A year and a half since the outbreak of the coronavirus (COVID-19) pandemic, the world has entered a new phase in which the race to vaccinate is shaping the path for post-pandemic recovery and economic growth. In this bulletin, we review the dynamics of the virus spread and the extent of the economic recovery being achieved by the countries of the Black Sea region.

Spread of the Virus

The partial reopening of economies and activation of vaccination rollout represented the first signs of recovery. However, the COVID-19 pandemic continues to pose extraordinary challenges due to new waves of infection and more persistent variants of the virus spreading even more easily. Thus, resurgences of COVID-19 cases have induced policymakers to respond with new containment measures, albeit, the strictness of the measures and their effectiveness to reduce the spread of the virus has been uneven in the Black Sea region.

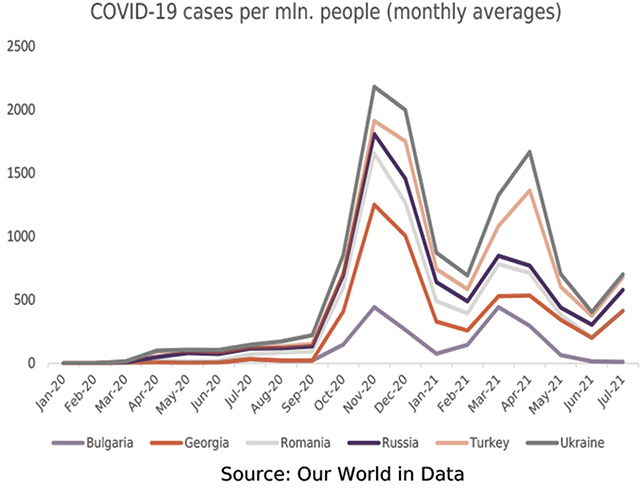

Despite the overall dynamics of COVID-19 cases and deaths being similar among the countries of the region, with peaks occurring at approximately the same periods in October-November 2020 and March-April 2021, there has been some variability in terms of magnitude during the reporting period.

A decrease in COVID-19 cases and deaths was noted in Q2 2021, with Ukraine and Turkey having the steepest declines. However, since June 2021, the number of COVID-19 cases has increased in all countries of the region, except Bulgaria. Thus, in some countries, the rise in COVID-19 infections is building into a new wave, expected to peak in the coming months.

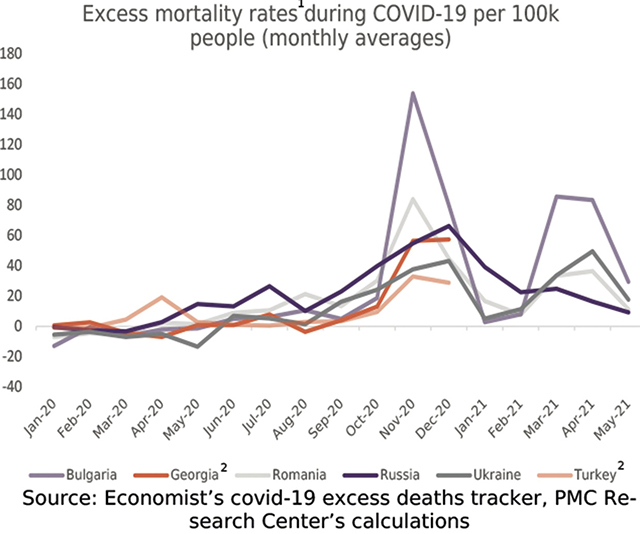

The official statistics may suffer from some discrepancies due to limited testing capacities and inefficient reporting in some countries. Therefore, an additional measure that can be used to evaluate the effect of the virus is the excess mortality rate, which compares current mortality rates to rates prior to the pandemic.

Bulgaria, despite having the lowest monthly average number of cases and deaths per million people, has the highest excess mortality rate in the region, which can be explained by its underreporting of COVID-19 cases due to its significantly low testing rates. In 2020, Turkey reported the lowest excess mortality rate per 100,000 people, on average.

Government responses and vaccination

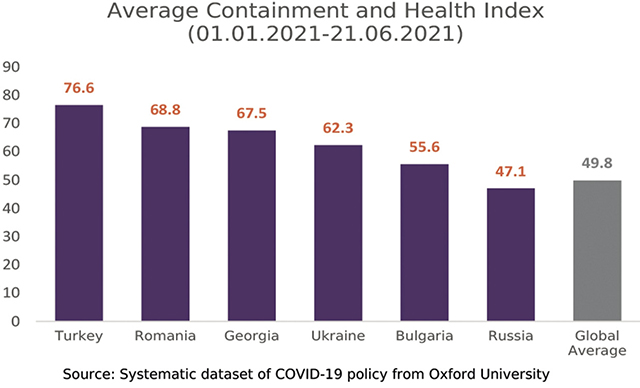

In order to reduce the number of COVID-19 cases, governments induced restrictions to reduce mobility and slow down the activity for extended periods of time, while investing in vaccines at the same time. The Containment and Health Index evaluates the combinations of “lockdown” restrictions and closures applied, including measures such as testing policies, requirements to wear face coverings, and policies regarding vaccine rollout. However, the index does not determine the appropriateness or effectiveness of countries’ policy responses. The average Containment and Health Index scores for the Black Sea region have been calculated and analyzed for the period from January to June of 2021.

