Keepz, a fast-growing fintech startup from Georgian, is transforming the way businesses and individuals handle digital payments. With its innovative QR-based payment solutions, Keepz has already onboarded 20,000 merchants, enabling them to receive payments via both traditional method and emerging channels, such as Cryptocurrency Wallets and Open Banking. Being the first company in Georgia to acquire open banking license and offer pay-by-bank option to merchants, as well as #1 company to facilitate everyday payments by crypto wallets, Keeps enables merchants to accept payments without borders, fostering greater global connectivity.

In December 2024 Keepz helped position Georgia as one of the first countries globally to enable tax payments via digital assets.

Keeps requires no app download or registration for payment – meaning anyone can pay simply with a smartphone. With this proven model in Georgia, Keepz is now expanding into Turkey and Italy, two rapidly growing digital payment markets. These regions offer significant opportunities due to their increasing adoption of cashless transactions and progressive fintech ecosystems.

Crypto Wallets: A New Era of Payments

As digital assets adoption continues to rise, Keepz is introducing cryptocurrency payment options for businesses. Merchants can now accept payments in USDT, Bitcoin, Ethereum, and other major cryptocurrencies, providing a secure and borderless alternative to traditional payment systems. This feature helps merchants reduce transaction fees, eliminate chargebacks, and tap into a global customer base that prefers decentralized finance solutions – a market of $4 trillion, that is expected to reach $10 trillion in 2030. By integrating crypto payments, Keepz is offering businesses a future-proof way to diversify their payment acceptance methods.

Open Banking: Improving Security and Speed

One of the most transformative developments in fintech today is open banking, which enables secure access to financial data and faster transactions at a lower cost. By leveraging open banking infrastructure, Keepz ensures seamless, real-time fund transfers directly into business accounts, minimizing transaction friction, reducing costs and increasing security.

Why Choose Keepz:

✔ No physical POS terminal needed – Fully digital, cost-effective payment acceptance.

✔ Instant transaction settlements – Funds are transferred to bank accounts in real-time.

✔ Multiple payment options – Accept payments via Bank cards, Apple Pay, Google Pay, Online Bank and crypto wallets.

✔ For all business types – From small vendors to large retailers and e-commerce platforms.

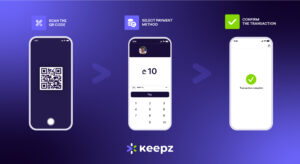

How It Works: Simple and Efficient

Using Keepz is effortless. Merchants simply:

- Download Keepz POS from App Store or Google Play.

- Register phone number and bank account.

- QR POS is ready to receive payments.

With its intuitive interface and seamless integration, Keepz enables businesses to start accepting QR-based payments in minutes.

At the core of Keepz’s success is CEO and Co-founder Papuna Lezhava. A key figure in financial technology regulation, Papuna spearheaded Georgia’s open banking reform and developed the virtual asset regulatory framework at the National Bank of Georgia. Now, he is bringing that expertise to the private sector, leading Keepz in its mission to make digital payments simpler, smarter, and more inclusive.

“At Keepz, we are redefining the future of digital payments by building the most accessible and innovative payment infrastructure. With no need for downloads or registrations, we are breaking down barriers and democratizing digital payments for everyone—merchants and payers alike. We believe financial freedom starts with choice, and we empower people to pay and get paid on their own terms. With 20,000 merchants and over 100,000 payers already onboard, we are now expanding into Italy and Turkey—key markets that will propel us toward becoming the leading payment provider across Europe and the Middle East.” – CEO and Co-founder of Keepz, Papuna Lezhava

As Keepz expands into new markets and innovates across payment solutions, it is setting new standards for fintech worldwide.

Stay tuned for more updates on Keepz’s journey towards a borderless, digital payment future!