By Josef Gassmann for Investor.ge

Georgia’s economy has long relied on remittances, with the World Bank designating the country as the 21st most remittance-dependent economy in 2021, ranking ahead of countries such as Capo Verde, Liberia, Bosnia, and Armenia. And the volume of remittances as a percentage of GDP is on the up – from 10% in 2016 to 13.3% in 2020. But this may be a good sign, as recent data from the National Bank of Georgia (NBG) shows that Georgians are finding work in higher-paying countries, increasingly choosing employment in the EU, North America and the Middle East over more traditional labor markets like Russia. Covid-19 and Russia’s war of aggression against Ukraine have only accelerated this process.

The imaging on this trend was clear until 2022, though the war has turned the numbers on their heads, and it may be some time before we can get an accurate read again on where Georgians are going to work.

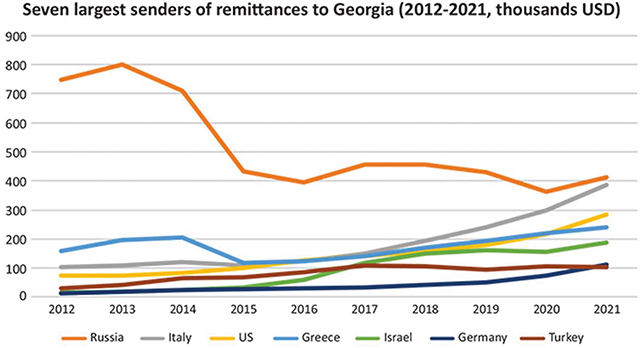

Remittances from Russia to Georgia had long been sloping downwards in the run up to Covid-19. Russia’s share in total remittances to Georgia sank from approximately 45% in the early 2010s to just 18% by 2021. Meanwhile, remittances from the EU surged from approximately 25% in 2012 to 41% in 2021, NBG data shows.

This was due less to an outflow of Georgian labor from Russia – which has remained fairly stable and even resilient to geopolitical friction between the two countries – but increased employment opportunities for Georgians in the EU and elsewhere, such as new labor markets in Poland and the Gulf. Part of this is the increased availability of jobs in traditionally ‘male’ professions. While Georgian women have been more likely to seek employment abroad where there has been high demand for them in nursing and elderly care, new employment opportunities in agriculture and construction have attracted more male Georgian labor.

But that was then, and the war is now. Data on remittances from April and May reflect a more complicated story. Money transfers (to call them remittances would be technically inaccurate) from Russia were up nearly 300% and 888% for April and May, respectively. These jumps brought Russia’s share in Georgian ‘remittances’ back up to 43% in April and 62% in May.

The volume of remittances as a percentage of GDP is on the up – from 10% in 2016 to 13.3% in 2020

There’s quite a bit to explain the sharp increase in remittances, though creating a line of best fit is difficult.

TBC Capital says it believes much of the increased activity from Russia is from middle-class individuals and families who have relocated to Georgia during the instability. This must be true to some extent; though it is hard to estimate how many Russian citizens have relocated to Georgia since February, the surge in long-term housing prices is enough to justify the claim that their numbers are substantial. Galt & Taggart, the brokerage arm of Bank of Georgia, puts the number of war-affected ‘‘migrants’ between 80,000 and 100,000, though this figure includes Ukrainians and Belarusians.

Nevertheless, TBC Chief Economist Otar Nadaraia says, “it has been quite difficult to understand exactly what is happening. To call this large-scale capital flight would be incorrect. Our sense is that it is mostly middle class families and individuals who are moving just portions of their assets here for regular expenses. We’ll have a better picture of what is happening when we can see the complete tourism statistics, as some of these funds will be double counted in visitor spending as well – many of the recipients of these transfers are non-residents of Georgia, after all.”

This ‘double-counting’, as Nadaraia points out, is a result of the fact that some of the funds from these money transfers may not be spent on general living expenses, but are rather being sent by Russian citizens vacationing in Georgia, and who cannot withdraw money in the country due to sanctions on their home banks. A clearer image of who has come to Georgia on vacation and who has come for an extended stay will be available once a general trend for tourism expenditures for the summer of 2022 can be identified.

The National Bank of Georgia (NBG) offers several other interpretations on top of the tourist and long-term visitor explanation.

“Because a number of Russian banks have been sanctioned, small exporters may now be accepting payment using fast money transfers [ed. Western Union, Korona, MoneyGram, etc]. Customers of sanctioned banks will have had to move elsewhere and find new means to affect payment,” Head of the Macroeconomics Department at the NBG Shalva Mkhatrishvili told Investor.ge.

Mkhatrishvili adds that much of this money is moving directly into and staying in the Georgian banking system; it is not simply being used as pocket money. Georgians coming back to Georgia account for a strong proportion of the money transfers being made.

“We’ve seen a fairly strong rise in deposits at commercial banks. Putting an exact number to the increased liquidity due to money transfers is hard, but it’s probably somewhere in the region of $200 million. Some of this is likely taking place in Lari-denominated accounts, which is one explanation for the strong appreciation of the Lari in recent months,” Mkhatrishvili says.

All of these factors undoubtedly explain a portion of the steep uptick in ‘remittances’ from Russia, but more data and time will be needed to ascertain for what purposes this money is entering the country and how it is being spent.

This last issue is an important one for the NBG, Mkhatrishvili notes, who stresses that Georgia is not serving as a gateway for sanctioned Russians or their money.

“Remittance outflows of the last several months have remained within their historical norm. We at the central bank are doing all we can to ensure that Georgia does not facilitate the avoidance of sanctions; this is very important to us.”