Turkey has the highest average score (76.6) in the region, which could be the reason why the country managed to reduce the number of cases and deaths significantly. Meanwhile, Romania ranks second with 68.8, followed by Georgia (67.5) and Ukraine (62.3).

Containment and health measures have been relatively relaxed in Bulgaria, although Russia’s restrictions have been the least strict in the region. Overall, on average, restrictions of the region were significantly stricter than the global average. Moreover, policies for vaccine delivery differed across the region.

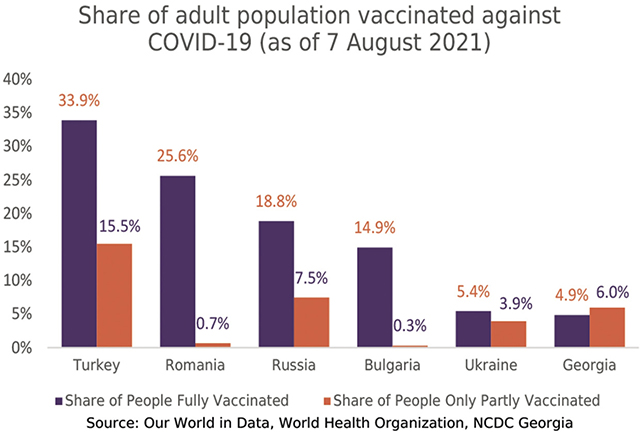

According to the vaccination policy indicator, in Bulgaria, Russia, and Romania, vaccines were mostly universally available nationwide, while vaccine availability in Turkey was relatively moderate. Ukraine and Georgia had the lowest average availability of vaccines in the region.

However, despite Turkey having moderate vaccine availability, it is the leading country in the Black Sea region for full and partial vaccination. Turkey has 33.9% of its population fully vaccinated against COVID-19, which could be explained by its relatively effective distribution of available vaccines. Romania (25.6%) ranks second in the vaccination rate, followed by Russia (18.8%) and Bulgaria (14.9%). Finally, Ukraine (5.4%) and Georgia (4.9%) have the lowest shares of the vaccinated adult population in the region.

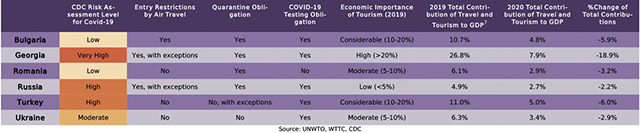

Restrictions and the role of tourism

Restrictions have an important impact on the recovery of economies. The countries with high economic dependency on tourism were strongly affected by travel and entry constraints. According to the WTTC, Georgia has the highest total contribution of tourism to GDP in the region. As such, the adverse effect of the pandemic is intensified due to the fact that the country is classified as a very high-risk country for travel (according to the Centers for Disease Control and Prevention (CDC), as of August 5th).

Meanwhile, the travel recommendations in other countries of the region are more positive. Additionally, Ukraine was recently added to the list of epidemiologically safe countries by the EU, becoming the only non-EU country in the region in the EU’s “safe” list.

Economic performance and forecasts

The pandemic still poses extraordinary challenges with regard to economic recovery, and continues to weigh on economic growth in many countries, including those in the Black Sea region.

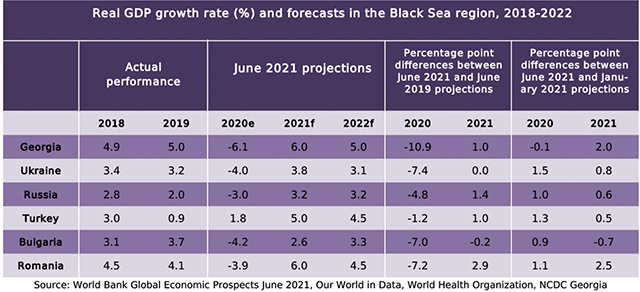

In 2020, every country in the region experienced an unprecedented decline in terms of economic growth. According to the latest estimates of the World Bank, among these six countries, Georgia suffered the sharpest fall in GDP, equal to 6.1 percentage points, while Turkey was the only country in the region to record positive economic growth, equal to 1.8 pp. Compared to projections made before the pandemic, Georgia performed poorest, being 10.9 percentage points worse off in 2020 than was predicted. In this regard, Turkey performed best – at 1.2 pp less GDP growth than expected before the pandemic.

