Tbilvino Opens New Wine Shop and Bar “The Wine” in Tbilisi with TBC as Key Financial Partner

Georgian wine producer Tbilvino has officially opened a new wine shop and bar, The Wine, offering a curated selection of premium wines from leading wine-producing regions around the world. The new venue is located at 64 Irakli Abashidze Street, Tbilisi.

The project’s main financial partner is TBC Bank.

The Wine features approximately 120 wine labels from nearly 10 countries, including France, Italy, the United States, New Zealand, Germany, and Spain. The assortment includes white and red wines, as well as internationally renowned sparkling wines such as Champagne from France’s Champagne region, Italian Prosecco, and Ferrari, one of Italy’s most prestigious sparkling wine brands. The Wine is the exclusive representative of Ferrari sparkling wines in Georgia.

While the core of the portfolio focuses on international wines, guests will also have the opportunity to taste Georgian wines from Tbilvino’s premium collection. The selection spans multiple price segments, offering both high-end labels and accessible, budget-friendly options.

In the future, The Wine plans to host educational and thematic events, including wine tastings and presentations. These initiatives aim to promote wine culture in Georgia and share international winemaking experience with local consumers.

TBC Bank and Tbilvino have been partners for 23 years. Over the past five years alone, the partners have jointly implemented projects worth GEL 48 million. The partnership covers a wide range of initiatives, including harvest financing, vineyard development, production line modernization, and the acquisition of new machinery and equipment.

Here is a polished English translation rewritten in a press-release style, with clear emphasis on TBC Capital’s role, adapted for online news portals. Grammar, tone, and structure are aligned with international financial media standards.

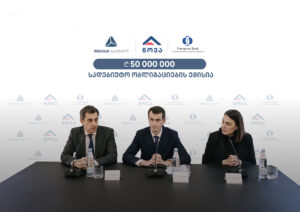

Nova Issues GEL 50 Million Debut Bonds with Exclusive Support from TBC Capital

Nova has successfully placed its debut GEL 50 million five-year bond issue, with TBC Capital acting as the exclusive placement agent.

The transaction represents the first tranche of Nova’s GEL 80 million bond programme.

During the offering period, the coupon guidance ranged between TIBR 6M + 3.00% and 3.50%. Due to strong investor demand, the final coupon was set at TIBR 6M + 3.25%, marking the lowest spread among publicly issued bonds by non-financial companies with a B+ credit rating.

The bonds were fully subscribed by institutional investors, including an international financial institution — the European Bank for Reconstruction and Development (EBRD) — which participated as a strategic investor in the issuance.

Proceeds from the bond placement will be used to refinance existing bank loans, finance capital expenditures, and support working capital needs.

As part of the debut bond issuance, Nova obtained a B+ credit rating with a Stable Outlook from Scope Ratings. TBC Capital served as the advisor throughout the credit rating process.

“We are pleased that Nova has taken its first step into the capital markets with TBC Capital as its partner. This issuance confirms the strong demand in Georgia’s securities market and demonstrates Nova’s credibility, even for an international institution such as the EBRD. TBC Capital offers companies comprehensive support — from obtaining a credit rating to the successful placement of bonds. Through our expertise and experience, we aim to simplify these processes for businesses and help create alternative financing sources,”

said Otar Sharikhadze, Director of TBC Capital.

“The EBRD’s investment in Nova Group’s debut bonds reflects the Bank’s commitment to strengthening Georgia’s local capital markets and supporting private sector growth. By introducing long-term instruments and promoting best practices in corporate governance, our goal is to foster a sustainable and transparent financial environment that benefits both local businesses and investors,”

said Alkis Vryenios Drakinos, Caucasus Regional Director at the EBRD.

“This is a historic milestone for us. The successful placement of Nova’s debut bonds represents the first public bond issuance in Georgia’s construction and renovation materials sector. The transaction was completed within a very short timeframe and attracted strong institutional investor interest, once again confirming the company’s financial strength and reliability. We extend our sincere gratitude to all institutional investors who placed their trust in Nova, including our strategic investor, the EBRD. We are also thankful to TBC Capital for its professional support — from securing the credit rating to the successful bond placement. The raised funds will allow us to further strengthen our financial structure and continue our sustainable, long-term growth,”

said Edisher Khimshiashvili, CEO of Nova.

