9%).

THE AVERAGE HOTEL PRICES IN GEORGIA

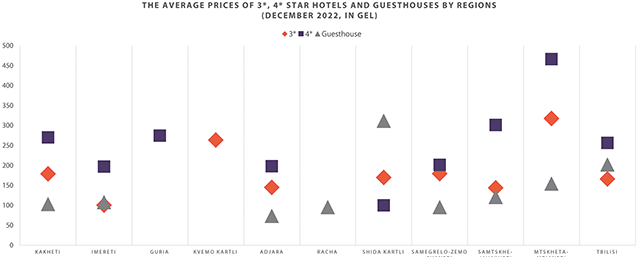

In Georgia, the average cost of a room in a 3-star hotel was 167 GEL per night in December 2022, while the average cost of a room in a 4-star hotel in Georgia was 275 GEL per night and the average cost of a room in a guesthouse was 122 GEL per night.

The average cost of a room in a 5-star hotel in Georgia in December 2022 was 456 GEL per night. In Tbilisi, the average price was 559 GEL, followed by Kakheti – 552, Samtskhe-Javakheti – 458, and Adjara – 429.