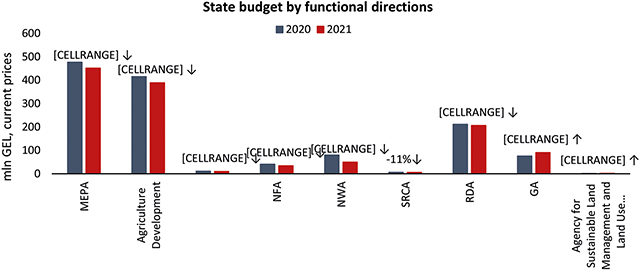

On 29 December 2020, the Parliament of Georgia approved the state budget for 2021, which includes allocations of around 18.3 billion GEL, from which the Ministry of Environmental Protection and Agriculture (MEPA) will receive 451.6 million (2.5% of the total budget allocation). The MEPA will direct 10 mln. GEL towards the Environmental Protection and Agriculture Development Program (2.2% of MEPA’s total budget), with around 389.6 mln. (86.3% of MEPA’s total budget) to be allocated to agricultural development, and approximately 51.9 mln. GEL (11.5%) to be spent on environmental protection.

Compared to 2020, the budget for agricultural development will decrease by around 6.3%. Though, additional state funds will be allocated to the newly established agency for sustainable land management and land use monitoring, by 85.8% and by 19.8% for Georgian Amelioration (GA). The budget for the National Wine Agency (NWA) and the National Food Agency (NFA) will decline by 37.7% and 15.2%, respectively. While the Scientific-Research Center of Agriculture (SRCA) budget will decrease by 11%, and the Rural Development Agency (RDA) will lose 2.4%. MEPA will also be directing less spending towards the joint Environmental Protection and Agriculture Development Program than in 2020 (-9.9%) (Figure 1).

Although the redistribution of funds has changed slightly, as in previous years, the biggest share of MEPA’s funds will further support the RDA (53%), GA (23.3%), and the NWA (12.8%). The RDA will continue financing around 16 programs; including their “Preferential Agrocredit project”, with the highest budget of 115 mln. (55% of their total budget), and 18 mln. (8.7%) and 12 mln. GEL (5.8%) will be directed towards “Plant the Future” and “Co-financing Processing and Storage Enterprises”, respectively.

The State Budget for 2021 identifies the main priorities for Georgian agricultural development as:

• Supporting domestic production and improving the quality of locally produced agricultural goods;

• Improving access to financial resources for farmers and agricultural enterprises;

• Supporting the development of climate-smart agriculture.

PRICE HIGHLIGHTS

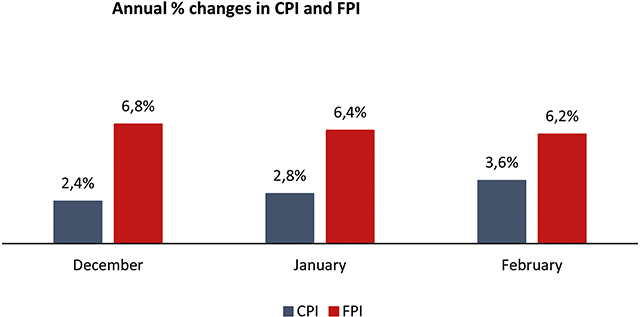

On a monthly basis, the country’s price levels were stable between December 2020 – February 2021. In December 2020, the Consumer Price Index (CPI) decreased by 1.0% from November 2020. In January and February 2021, the month-over-month inflation rate remained at 1.1%. Meanwhile, food and non-alcoholic beverages prices increased during the period.

Interestingly, the monthly food price inflation rate exhibited a downward trend. In December 2020, food prices, measured by the Food Price Index (FPI), increased by 2.1% from November 2020, while the corresponding month-over-month price changes in January and February 2021 were 2.0% and 1.1%, respectively.

From an annual perspective, the CPI continued to increase between December 2020 – February 2021. In December 2020, the CPI rose by 2.4% on an annual basis. Within the period, annual inflation marked its highest level in February 2021 at 3.6% (Figure 2).

In February 2021, year-over-year prices for food and non-alcoholic beverages increased significantly, by 6.2%, contributing 2.03 percentage points to the change in total CPI. The main drivers were price fluctuations in the following sub-groups: oils and fats (+34.3%), sugar, jam, honey, chocolate, and confectionery (+14.1%) and coffee, tea, and cocoa (+12.4%).

Over the last year, prices for food and non-alcoholic beverages have been increasing; mainly due to disruptions in food supply chains and pandemic-related restrictions. Depreciation of the Georgian lari has forced additional upward pressure on food prices. In February 2021, the FPI increased by 6.2% compared February 2020. Prices increased the most for the following categories:

Oils and fats – In this category, the price of sunflower oil exhibited the largest increase of 62% in February 2021, in comparison to the previous year. Such sharp increases in sunflower oil prices were driven by trends on the Russian markets (Georgia imports around 90% of the oil from Russia). Increased production costs, due to depreciation of the national currency and a poor harvest due to unfavorable summer weather conditions, drove Russian sunflower oil prices up. This rise in the Russian market thus contributed to the spike in Georgian prices for sunflower oil.

