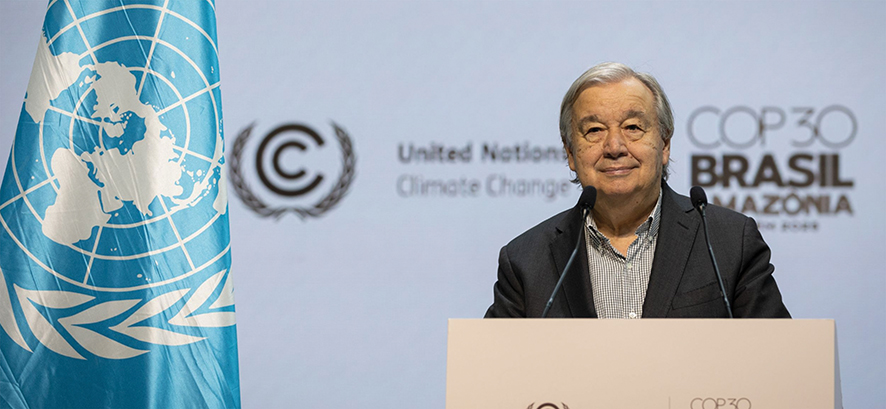

COP30 in Belém emerged as a defining moment for climate finance and energy transition — but the outcomes revealed a high-stakes dance, where ambition and compromise collide, and not everyone came out on equal footing.

The Winners

1. Forest Protection Gains Real Momentum

One of the clearest business‑wins from this COP comes in the realm of nature‑based solutions. A new global drive to close the estimated $66.8 billion annual gap in tropical forest finance has crystallized through a six-point roadmap supported by Brazil and 34 other governments. This gives conservation finance real teeth.

This roadmap, if implemented, could unlock major funding flows to forest-rich countries and Indigenous communities — an opportunity for sustainable forestry, carbon credit markets, and green investment vehicles. For companies and investors, this could reframe tropical forests as not just carbon sinks, but valuable assets in a low-carbon economy.

2. A Broad Coalition Pushes Fossil Fuel Phase‑Out

More than 80 countries, spanning developed and developing economies alike, have united to demand a formal roadmap to phase out fossil fuels in a “just, orderly, and equitable” way.

This coalition’s size and diversity send a strong signal to markets: momentum is building for a structured energy transition, not just voluntary pledges. For clean‑energy companies, this could mean greater policy alignment and long-term demand certainty. For financiers, the roadmap (if realized) presents risk‑mitigation opportunities by signaling more predictable demand for renewables, efficiency, and clean fuels.

3. Business Voices Align on Climate Ambition

In a powerful counterweight to fossil-fuel lobbying, more than 100 companies, business associations, and subnational governments have formally called on COP30 leadership to adopt an energy-transition pathway.

This coalition demonstrates that business is not monolithic: many firms recognize that a managed phase-out of fossil fuels is not only morally urgent, but economically prudent. For forward-looking corporations, COP30 could accelerate the alignment of climate policy with corporate strategy, especially in sectors like renewables, sustainable finance, and green infrastructure.

4. Pressure for Scaled Climate Finance

COP30 is re-energizing the financial architecture of climate action. Stakeholders are pushing to triple adaptation finance by 2030 and fully deliver on the ambition of $1.3 trillion per year by 2035, as envisaged in previous COP commitments.

If this finance target holds — and especially if it shifts toward more grant-based, predictable funding — it will unlock enormous opportunities for businesses in climate-resilient infrastructure, resilient agriculture, and clean technology, while helping vulnerable economies leapfrog into low-carbon growth.

The Losers / Risk Areas

1. Major Fossil Fuel Producers Risk Losing Influence

Despite the strong coalition pushing for a fossil-fuel roadmap, powerful oil and gas producers such as Saudi Arabia and Russia remain resistant.

If fossil phase-out becomes more than rhetoric, their business models — heavily dependent on continued production — may face increasing policy and financial pressure. Without a clear exit strategy, these countries could be left exposed to stranded-asset risk as global finance pivots to clean alternatives.

