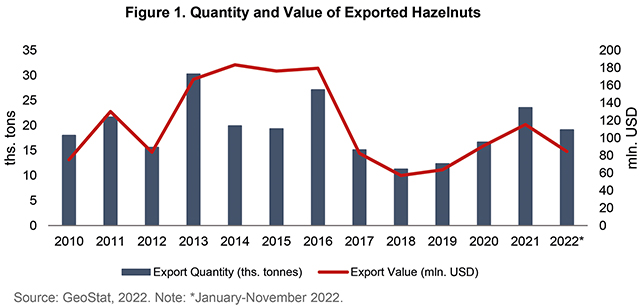

Hazelnuts are one of the most important crops for Georgia in terms of export: between 2010-2021, they accounted for around 4.4% of total exports (GeoStat, 2022). In 2013, the quantity of exported hazelnuts reached its maximum level (30 ths. tons), in the following years it then decreased to 19 ths. tons alongside an increase in value, thus indicating higher prices per exported kg of Georgian hazelnut (Figure 1).

However, 2017 was a very challenging year for hazelnuts, as the trees suffered various fungal diseases and an Asian Stink Bug (Pharosana) invasion subsequently worsened the situation. Accordingly, both the quality and quantity of hazelnut production declined. In 2019, the hazelnut sector rebounded and production as well as export increased in 2020 and 2021.

This year has again been challenging for the hazelnut sector, mainly due to unfavorable weather conditions. Farmers were unable to properly carry out crop maintenance measures and, consequently, there have been various concerns about decreased production and the quality of the nuts.

In response to these challenges, on 31 October, 2022 the Government of Georgia (GoG) launched a new program to promote the production of hazelnuts and to aid farmers. This program aims to support the primary production of hazelnuts through incentives for hazelnut orchard owners and proprietors, and by subsidizing the goods necessary for the care and production of hazelnuts. To obtain a subsidy under this program, a potential beneficiary must own, co-own, or factually co-own a hazelnut orchard(s) with a total area no less than 0.2 ha but not exceeding 3 ha. The amount of the subsidy per ha of land will be defined at 500 GEL or/and points; via the calculation per 1 ha of hazelnut orchard for each beneficiary.

To participate in the program, farmers should register in the hazelnut orchard cadastral registry. The GoG aims to create this hazelnut cadastre to collect data on production and varieties, and to take appropriate measures that support the sector based on respective data analyses.

The program is being implemented by the Rural Development Agency, under the Ministry of Environmental Protection and Agriculture, and around 20 mln. GEL is being allocated during its initial stage. This is not the first time the government has subsidized a specific sector. During the last ten years, the GoG has continuously subsidized grape, apple, and tangerine production throughout the country.

PRICE HIGHLIGHTS

DOMESTIC PRICES

On a monthly basis, the country’s price levels held steady between September-November 2022. The Consumer Price Index (CPI) in November stood marginally (0.47%) above its corresponding value in October 2022. While the corresponding month-over-month price changes in September and October were 0.8% and 0.49%, respectively.

Between September-November 2022, monthly prices for food and non-alcoholic beverages, measured by the Food Price Index (FPI), exhibited an upward trend. In November, food prices increased by 1.5%, compared to July 2022; while the corresponding month-over-month price changes in September and October were 1.7% and 1.4%, respectively.

From an annual perspective, the CPI continued to increase between September and November 2022. In September, annual headline inflation hovered around 11.5%, while the corresponding figures for October and November were 10.6% and 10.4%, respectively.

In November 2022, the year-over-year prices of food and non-alcoholic beverages also rose significantly, by 16.8%; contributing 5.55 percentage points to the change in total CPI. The main drivers were price increases in the following sub-groups: vegetables (+26.0%), bread and cereals (+23.8%), mineral waters, soft drinks, fruit and vegetable juices (+22.0%).

SPOTLIGHT

Over the last two years, food prices in Georgia have been rising and hovering around double digits; driven mainly by supply side factors (concerns over decreased production, increased crude oil prices, and COVID-19 pandemic restrictions). The Russian full-scale invasion of Ukraine has increased pressure on food markets, those already struggling with soaring prices. Food price surged by 22% on an annual basis in May 2022, and then levelled out at around 17.4% in the following months. By November, the annual price increase for food was 16.8%. Prices rose most notably within the following categories:

Vegetables – In November 2022, prices increased for most products within the vegetable sub-category. The largest increases were observed for potatoes (39.2%) and onions (37.9%). According to farmers, such a sharp price rise for potatoes is driven by limited production and increased export demand from Azerbaijan, as well as amplified input and transportation costs. As for onions, reduced production is paired with a ban on the export of onions in Turkey. Notably, Turkey also banned potato export to ensure its supply security.

Bread and cereals – In this category, prices for corn and wheat flour increased the most in November 2022 – by 82.8% and 27.1%, respectively. Such a hike in the price of corn flour is related to decreased maize production due to unfavorable weather conditions. As for wheat flour, Russia is the main supplier for Georgia and thus the country’s trade-restrictive measures (e.g., increased export tax) have influenced swelling prices in the bread and cereal category. Prices may also increase further as the export tax burden on Russian wheat is increasing.

