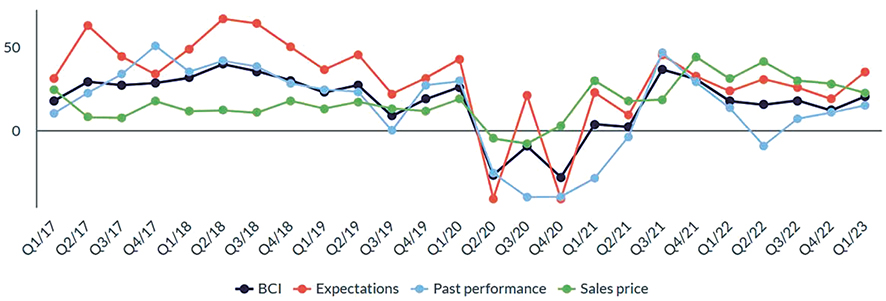

After a decrease in the previous quarter, BCI has improved compared to Q4 2022 (+8.4) and reached 20.1 index points for Q1 2023. Expectations in the Georgian private sector have increased significantly by 16.3 index points, reaching 34.9. As for the business performance over the past three months, it also increased, reaching 14.7 points, indicating an upturn in production, turnover, and sales. Compared to the previous quarter, the Sales Price Expectation Index has decreased, showing a decline in the market share of businesses that expect higher sales prices over the next three months.

For Q1 2023, the highest business confidence is presented in the financial (35.6), service (26.5) and agriculture (20.0) sectors, while the lowest business confidence is observed in the construction (6.7) sector.

Business confidence for the first quarter of 2023 amounted to 38.5 for large companies and to 15.8 for SMEs.

PAST PERFORMANCE

Businesses’ Past Performance Index, which shows the development of businesses’ production, turnover, and sales in the past 3 months, increased for Q1 2023 compared to the previous quarter. Index was highest in the manufacturing (37.6), agriculture (30.0) and financial (27.8) sectors. The lowest past performance index was observed in construction (-5.6) sector.

For large firms, the past performance index for Q1 2023 amounted to 41.2. The same indicator for SMEs reached 9.3 index points.

EXPECTATIONS

The Expectations Index increased significantly for Q1 2023 and settled at 34.9. Prospects for the next three months are highest for the manufacturing (62.5), agriculture (50.0) and service (40.2) sectors. The construction sector shows the lowest expectations index (22.2) for Q1 2023.

The expectations index reached 61.7 points for large companies, while the index amounted to 28.4 for SMEs.

For Q1 2023, 61% of the surveyed businesses do not expect any changes in employment over the next three months, 6% of firms stated that they would hire fewer employees in the future, and 32% think that they would hire more.

As for the business condition, 46% of the firms surveyed expect the economic condition of their businesses to improve over the next three months, 43% do not predict any changes, and 12% of businesses believe their business conditions will worsen.

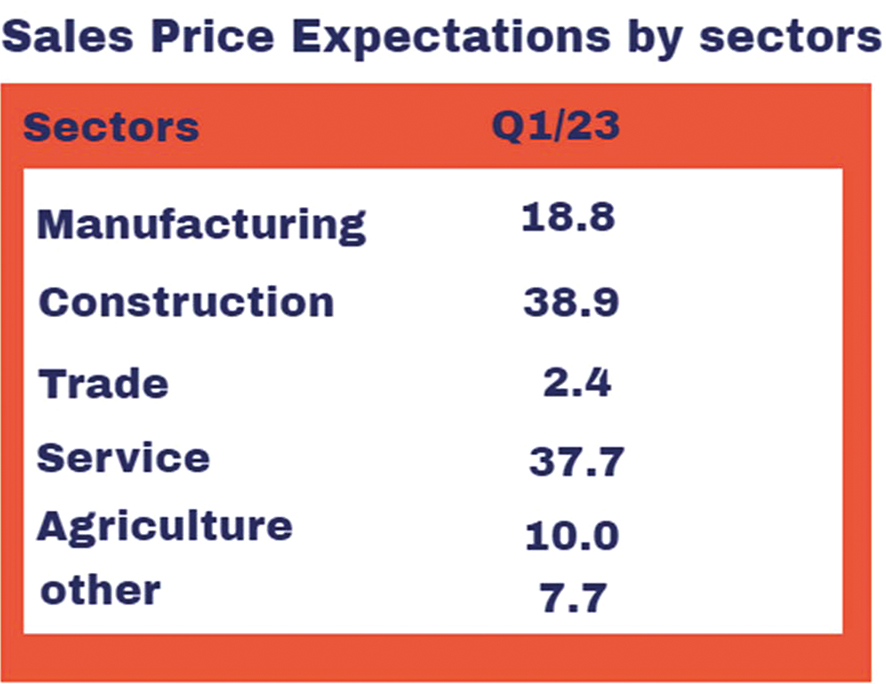

SALES PRICE EXPECTATIONS

The Sales Price Expectations Index decreased to 22.3 points for Q1 2023. The index was highest in the construction (38.9) and service (37.7) sectors, while the retail and wholesale trade (2.4) sector depicted the lowest sales price expectation index. For Q1 2023, index amounted to 26.9 for large companies and 20.9 points for SMEs.

Around 30% of all firms surveyed intend to increase their prices over the next three months. 7% of firms expect to decrease prices, and the remaining 64% are not planning to change their prices in near future.

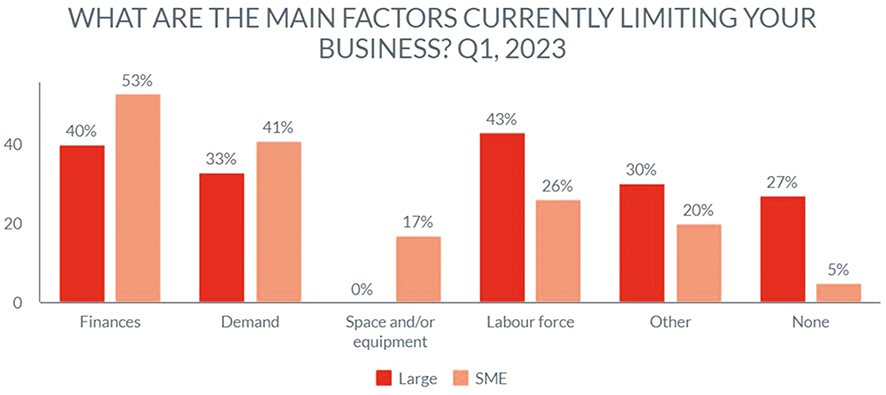

For Q1 2023 lack of qualified labor force and limited access to financing are the most significant obstacles for large companies. Meanwhile, limited access to financing and lack of demand and indicated as major constraints by SMEs.