Founded in 2006, Nova operates across Georgia and is one of the country’s leading companies in the construction and renovation materials market. The company has branches in nine cities nationwide and employs over 1,000 people.

TBC Capital Releases Macroeconomic Update on Economic Growth and Current Account Balance

TBC Capital has published its latest macroeconomic update, providing an overview of Georgia’s economic growth dynamics, external balances, and key medium-term risks and forecasts.

Economic Growth Outlook

According to data from Geostat, Georgia’s economic growth reached 6.4% in the third quarter, slightly below the preliminary estimate of 6.5%. The moderation in annual growth partly reflects base effects from last year. However, TBC Capital notes that seasonally adjusted real GDP accelerated quarter-on-quarter, indicating continued underlying momentum.

Economic growth in November is expected to slightly exceed October’s 6%, while annual growth is projected to continue normalizing. For 2025, total economic growth is forecast at 7.3%. Nominal GDP grew by 11.4% year-on-year in the third quarter and by 12.3% over the first nine months of the year. According to TBC Capital’s projections, nominal GDP is expected to exceed GEL 104 billion in 2025.

Medium-Term Risks and the War in Ukraine

The most significant factor shaping Georgia’s economic outlook for the coming year remains the Russia–Ukraine war. TBC Capital reiterates its hope that ongoing negotiations will result in a fair and sustainable peace agreement.

As discussed in previous publications, a conflict-resolution scenario would likely involve partial re-orientation of trade flows that have expanded since 2022. At the same time, such a scenario would also bring positive economic effects, including a lower regional risk premium, stronger regional growth, potential declines in consumer goods prices, and a stronger euro—factors that are supportive for the Georgian lari.

Taking these offsetting forces into account, and assuming an increased probability of the war ending, TBC Capital forecasts that economic growth in 2026 will converge toward its long-term trend of approximately 4.5%. The exact timing and terms of any peace agreement remain uncertain and will play a crucial role in shaping this outlook.

Sectoral Drivers of Growth

In 2025, as in the third quarter and over the first nine months of the year, the information and communication and education sectors were the primary contributors to economic growth. In a longer-term perspective compared to 2019, the largest growth components have been information and communication, transportation, and trade.

External Trade and Currency Inflows

Net foreign currency inflows remain elevated. In November, exports increased by 44.2%, while imports declined by 1.2%, resulting in a significant reduction in the trade deficit compared to previous years.

Export growth was driven by both re-exports—largely automobiles—and domestic exports, particularly precious metal ores, oil products, and ferroalloys. The decline in imports was mainly attributable to a 17.5% year-on-year drop in car imports, alongside a 53.2% increase in car exports.

TBC Capital emphasizes that the positive trade balance in automobiles is temporary and is expected to adjust over time through higher imports or lower exports. According to the firm’s estimates, excluding seasonal factors, maintaining recent trade flow levels would have resulted in a car-trade deficit approximately USD 300 million higher this year.

Beyond automobiles, the reduction in the goods trade deficit has also been supported by precious metals and oil prices. Rising global prices for precious metals have boosted exports, while declining global oil prices have reduced import values. The combined impact of these factors is estimated at around USD 250 million.

Remittances and Domestic Spending

In November, remittances increased by 13.1% year-on-year, only slightly below October’s 13.4%. Growth drivers vary by country. Remittances from the United States increased due to both higher transaction volumes and larger average transfer amounts. In contrast, growth from EU countries such as Italy, Greece, and Germany was almost entirely driven by euro appreciation, with transfer volumes in euros remaining largely unchanged. A similar pattern is observed for remittances from Russia.

In December, non-cash spending continued to rise, particularly expenditures by non-residents, which serve as a proxy for tourism revenues. Domestic spending showed moderate growth, while migrant spending remained broadly stable.

Current Account Balance Outlook

Overall, net foreign currency inflows remain high as of November. Combined with declining reinvestments, this points to a substantial expected improvement in the current account deficit. According to TBC Capital’s baseline forecast, the current account deficit is expected to decline to around 3.5% of GDP in 2025, assuming other factors remain unchanged.

