Real GDP expanded by an estimated 10.5% in the first half of 2022, driven by growth in services and manufacturing. Services increased by 15.3% on gains in accommodation, food services, trade, transport, and real estate. Industry expanded by 18.0%, led by manufacturing and utilities. Agriculture grew by 2.3%, reflecting favorable weather and a good harvest.

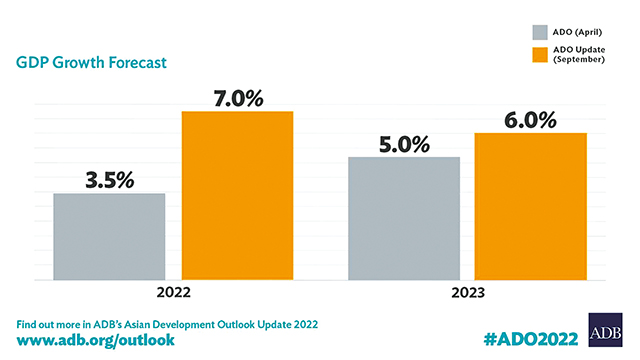

Growth on the demand side came from strong private consumption, higher export and tourism revenue, and a large inflow of money transfers from Georgians working abroad and Russian citizens entering Georgia. With higher inflow of money transfers and encouraging growth figures, this Update raises growth projections for 2022 and 2023, despite heightened geopolitical risks from the ongoing Russian invasion of Ukraine (Table 3.1.4).

Average annual inflation accelerated to 12.9% in the first 7 months of 2022 from 7.2% in the same period of 2021, led by food prices. Prices rose by 19.0% for food, 9.6% for other goods, and 7.1% for services, including increases of 19.3% for transport and 21.6% for utilities. The producer price index, which often presages increases in consumer prices, rose by 15.0% in the same period, while core inflation—excluding food, energy, and regulated tariffs, including some for transport—was 7.1%. With double-digit inflation in consumer prices, the National Bank of Georgia, the central bank, raised its policy rate by 50 basis points to 11.0% in March 2022 to help contain inflation and manage inflationary expectations. After some volatility following the Russian invasion of Ukraine, the currency appreciated significantly, helping to contain imported inflation. With higher-than-expected global commodity prices and strong domestic growth, this Update raises inflation forecasts for 2022 and 2023.

Solid economic growth and the gradual unwinding of pandemic response measures have effectively tightened fiscal policy. Revenue grew at an annual rate of 33.6% through June 2022 as high personal and corporate income tax receipts more than offset an increase in public pensions equal to 0.6% of GDP, a 10% hike in the public sector wage bill, and targeted support to the vulnerable. The fiscal deficit is thus projected to fall from 6.1% in 2021 to less than 4.0% in 2022, with public debt declining from the equivalent of 49.5% of GDP to 47.0%, reflecting in part reduced public borrowing.

The current account deficit widened slightly from the equivalent of 12.5% of GDP in the first quarter of 2021 to 13.0% a year later but is expected to narrow from the second quarter. In the first 7 months of 2022, merchandise exports increased by 36.3% and imports by 34.8%. Exports to Ukraine fell by 21.1%, but those to the Russian Federation remained largely unchanged. Inflow of money transfers soared by 68.5% year on year in the first 7 months of 2022 as inflow from the Russian Federation surged by nearly sixfold during April–July 2022, representing 50.3% of all such transfers, due to an influx of Russian citizens to Georgia. About 2.3 million travelers visited Georgia in the first 7 months of 2022, a 214.4% annual increase from 2021, though receipts from tourism remained about 20% below those in the same period of 2019, before the pandemic. Considering these trends, this Update trims forecasts for current account deficits in 2022 and 2023. Foreign direct investment more than quadrupled to $568 million in the first quarter of 2022, reflecting a high share of reinvested earnings.

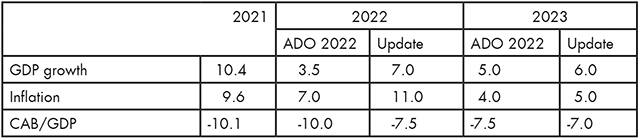

Table 3.1.4 Selected economic indicators in Georgia, %

Growth and inflation will be higher than forecast earlier in ADO 2022, and current account deficits smaller.

ADO = Asian Development Outlook, CAB = current account balance, GDP = gross domestic product.

Sources: National Statistics Office of Georgia; National Bank of Georgia; Asian Development Bank estimates.