Sugar, jam, honey, chocolate, and confectionery – In this category, sugar prices increased the most on an annual basis, by 36.7%, in February 2021. Given that Georgia is a net sugar importer, international trends influence sugar prices.

According to the Food and Agriculture Organization (FAO), international prices of sugar exhibit an upward trend; reflecting concerns over tighter global supplies due to falling production in key producing countries.

Coffee, tea, and cocoa – In this category, prices for ground coffee increased the most (14% in February on an annual basis), reflecting recent trends on international markets. According to Forbes, international coffee prices are close to the highest levels since 2020; signaling weather concerns and expectations of reduced Brazilian coffee production.

As to international prices, during December 2020 – February 2021, international prices exhibited an upward trend on both a monthly and annual basis. In February 2021, the Food Price Index, measured by the Food and Agriculture Organization (FAO), increased sharply, by 16.7% compared to February 2020, and marked the highest level since July 2014. The February increase in the FPI was driven by strong gains in the vegetable oils (51%), cereals (26.5%), and sugar (9.5%) sub-indices. Such a sharp increase in vegetable oil price was driven by increases in the price of palm oil, due to concerns over dwindling inventories in the chief exporting countries. Cereal prices rose due to increased demand from China, while increases in sugar were heightened by falling production in major producing countries.

TRADE HIGHLIGHTS

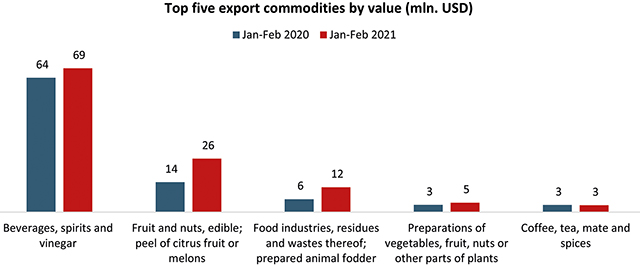

Total Georgian exports in January-February of 2021 amounted to 495 mln. USD, which is 7% lower than the same indicator in 2020 (531 mln. USD). Whereas agricultural exports expanded by a significant 20%, from 112 mln. in 2020 to 134 mln. USD in 2021.

Considering imports, the total decreased by 14%, from 1,349 to 1,159 mln. USD. A similar trend can be observed in agricultural imports, which decreased by 13%, from 165 to 143 mln. USD during the first two months of 2021. Given that the COVID 19 pandemic negatively affected incomes all over the world and caused trade restrictions, the reduction in international trade is not surprising. The depreciation of the Georgian lari puts an additional pressure on imports.

Interestingly, the first two months of 2021 are marked by an increase in agricultural exports, which if sustained in the long-run is obviously a positive development for Georgia’s international trade.

A closer look at the drivers of increased agricultural exports shows that the highest export values in Jan-Feb 2021 compared to the same period of 2020 are observed for the following commodities:

• Beverages, spirits and vinegar (HS code 22);

• Fruit and nuts, edible; peel of citrus fruit or melons (HS code 08);

• Food industries, residues and wastes thereof; prepared animal fodder (HS code 23);

• Preparations of vegetables, fruit, nuts, or other parts of plants (HS code 20);

• Coffee, tea, mate, and spices (HS code 09).

Exports of beverages increased by 7%, from 64 to 69 mln. USD. For edible fruits and nuts the same indicator was 79%, where the export value from this category increased from 14 to 26 mln. USD, highlighting significant, almost double, growth. An even greater increase can be observed in the exports of animal fodder, which rose by 92%, from 6 to 11 mln. USD, on an annual basis. For vegetables (HS code 20) and for coffee, tea, mate, and spice (HS code 09), the respective percentage changes in export value are 29% and -3% (Figure 3).

POLICY WATCH

Export quotas on wheat have entered into force in Russia

On 15 February 2021, export quotas on wheat, rye, maize, and barley came to force in Russia; where customs tariffs and prohibitive duty, amounting to 50% of customs, were also imposed.

For more information see the following link: https://iset-pi.ge/index.php/ka/iset-economist-blog/entry/khorblis-bazari-sakartveloshi

Agro-startup financing project

Within the framework of an innovative product created to support agribusinesses, TBC has implemented an agro-startup project. This agribusiness start-up support program provides for a long-term grace period over the principal amount, dependent on the specifics of the financing activity, of up to a maximum of five years.

For more information see the following link: https://georgiatoday.ge/tbc-invests-more-than-gel-70-million-in-support-of-agribusinesses/

The EU and FAO support the Georgian government in enhancing climate-smart agriculture practices

With the support of the European Union (EU) and the Food and Agriculture Organization of the United Nations (FAO), the Ministry of Environment Protection and Agriculture of Georgia (MEPA) has established a Climate Agriculture Working Group, which conducts regular online sessions to address the challenges of climate change in the country.

For more information see the following link: http://www.fao.org/georgia/news/detail-events/en/c/1375656/