However, the firm cautions that the current improvement—supported by favorable automobile trade dynamics and high gold prices on the one hand, and lower oil prices and imports on the other—represents a combination that may be difficult to sustain over the medium term. As a result, the current account deficit is projected to widen slightly to around 5% of GDP in 2026.

Exchange Rate Dynamics and Central Bank Policy

In addition to strong currency inflows, excess liquidity in the foreign exchange market continues to be driven by deposit larization. Based on daily data, larization accelerated again from the second week of December.

Given the close link between larization and central bank foreign exchange interventions, TBC Capital estimates that interventions continued in December, with the National Bank of Georgia purchasing approximately USD 200 million during the month. Total FX purchases from March through December are estimated at USD 2.3 billion.

According to IMF assessments, the central bank’s foreign exchange reserves had reached close to 100% of the adequacy benchmark by the end of November. While interventions are expected to continue under supportive lari conditions, significant appreciation of the lari is not considered the baseline scenario.

In a war-resolution scenario, potential re-orientation of currency flows may exert short-term pressure on the exchange rate, including increased currency conversions. However, against the backdrop of stronger reserves and the central bank’s policy of limiting excessive volatility, risks remain manageable.

The full publication is available at.

S&P Global: TBC Among Europe’s Leading Banks in Artificial Intelligence Development

According to the international rating and analytics agency S&P Global, TBC Bank is among the leading European banks in terms of artificial intelligence (AI) adoption. In its analytical feature, S&P Global highlights TBC as a successful case study of effective AI implementation in the banking sector.

S&P Global became interested in TBC’s experience following a presentation at the Financial Times Global Banking Summit, where TBC’s Deputy CEO Giorgi Tkhelidze spoke about the bank’s technological transformation and digital strategy. The article focuses on banks that actively use AI to enhance operational agility, improve financial performance, and elevate customer experience. In this context, TBC is named alongside major international financial institutions such as the UK-based Lloyds and Standard Chartered PLC, as well as the Netherlands-based ING Groep.

S&P Global notes that despite the growing interest in artificial intelligence, only a limited number of European banks have successfully adapted AI technologies and translated them into tangible financial benefits. The article emphasizes that TBC’s early investment in technological development in Georgia enabled the bank to successfully launch the first digital bank in Uzbekistan, which has already attracted 6 million active users.

In an interview with S&P Global, TBC Deputy CEO Giorgi Tkhelidze outlined the key areas in which the bank has achieved notable success through AI integration:

“TBC actively leverages artificial intelligence to manage interactions with both retail and corporate clients more efficiently. As a result of advanced technology adoption, 60–70% of corporate lending processes are now completed digitally. Modern technologies allow us to analyze industry potential, assess partners, and evaluate their financial performance much faster. Through automation, we offer clients tailored services and products that take into account each company’s specific financial needs. This approach results in more personalized, growth-oriented partnerships,” said Giorgi Tkhelidze, Deputy CEO of TBC Bank.

This recognition by S&P Global underscores TBC’s position as a regional innovator and a notable European player in the practical application of artificial intelligence in banking.

Awork Named Finalist of the TBC Business Awards

Job hunting is rarely an enjoyable process. It is often emotionally demanding and complicated by the need to navigate multiple employment platforms. Under the “traditional” model, candidates must upload a CV, search for additional documents, complete motivation letters, and carefully specify vacancy titles—turning job applications into a time-consuming and stressful routine.

The process is no easier for employers. Downloading dozens of applications from email, sorting them, and managing the full recruitment cycle requires significant time and resources.

High employee turnover remains one of the key challenges in the service sector. Seasonal workloads, demand for flexible schedules, and employees’ natural progression toward the next stage of their careers lead to frequent staff changes over time.

The COVID-19 pandemic further amplified these challenges. Hybrid work models made job proximity to one’s place of residence a critical factor in employment decisions.

It was during this period that Awork, a Georgian digital employment ecosystem, emerged—designed to simplify the recruitment process for both job seekers and employers.

“When we first launched the website, we noticed that 75% of visitors accessed it from mobile devices. It became clear that speed and convenience were essential, and that an app-based format was the right solution. We asked ourselves: why not apply Tinder-style logic to the employment process?” recalls Awork’s CEO, Giorgi Razmadze.