2. Finance Commitments Lack Clarity and Trust

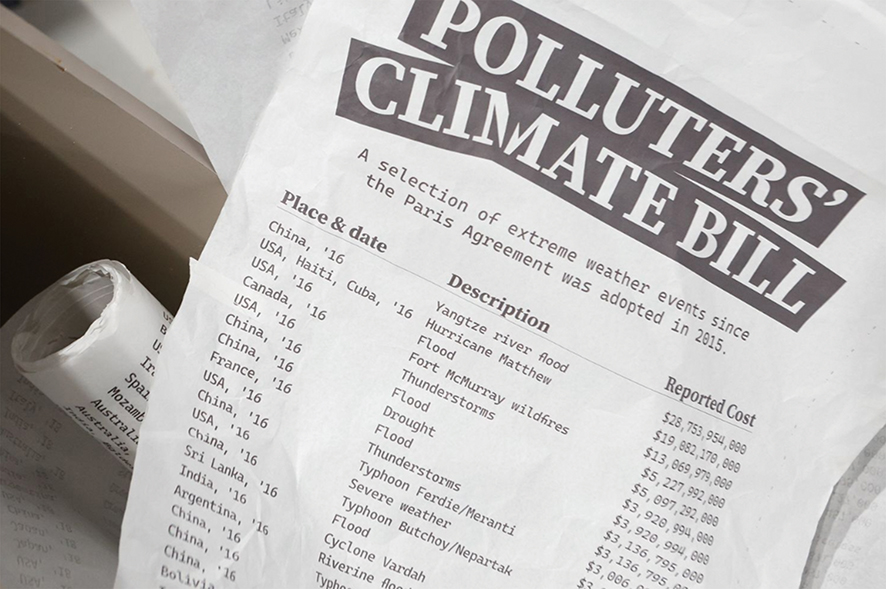

While $ 1.3 trillion by 2035 is being discussed again, critical questions remain: who will provide the funding (governments, MDBs, private sector), in what terms, and with what safeguards? Some of the text under negotiation is vague, raising concerns that money could rely on debt-based instruments.

Developing and climate-vulnerable countries, in particular, risk being short-changed if the funds don’t come on favorable terms or in the predictable, grant-like form they need. For businesses, especially in emerging markets, unclear finance terms could dampen the appetite for long-term low-carbon investment.

3. Implementation Risk on Transition Roadmap

Although the fossil fuel roadmap call is powerful, its implementation is far from guaranteed. Major holdouts (China, India, some petro-states) are deeply skeptical, and consensus-based negotiations mean even a few no-votes can derail strong language.

For investors and clean energy firms, this introduces execution risk: without a binding or enforceable timeline, the roadmap could remain aspirational, limiting its impact on capital markets.

4. Civil Society & Rights Concerns

Even as finance for forests is scaling, rights-based concerns remain. Human rights groups warn that scaling up major forest‑finance mechanisms must be accompanied by strong safeguards, transparency, and genuine participation of Indigenous peoples.

If these safeguards are weak, some of the credibility and long-term value of nature-based finance could be undermined. For businesses engaging in forest-related investments, ensuring responsible, rights-based engagement will be critical — both ethically and reputationally.

Why It Matters to Business

From a corporate and investor standpoint, COP30 could be a turning point: the broad push for fossil-fuel phase-out and significant forest financing suggests that the climate transition might finally be coalescing into a more structured global effort. Green-tech companies, financial institutions, and sustainable businesses are likely to benefit if the emerging commitments are implemented.

However, the real test lies in delivery. Without clarity, transparency, and enforceability, many of the COP30 ambitions risk ending up as statements on paper rather than drivers of capital flow. Fossil fuel–dependent economies, meanwhile, face a crossroads: they can adapt — or risk being left behind as global finance and markets shift decisively.

In short, COP30’s rhetoric may be bold, but business leaders will be watching closely to see whether these ambitions translate into concrete deals and credible mechanisms — or whether, once again, the gap between promise and performance proves too wide.

By Team GT