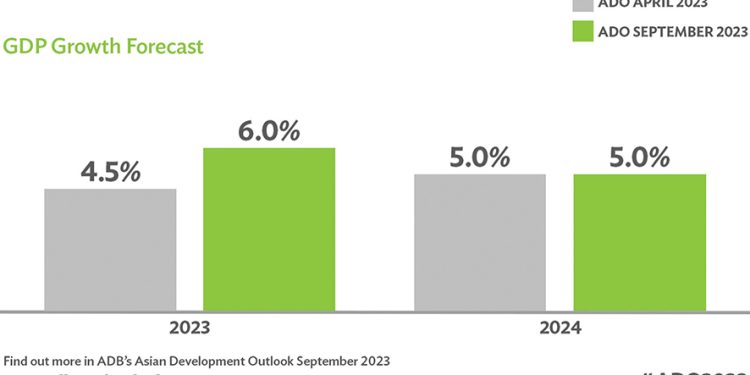

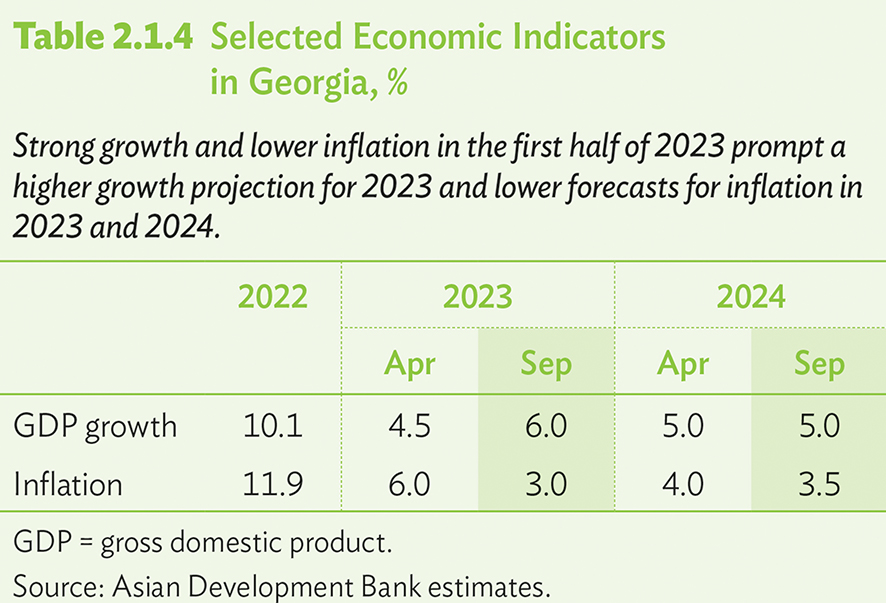

Growth has moderated but remains robust, supported by tourism and financial inflows. Growth moderated from 10.6% in the first half of 2022 to 7.6% a year later as industry contracted by 0.7% and agriculture by 2.3%, and despite strong growth in construction at 15.1% and services at 10.2%. Expansion in services reflected increases of 14.0% in wholesale and retail trade, 15.7% in accommodation and food services, 44.2% in information and communication, and 17.2% in arts, entertainment, and recreation, much of this reflecting a recovery in tourism. On the demand side, growth came from strong domestic demand, reflecting high consumer spending on goods and services, particularly by Russian migrants, and continued revival in investment and tourism. Foreign direct investment remained high at nearly $500 million in the first quarter of 2023, and the unemployment rate declined by more than 3 percentage points to 17.3%. Such encouraging figures prompt this update to raise the growth forecast for 2023 but not for 2024, in light of an expected return to growth potential and possible fallout from slowing global expansion (Table 2.1.4).

Inflation has fallen below target, helped by a relatively stable Georgian lari and prudent macroeconomic policies. With inflation year on year continuing to decline to 0.3% in July 2023, average annual inflation slowed from double digits throughout 2022 to 4.0% in 2023 to July despite increases of 7.3% for food, 24.9% for rental housing, and 12.1% for hospitality. Apart from a high base in 2022, slower inflation reflected lower import prices and transport costs with increased transit volume, strong foreign currency inflow that supported the lari, continued fiscal consolidation, and tight monetary policy that kept the policy rate high at 10.25% despite a 0.25% cut in August. Core inflation—which excludes food, nonalcoholic beverages, energy, regulated tariffs, and certain transport charges—slowed from 6.9% in December 2022 to 3.2% in July 2023. The National Bank of Georgia, the central bank, increased reserves to more than $5.0 billion, which the International Monetary Fund declared adequate. With inflation decelerating, this update cuts inflation forecasts for 2023 and 2024.

A small budget surplus in the first half of 2023 reflected strong revenue and ongoing fiscal consolidation. Revenue increased by 18.4% over the first half of 2022, outpacing 15.2% growth in public expenditure that saw substantial social spending and capital outlays for priority public infrastructure. Public sector debt remained low, equal to 39.8% of GDP, as strong economic growth and a relatively stable lari boosted GDP. While three-quarters of this debt is in foreign currency, much of external debt is on concessional terms or at fixed interest rates.

The current account deficit narrowed sharply from the equivalent of 13.3% of GDP in the first quarter of 2022 to 3.2% a year later. This reflected soaring money transfers and higher service surpluses from travel and from information and communication technology. Money transfer inflows, following a record high in 2022, increased in the first 7 months of 2023 at an annual rate of 27.5% to $2.7 billion, nearly half of it coming from the Russian Federation. In the same period, merchandise exports increased by 15.7% on strong vehicle reexports, and imports rose by 19.0% on high domestic demand and a relatively stable lari against the US dollar. In the first half of 2023, revenue from tourism increased by 57.9% year on year to reach $1.8 billion. Downside risks to the current account include, aside from domestic political polarization and geopolitical risks, a possible weakening of external demand, rising global interest rates that could constrain capital inflow, and a widening investment–savings gap.