According to the latest forecasts of the World Bank made in June, GDP growth rates for almost all countries in the region will return to pre-pandemic projections in 2021. Only Bulgaria is expected to remain slightly below these levels (by 0.2 percentage points), while Romania is expected to considerably surpass its pre-crisis rate of growth by 2.9 pp. Interestingly, the World Bank’s June 2021 estimates were more positive compared to the previous projections published in January. Especially significant were the changes in forecasts for Romania and Georgia – the Romanian economy in 2021 is now predicted to grow by 2.5 percentage points more than was predicted in January, while the forecast for the growth of Georgian economy improved by 2 pp. As for the nominal value of GDP, according to the latest forecasts, only Russia, Turkey and Romania will manage to return to their pre-pandemic levels this year.

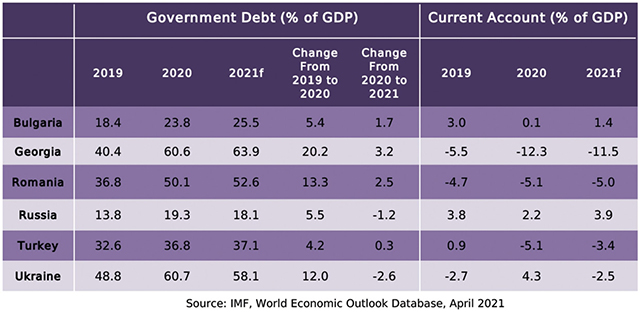

Containment measures imposed against the pandemic have led to a surge in government debt and financing needs. In 2020, the size of government debt measured as a percentage of GDP significantly increased in all Black Sea region countries. Georgia, which already had the highest government debt before 2020 (40.4%), experienced the sharpest rise of 20.2 percentage points, reaching government debt equal to 60.6% of GDP in 2020. Meanwhile, the lowest rise in debt was observed in Turkey – 4.2 percentage points. Turkey was followed by Russia (a rise of 5.5 pp), which interestingly stands out by having the lowest government debt in the region both before and after the crisis. As for 2021, according to the forecasts of the IMF, 4 out of 6 countries in the region will experience further increase in debt levels. Only Ukraine and Russia will manage to decrease their indebtedness compared to 2020, but neither will return to the pre-pandemic levels.

In 2021, the current account balances of Black Sea countries are predicted to benefit from a rebound in global demand and recovering remittances, and consequently, start to recover from 2020 levels. However, the situation varies significantly depending on the country. Russia will benefit from increasing oil prices and oil exports as an oil-exporter country, and will even recover to its pre-pandemic level of current account surplus. Meanwhile, the current account of Georgia, which fell from -5.5% to -12.3% in 2020, is not expected to recover much in 2021, given that restoration of tourism is being delayed.

The trend observed in Ukraine is opposite from the one in the other countries of the region. Ukraine had a current account deficit equal to -2.7% in 2019, but managed to record a current account surplus of 4.3% in 2020. This might be explained by the fall in oil prices (Ukraine is an oil-importer country) and rise in prices for the primary exports of Ukraine (iron ore, agricultural goods). However, with the prices stabilizing back to pre-pandemic levels, the current account of Ukraine is expected to drop back into deficit.

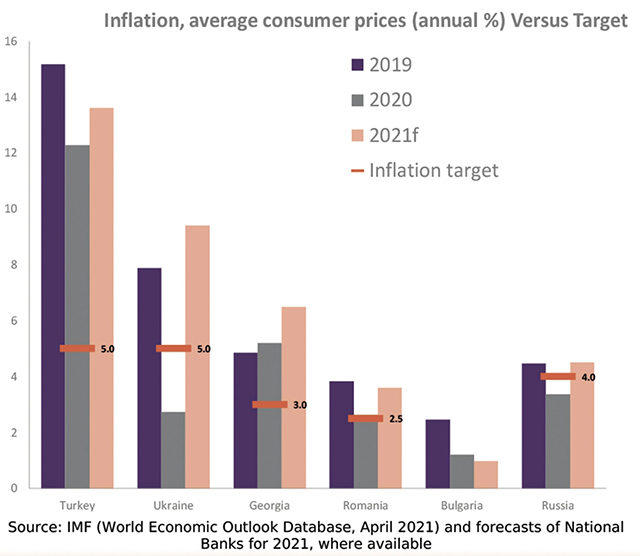

Recovery in economic activity and a rebound in commodity prices, as well as currency depreciations in 2020, are all putting upward pressure on inflation. This pattern can be clearly seen in Black Sea region countries, especially in more vulnerable markets, such as Turkey, Ukraine and Georgia. In 2021, all countries in the region are expected to surpass their inflation targets.

To sum up, the recovery of the Black Sea region from the COVID-19 pandemic is not assured. The possibility of new outbreaks, especially considering the emergence of new variants, vaccination challenges, travel restrictions, mounting debt levels and rising inflationary pressures, suggests that the path to recovery in 2021 will be long and divergent.

![]()