The results were immediate. Instead of endless scrolling and paperwork, job seekers could submit applications with a simple swipe—significantly reducing stress—while businesses gained faster access to relevant candidates, effectively turning applications into high-quality leads.

Today, Awork partners with more than 1,000 businesses. For high-turnover positions, where the average recruitment process typically takes up to two weeks, Awork reduces hiring time to an average of just three days. This allows companies to fill vacancies quickly, serve more customers, and increase revenue. Businesses can choose between flexible hiring models, including one-time vacancy postings or monthly subscription packages tailored to their needs.

What sets Awork apart from competitors is its precise focus on segments where rapid hiring is essential and recruitment is often perceived as stressful.

This innovative approach has earned Awork a place among the finalists of the TBC Business Awards.

“This is our third time participating,” says Razmadze. “To be honest, in previous years we had higher expectations of winning. But this year’s recognition clearly showed us something important: our startup continues to remain innovative. It became a kind of benchmark for us—to understand where we stand today.”

Looking ahead, the Awork team plans to expand its product into Eastern European markets, scaling its digital recruitment model beyond Georgia.

ESKI Named Finalist of the TBC Business Awards

“Squirrel Sitting,” “Angel Kato with Bags,” “Running Turtle” — even the names of the handmade products at the ESKI store hint that each item carries its own story.

The idea behind ESKI did not belong to a single person. It emerged organically, out of necessity. The team behind the Alliance of Social Enterprises recognized the urgent need for a physical space that could unite socially produced goods, give them visibility, and — most importantly — create direct feedback from customers.

Due to their small scale, social enterprises often lack their own retail outlets or opportunities for face-to-face interaction with consumers. This challenge is even greater for regional enterprises, where transporting products to Tbilisi and selling them creates additional barriers. ESKI addressed this gap by creating a shared platform. Visitors to the store do not simply purchase products — they become part of a conscious decision-making process where every choice matters.

Each purchase supports green initiatives, empowers women and people with disabilities, and contributes to the preservation of cultural heritage. These are not exaggerated claims: ESKI brings together products from nearly 30 social enterprises, offering more than 650 items under one roof.

“I sincerely believe that individual behavior has a powerful impact on the world and can lead to positive change. There are people around us who need more support,” says Salome Kusiani, Head of ESKI. “I will never forget one woman’s answer when I asked about the impact of social enterprise — she said, ‘This work taught me how to speak again.’”

For social enterprises, the production process is often more complex than in traditional businesses. When employing people with disabilities, for example, production requires more time, different approaches, and additional resources. An employee may have memory challenges, meaning instructions must be repeated multiple times. From a purely business perspective, this may seem inefficient, but social entrepreneurship follows a different logic: enabling individuals to feel like valued members of society who are capable of creating something meaningful.

“This complexity is compounded by the nature of handmade products,” Salome explains. “Time, labor, and quality are inevitably reflected in the price. Anyone who has worked with ceramics or handcrafted an item understands why such products cannot be mass-produced cheaply. That is why we emphasize the importance of conscious consumption.” She notes that customers are often drawn not only to the product itself, but to the story behind it.

Maintaining this balance is possible thanks to socially responsible individuals and companies. There are still people willing to choose value over price — and the sustainability of social enterprises depends precisely on such choices.

Becoming a finalist of the TBC Business Awards is a continuation of this journey.

“When I submitted the application, I thought that becoming a finalist would mean we are on the right path and should believe in our success,” says Salome. “That was exactly the intention behind clicking ‘submit.’ For us, it is also meaningful that first place was awarded to Social Cafe Mziuri. When such a major award recognizes small initiatives like ours, it truly motivates you to keep going.”

ESKI’s experience has also highlighted a broader shift: stereotypes about products made in Georgia are gradually breaking down. Customers are often surprised to learn that high-quality wooden toys or ceramic items are produced locally. That surprise turns into pride when people return, build collections, or gift Georgian social products to friends abroad.

This shows that ESKI functions not only as a store, but as an idea with real magnetic power. Joining this movement — and purchasing products — is also possible online at.