Mineral waters, soft drinks, fruit and vegetable juices – In November 2022, prices rose for all products within this sub-category. The most notable increases were observed for sparkling mineral water (25.9%) and soft drinks of Coca-Cola type (19.3%). The price of mineral waters has been rising notably since the beginning of 2022, due to increased input, and therefore production, costs.

Regarding other types of soft drink, the trade statistics highlight that the export of waters, including mineral and aerated, containing added sugar or other sweeteners or flavors increased in both quantity and value between January and November of 2022. This may be a sign of firm external demand pushing prices upwards.

INTERNATIONAL PRICES

Between September and November 2022, international prices registered their eighth consecutive monthly decline, although they remained well above the corresponding value in the previous year. In November, the Food Price Index, measured by the Food and Agriculture Organization (FAO), remained almost unchanged (up by 0.3%) compared to November 2021 (Figure 2). Whereas prices jumped for the dairy (9.2%), cereal (6.3%), and meat (4.1%) sub-indices. Meanwhile, prices fell for vegetable oils (-16.2%) and sugar (-4.9%).

The extension of the Black Sea Grain Initiative and expectations of ample global supplies brought downward pressure on monthly prices of grains, cereals, and oils. Meanwhile, concerns over limited production and export availability led to rising month-over-month dairy and meat product prices.

TRADE HIGHLIGHTS

Exports have shown notable increases this year, and the trend is continuing. Total exports from January to November 2022 amounted to 5,037 mln. USD, which is 32% higher than the corresponding figure last year (3,823 mln. USD in 2021). Agricultural exports have grown as well – from 1,028 mln. USD in Jan-Nov 2021 to 1,134 mln. in 2022 (10% increase). The total share of agricultural products in all exports has fallen from 27% to 23%, as overall export is rising faster than agricultural exports alone.

Imports are also continuing on an increasing trend. Total imports from January to November of 2022 amounted to 11,981 mln. USD, compared to 9,049 mln. observed in 2021 (a 32% increase). Unlike, agricultural exports experiencing moderate increase, agricultural imports grew significantly, by 35% – from 1,203 mln. USD in Jan-Nov 2022 to 1,628 mln. between Jan-Nov 2022. The share of agricultural imports in total imports has also slightly increased from 13% in 2021 to 14% 2022.

An increase in imports can be driven by appreciation of the national currency, which usually positively affects imports, but has negative impact on exports. In spite of this, Georgian exports have still managed to maintain a high growth rate, with an even higher export growth rate in Jan-Nov 2022 than in the same period of 2021.

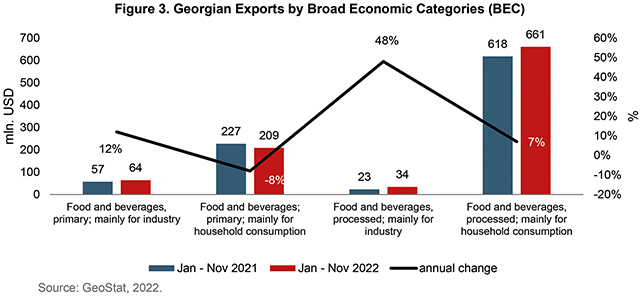

Considering total export through the perspective of Broad Economic Categories, it appears that the net increase is derived from the rise in the absolute value of processed food and beverages exports (amounting to a 54 mln. USD rise), while for primary goods, there has been a decline in absolute value (of 11 mln. USD).

To differentiate further in terms of end user, the highest increase, 48%, was observed in the export of processed food and beverages mainly for industry use, followed by 12% growth in the export of primary food and beverages, again primarily for industrial use. The export of processed food and beverages mainly for household consumption constituted a 7% rise, and lastly there was an 8% fall in the export of primary food and beverages for household consumption (Figure 3).

During the last decade, overall and agricultural exports in Georgia have been characterized by an increasing trend. Higher growth rates in the exports of processed goods are a positive development in the sector, however Georgian exports are still mostly intended for household consumption, while the share of exported primary and processed food and beverages for industry use is rather small.

POLICY WATCH

The Government of Georgia approves the Draft Law on Industrial Emissions, 12 December 2022.

The draft law entails imposing new obligations on the private sector in order to properly equip large enterprises and improve their technological process, starting from 2026. In the following years, several enterprises will be evaluated and selected for a pilot scheme, and with EU support the best environmentally friendly technologies will be introduced in these select companies.

The draft law “On Industrial Emissions” envisages a new, integrated permitting system for preventing, reducing, and controlling the air, water, and soil pollution caused by industrial activities. The project also includes prevention of waste production. Furthermore, the draft law will regulate all industrial activities (up to 200 large enterprises) that affect the environment or human health.

For more information follow this link: https://mepa.gov.ge/En/News/Details/21131/

A project restoring and spreading unique Meskhetian vines, endemic species, and varieties of Georgian wheat will be launched in Samtskhe-Javakheti

The project aims to promote the sustainable use and protection of agrobiodiversity in the Samtskhe-Javakheti region, to improve state policy and the existing legal framework, and to promote the introduction of the local vines and wheat varieties in the region. Under the plan, guidance documents on the sustainable management of agrobiodiversity will be elaborated; the planting and seed material of local vines and wheats will be delivered to farms; appropriate agricultural and technical assistance will be provided to farmers; and training and field training programs will be offered to farmers to strengthen their skills and capabilities.

For more information follow this link: https://mepa.gov.ge/Ge/News/Details/21068